ETH ETFs Start Bleeding Again, but BlackRock Quietly Buys Dip

Ether ETH $2 809 24h volatility: 1.1% Market cap: $339.02 B Vol. 24h: $27.56 B is back under pressure with the recent sharp pullback from the $3,000 zone. The US spot ETFs recorded $79 million in outflows on Dec. 1 as the price briefly lost the $2,800-$2,850 support level.

At the time of writing, ETH is trading around $2,800 with a market cap of $337.7 billion.

According to popular crypto analyst Ted, if the leading altcoin loses this key level, it could drop towards the $2,500 level. However, he added that a reclaim of the $2,800 level will send ETH above $3,000.

Open Interest Crash Signals a Wide Reset

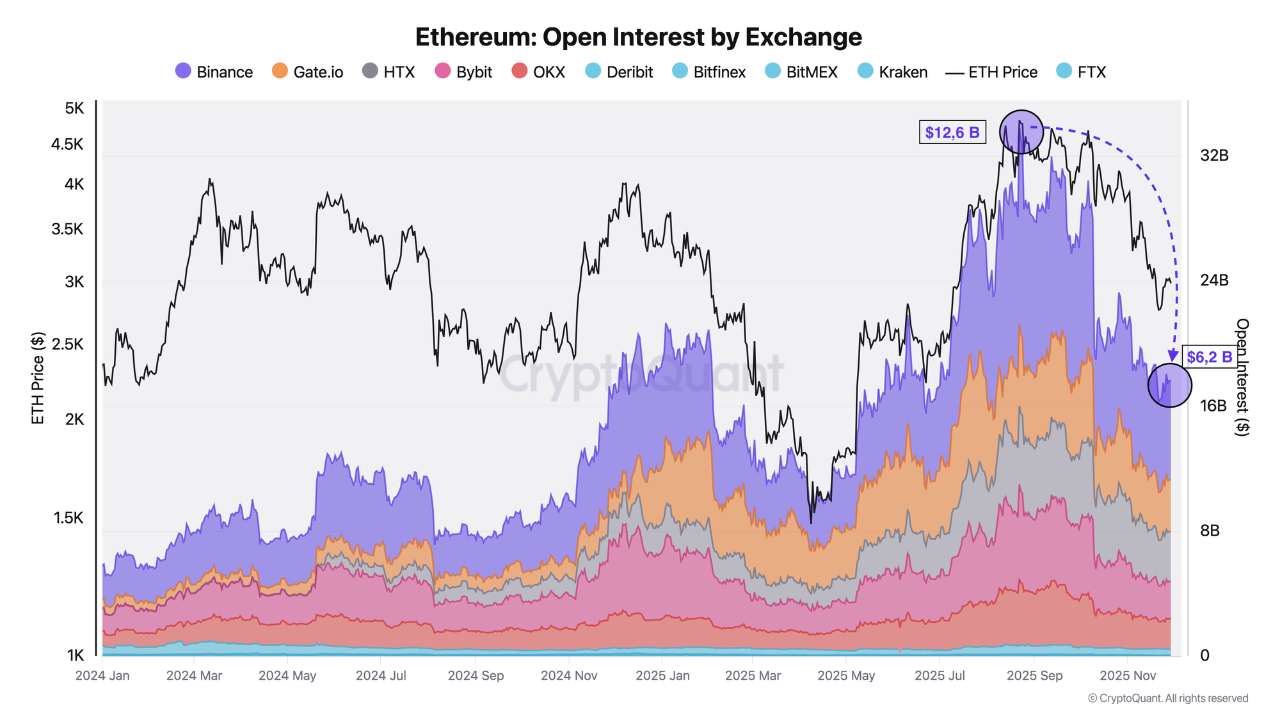

Ethereum’s open interest (OI) on Binance has seen a major drop after peaking at $12.6 billion in August. In just three months, roughly $6.4 billion in derivative positions disappeared, bringing the OI 51% down to $6.2 billion.

Ethereum open interest by exchange | Source: CryptoQuant

ETH itself has dropped from its $4,830 peak to about $2,800, a decline of around 43%. While this drop in OI looks dramatic, it has only dropped below the previous peak of $7.7 billion.

Traders seem hesitant to jump back in with liquidations stacking up. According to CryptoQuant analyst Darkfost, the scale of this reduction could help clear excess leverage and form a strong price bottom once the dust settles.

Big Buyers Step In to Buy the ETH Dip

While Ether ETFs saw an outflow with fear among retail traders, institutions are buying the ETH price dip. BlackRock recently purchased about $26.7 million worth of ETH, which suggests that long-term buyers are not backing away.

Moreover, on-chain data from Lookonchain shows that the trader pension-usdt.eth shifted long after the latest dip, opening a 2x position on 20,000 ETH (around $56 million).

This came shortly after the trader earned roughly $1 million in one hour by taking a 2x short on 6,358 ETH right before prices dropped on Dec. 1.

This optimism comes as Ethereum awaits its Fusaka upgrade, scheduled for Dec. 3. The upgrade aims to increase the network’s blob space capacity and reduce transaction costs across Ethereum Layer 2 networks.

nextThe post ETH ETFs Start Bleeding Again, but BlackRock Quietly Buys Dip appeared first on Coinspeaker.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

Holywater Raises Additional $22 Million To Expand AI Vertical Video Platform