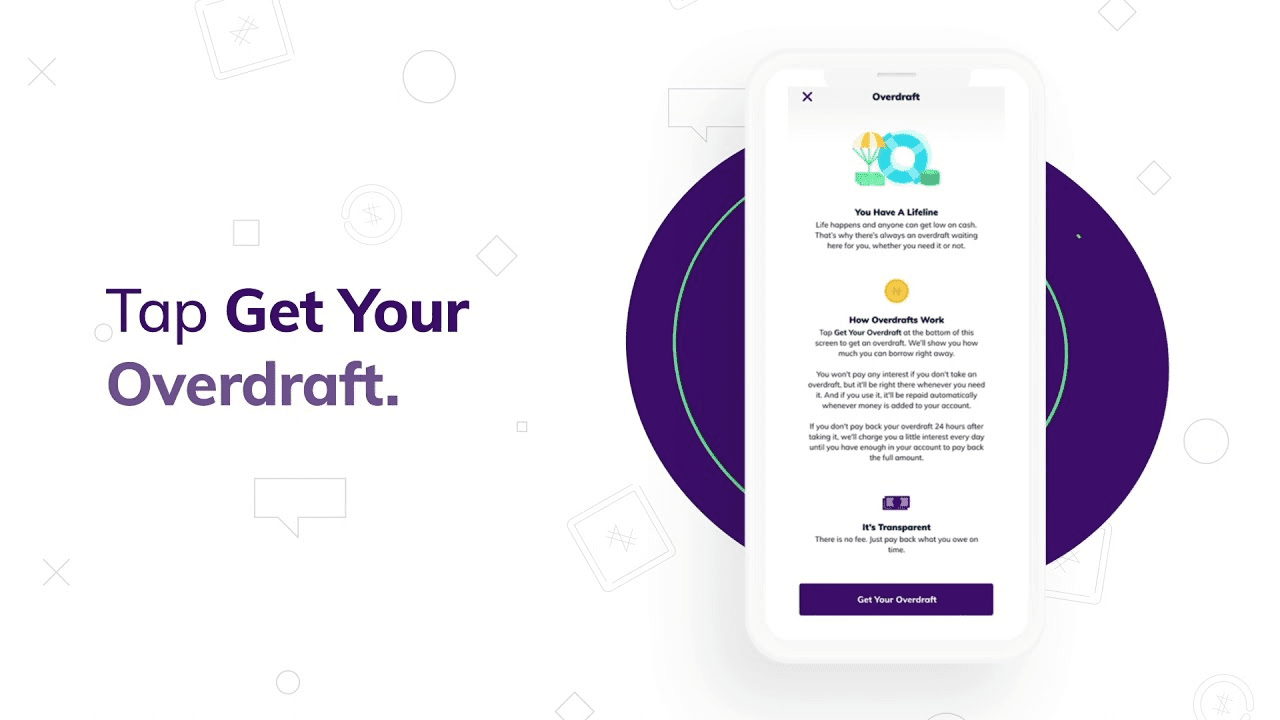

How to use Overdrafts

We’ve all been there, you need cash urgently, but your account is low. It’s frustrating when life won’t wait for your next payday. That scramble to figure out where the money is coming from is exactly what an overdraft is designed to help solve.

It’s a simple safety net designed to cover you instantly. This guide will walk you through how to access that quick cash.

What is an Overdraft?

An overdraft is a quick way to borrow money when you don’t have enough. Think of it as a small, short-term safety net from your bank.

Nigerian banks offer two kinds of overdrafts:

Authorized overdraft: You agree on a credit limit with your bank ahead of time. The amount depends on your income.

Unauthorized overdraft: This happens when you spend more than you have without setting a limit first. Because it’s unplanned, the fees are usually much higher.

Several Nigerian banks, including Kuda, offer overdrafts. With Kuda, you can see your fees and limits instantly in the app, making it much faster and more transparent than traditional banks.

