Chainlink (LINK) Soars by 20% Daily: Further Gains on the Way?

The cryptocurrency market rebounded substantially over the last 24 hours, with Bitcoin (BTC) temporarily surging to nearly $94,000.

Some of the leading altcoins, including Chainlink (LINK), performed even better. This has fueled expectations among analysts that the asset could be gearing up for a much more aggressive pump.

The Next Targets

Chainlink (LINK) jumped by approximately 20% on a daily scale and currently trades at around $14.50 (per CoinGecko’s data), the highest mark since mid-November.

LINK Price, Source: CoinGecko

LINK Price, Source: CoinGecko

The main catalysts fueling the surge appear to be the overall market revival and the hype surrounding the launch of the first spot LINK ETF in the United States. The product is issued by Grayscale and is already live on the NYSE Arca.

The asset’s solid performance has drawn attention from popular market observers, some of whom believe this could be the start of a major rally. X user Rand thinks LINK “is getting absolutely ready for the bull reversal,” suggesting that a push above $15 will confirm that move.

Bitcoinsensus also gave their two cents. The analyst claimed LINK “is holding strong” above the $13 support level and predicted a potential spike to $46 if it doesn’t break that zone to the downside.

The X user CW seems to be among the biggest optimists. The industry participant argued that LINK has been trading inside an upward channel for the past several years, forecasting that its price could explode to the middle of that formation (set above $100) in the coming weeks.

Analyzing These Indicators

Over the past few months, there has been a clear trend of LINK tokens flowing off centralized exchanges into self-custody methods. According to CryptoQuant, less than 130 million coins are currently held on such platforms, which is quite close to the 44-month low seen at the start of December. This is a bullish sign since it reduces the immediate selling pressure.

LINK Exchange Netflow, Source: CryptoQuant

LINK Exchange Netflow, Source: CryptoQuant

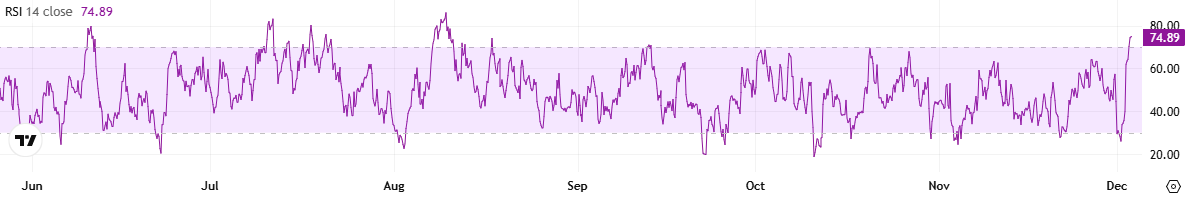

On the other hand, LINK’s Relative Strength Index (RSI) should serve as a warning to investors. The technical analysis tool measures the speed and magnitude of the latest price changes and helps traders identify possible reversal spots. It ranges from 0 to 100, and readings above 70 indicate that the asset is overbought and poised for a potential plunge. Conversely, ratios below 30 are seen as buying opportunities. As of this writing, LINK’s RSI stands at around 74, meaning bearish territory.

LINK RSI, Source: CryptoWaves

LINK RSI, Source: CryptoWaves

The post Chainlink (LINK) Soars by 20% Daily: Further Gains on the Way? appeared first on CryptoPotato.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

XRP Treasury Firm Evernorth Prepares Public Listing to Boost Institutional Exposure