Crypto Crash Today: Bitcoin Price Drops to $86K as $637M Liquidations Hit the Market

The post Crypto Crash Today: Bitcoin Price Drops to $86K as $637M Liquidations Hit the Market appeared first on Coinpedia Fintech News

The market witnessed a sudden crypto crash in the last 24 hours, with Bitcoin plunging from $92,000 to $86,000. The sharp drop triggered more than $637 million in liquidations across major cryptocurrencies. While the fall looked dramatic, analysts say the sell-off was largely caused by global macro turbulence, not internal crypto weakness.

Why the Crypto Crash Happened

Japan’s Rate Shift Sparked Global Panic

Today’s crypto crash began after the Bank of Japan signaled a 76% chance of raising interest rates on December 19, pushing Japan’s 2-year bond yield to 1.84%, the highest since 2008. This move threatens the long-running yen carry trade, where traders borrowed cheap yen to invest in higher-yielding global assets. As borrowing costs rise, traders unwind positions and pull money out of risk assets like Bitcoin, fueling the crypto crash.

Trading Algorithms Accelerated the Sell-Off

The crash intensified as the new day, week, and month began. Resetting trading algorithms fired simultaneously, causing instant selling across the market. This wasn’t emotional behavior; it was automated portfolio rebalancing and risk reduction, adding fuel to the ongoing crypto crash.

Capital Returning to Japan and China Tightened Liquidity

As Japanese yields rise, money naturally flows back home. At the same time, Japan and China are purchasing less U.S. debt. This reduces global liquidity, creating pressure on all risk assets, including crypto, and contributing to the sharp market downturn.

Technical Volatility Made the Crypto Crash Worse

Monthly and weekly candle closes added another layer of volatility. There was no major negative news within crypto today. Instead, several global and technical factors aligned, turning a normal pullback into a full crypto crash.

$637M Liquidated as the Crypto Crash Deepens

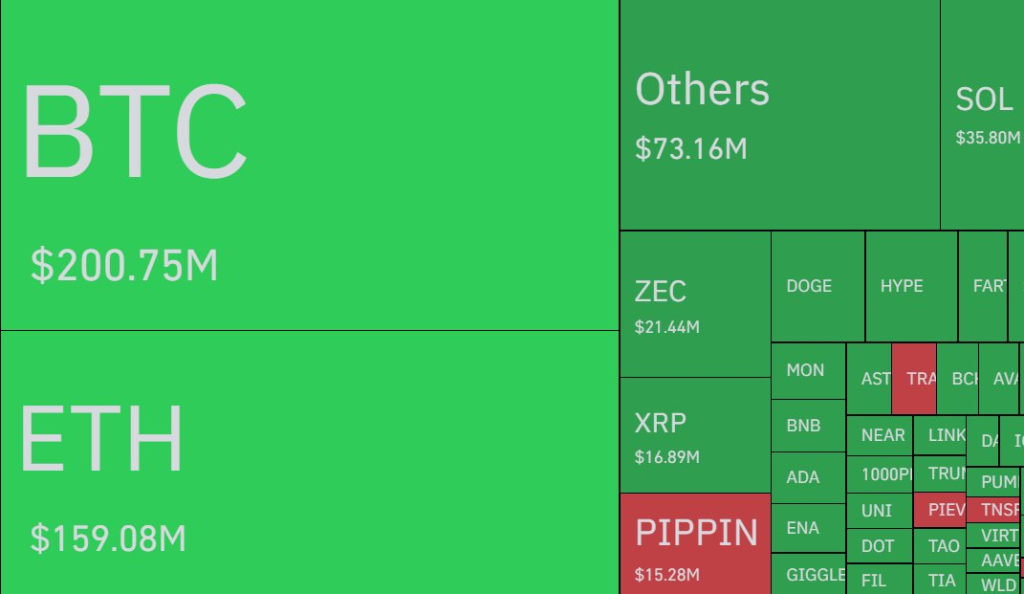

The ongoing crypto crash resulted in more than $637.57 million in liquidations over the past 24 hours. Long positions took the biggest hit, losing $567.96 million, while short positions lost $69.61 million.

Bitcoin saw more than $200 million in liquidations. Ethereum faced losses of around $159 million, while Solana recorded about $35 million in liquidations. XRP and other altcoins also came under pressure, with ZEC and PIPPIN witnessing notable liquidation spikes.

Liquidations surged sharply between the 4-hour and 12-hour windows, jumping from $15 million to over $578 million, showing how quickly the crypto crash intensified once selling momentum began.

You May Also Like

Over $145M Evaporates In Brutal Long Squeeze

Vitalik Buterin Reveals Ethereum’s Bold Plan to Stay Quantum-Secure and Simple!