569 XRP Whales Disappear—Yet Whale Holdings Hit 7-Year High. What’s Going On?

The post 569 XRP Whales Disappear—Yet Whale Holdings Hit 7-Year High. What’s Going On? appeared first on Coinpedia Fintech News

The cryptocurrency market ended the month on a bearish note, with the Bitcoin (BTC) price falling below $84,000 and the XRP price dropping to $1.98. Although both tokens have recovered to above $85,000 and $2, the prospect of a deeper correction continues to haunt the rally. With selling pressure soaring due to a nearly 180% increase in trading volume, it’s time to see whether the XRP Army can keep the rally above the key support level of $2.

XRP Whales Disappear, But Accumulation Increases

XRP just experienced one of its most unusual whale-behavior patterns of the year: the number of major whale wallets is shrinking, yet the remaining large players are quietly amassing their biggest holdings in seven years. The contrasting signals suggest a consolidation phase among deep-pocketed investors rather than an outright exit.

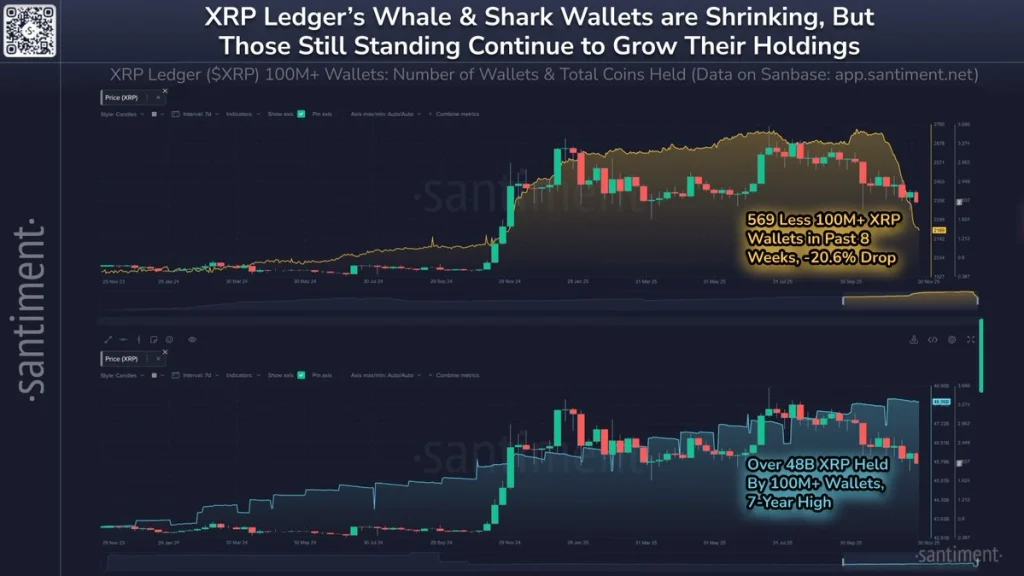

Data from Santiment shows a 20.6% drop in 100M+ XRP wallets over the past eight weeks, with 569 whale and shark wallets disappearing during the period. This marks one of the sharpest contractions in the large XRP wallet count in 2024–2025.

Despite the drop in the number of whales, the total amount of XRP held by 100M+ wallets has surged to a 7-year high of 48B XRP. This trend signals that the whales who remain are absorbing supply from those exiting.

For Example, if a wallet holding 250M XRP shuts down or redistributes its holdings, it may no longer be in the 100M+ wallet category. But if another whale accumulates aggressively at the same time, total holdings of the class rise even as the number of wallets shrinks. This explains why wallet count is falling, while supply concentration is climbing—a classic sign of consolidation.

What’s Causing the Shrinking Whale Count?

XRP’s whale count has dropped sharply in recent weeks, leaving the market questioning what’s driving the decline. While it may appear bearish at first glance, the shift is more complex—reflecting changes in holder behavior, redistribution, and evolving liquidity conditions on the XRP Ledger.

- Profit-taking after large rallies: XRP rallied strongly earlier this year, and some older whale addresses may be taking profits or reallocating capital.

- Redistribution to custodial or CEX-controlled addresses: Some high-value wallets may have moved funds to institutional custodians or exchanges, causing the on-chain “whale count” to drop even though the funds haven’t technically left the ecosystem.

- Dormant wallets may be cleaned, merged, or deactivated: Long-inactive whale wallets sometimes consolidate into fewer addresses, reducing the count but leaving the total supply unaffected.

Is This Trend Bullish or Bearish for XRP Price?

The data points toward accumulation by strong hands, which historically has been more bullish than bearish. A falling whale count suggests weaker or inactive whales are exiting, while rising concentration indicates remaining whales are strengthening their position. The last time XRP showed a similar pattern was in 2017 and 2020, both of which preceded major upside moves.

The weekly price action of XRP suggests the selling pressure has not waned yet, as the RSI is heading towards the lower threshold. In the meantime, the weekly CMF has plunged below 0, hinting towards a massive outflow of capital from the platform. Therefore, the XRP price is expected to enter the support range between $1.97 and $1.92 shortly. The bulls have been defending the range since the start of the year, and there is a strong possibility they will continue to do so until the end of the year.

Conclusion

XRP’s shrinking whale count may unsettle traders, but the surge in total whale-held supply shows that stronger hands are tightening control. If accumulation continues near current levels, the XRP price could stabilize above key support and set up a relief bounce. However, failure to retain whale demand may expose the price to a deeper pullback before any sustainable recovery begins.

You May Also Like

Over $145M Evaporates In Brutal Long Squeeze

Non-Opioid Painkillers Have Struggled–Cannabis Drugs Might Be The Solution