Ethereum Speculators Add $654M In Bets As Price Plunges To $2,800

Data shows the Ethereum Open Interest has shot up by more than 4% following the sharp move down in the cryptocurrency’s price.

Ethereum Has Seen A Pullback Over The Past Day

The cryptocurrency sector as a whole has witnessed a plunge to kick off the new month, with Bitcoin and Ethereum both being down by more than 5% over the last 24 hours. ETH is back in the low $2,800 levels, having essentially retraced the recovery that it had made during the last week of November.

The sudden price decline has unleashed a wave of liquidations on the derivatives exchanges, leading to $158 million in Ethereum-related contracts being flushed. Of these, $140 million of the liquidations involved long positions alone.

Below is a heatmap from CoinGlass that breaks down the liquidation numbers related to the various digital asset symbols.

Interestingly, while notable liquidations have occurred, derivatives investors still haven’t become discouraged.

ETH Open Interest Has Gone Up Since The Dip

As pointed out by CryptoQuant community analyst Maartunn in an X post, the Ethereum Open Interest has witnessed a sharp jump following the price decline. The “Open Interest” here refers to an indicator that measures the total amount of positions related to ETH that are currently open on all centralized derivatives platforms.

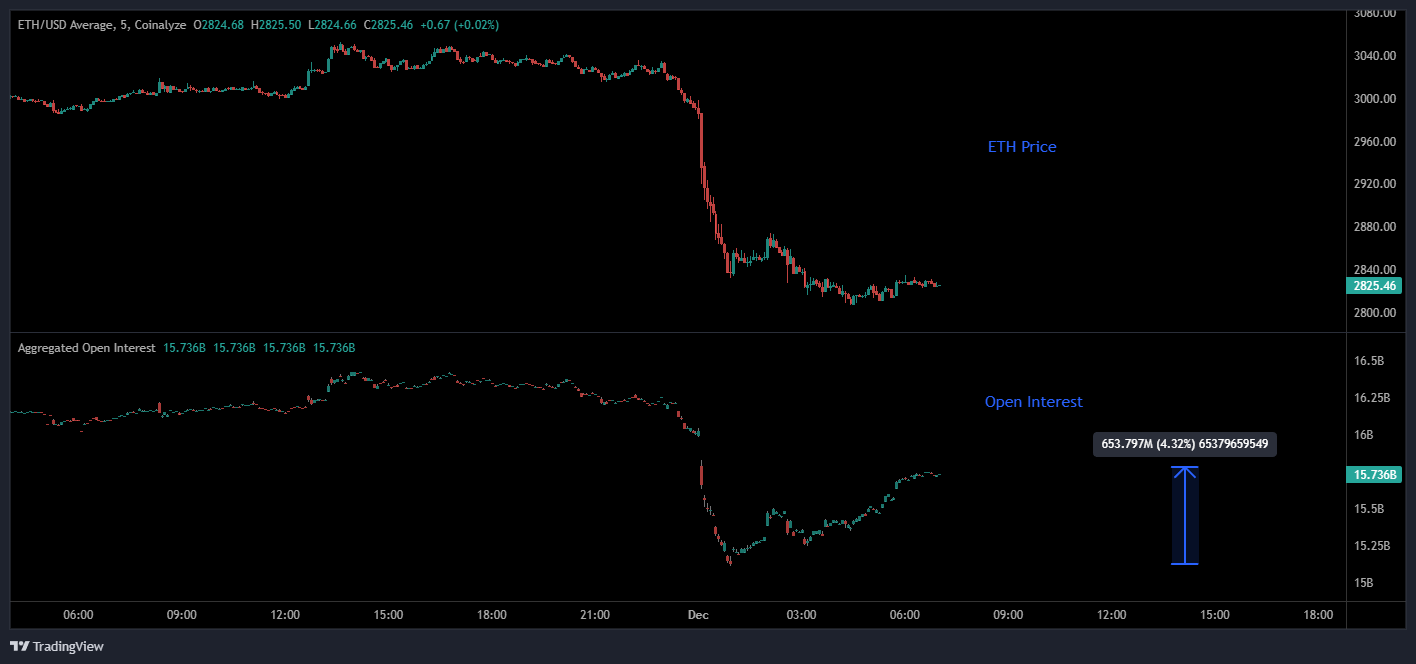

Here is the chart shared by Maartunn that shows the trend in this metric over the past couple of days:

As displayed in the above graph, the Ethereum Open Interest initially collapsed alongside the price drop as long positions suffered forceful closures. As ETH’s bearish momentum tapered off and the price settled into a sideways rhythm, however, the metric saw a gradual reversal in direction, indicating that speculators have started opening up fresh positions.

Since the dip, the ETH Open Interest has gone up by almost $654 million, equivalent to an increase of 4.3%. “Looks like the gamblers are back for another round,” noted the analyst.

Historically, a high value on the metric has generally been something that has led to volatility for the cryptocurrency. This is because an extreme amount of positions implies the presence of a high amount of leverage in the sector. In these conditions, any sharp swing in the asset can induce a large number of liquidations in the market. These liquidations only feed back into the price move that caused them, making it more intense.

An example of this pattern was already seen during the past day. With the Ethereum Open Interest now rising again, it remains to be seen whether more volatility will follow.

You May Also Like

Pi Network Emerges Amid Extreme Crypto Fear: Could This Be the Next Major Opportunity?

Top 5 News This Week: Bong Suntay, 18 ‘ex-marines’, China’s Filipino spies

Pi DEX: The Gateway to Web3 for Everyone, Even Crypto Beginners

Pi Network continues to redefine accessibility in the blockchain space with the launch and development of Pi DEX,