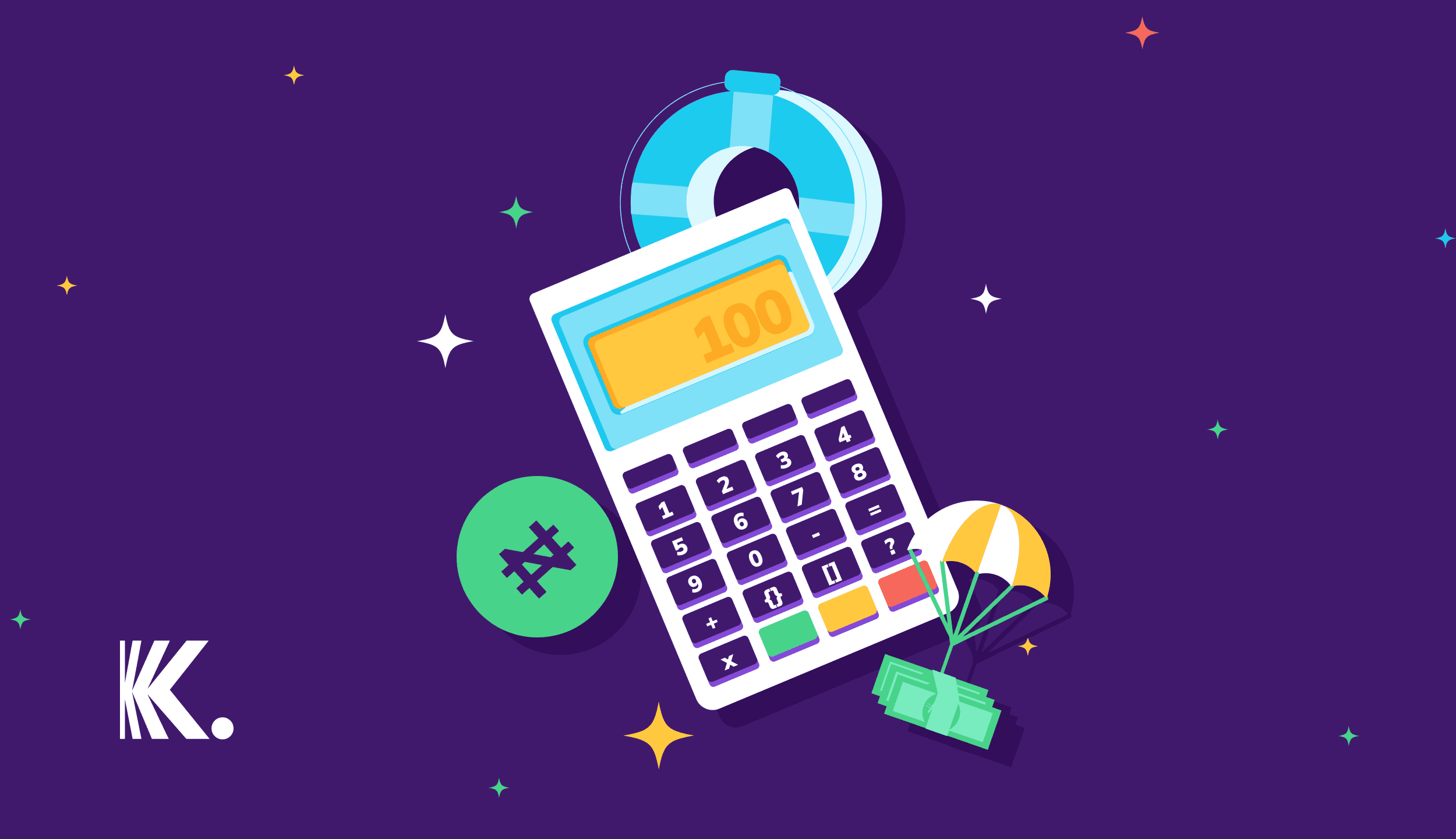

What do the interest rates look like?

According to the CBN (Central Bank of Nigeria), overdraft interest rates are usually between 25% and 35% per year, but you only pay interest on the amount you actually use.

Am I eligible for an overdraft?

Overdrafts work best as a bridge, a way to cover an urgent expense before you have the money. They work best for people with predictable income streams who need occasional short-term cash flow help.

Overdrafts are great if you fall within this bracket:

- Salary earner: You’re out of money a few days before payday, and you need a little help.

- Small business owner: You need to cover a sudden equipment breakdown or to pay staff while waiting for an invoice to clear.

Freelancer or consultant: You need to cover immediate expenses during the 30–60 day wait for client invoice payments.

Overdrafts are NOT a good idea if:

- Your income is unpredictable.

- You are struggling with existing debt.

You need money for a long-term goal e.g. building a house.

The most important rules

1. Pay back as soon as you can: The golden rule is to clear the balance quickly. Most banks want the money back within 30 days. You should aim to pay back as soon as your salary hits your account. You can set up an automatic transfer to do this right away.

2. Avoid the rollover trap: If you clear the overdraft one day, only to use it again the next day, you’re stuck in an expensive cycle. You’re basically paying high interest for permanent financing.

When is it okay to use an overdraft?

To bridge payroll gaps: Imagine a small business in Kano that has to pay employees at the end of the month, but their clients only pay every 45 days. An overdraft helps cover that gap until the money arrives.

Work emergencies: A bakery in Ibadan uses their overdraft to immediately fix a broken oven rather than lose a week’s revenue.

Unexpected costs: Your service charge might be due on the 25th, but your salary won’t land until the 30th. An overdraft can cover the payment immediately.

These scenarios share common elements: they’re temporary, there’s a predictable repayment source, and clear benefits exceeding the interest cost.

Understanding lender criteria and eligibility in Nigeria

Being eligible for an overdraft is easier if you know what banks are checking.

- Income: Nigerian banks usually require a minimum monthly income of ₦100,000 (this depends on the bank). Your salary account must also have been active with them for at least six months.

- Credit check: They check your credit history to see if you have a good record of paying back debts. A good credit score always increases your chances and secures better rates.

- For businesses: Banks require audited financial statements, CAC registration evidence, and proof of business relationships.

- Interest rates: These usually depend on risk profile. Prime customers might get 15-18% annually, while higher-risk applicants face 25-30% rates. Always compare offers from multiple banks before deciding.

In conclusion

Overdrafts can be a financial lifeline when used correctly. The Kuda Overdraft is designed to be a fast, short-term safety net.

Use it for urgent needs, track your spending, and pay it back quickly to avoid those extra charges and the costly rollover trap. That’s how you stay in control of your money.

See also: Kuda Bank raises $55m Series B at a $500m valuation to drive its expansion outside Nigeria

You May Also Like

TECNO Unveils the World’s Thinnest Modular Smartphone Ecosystem Concept

Yiwu Spring Festival Gala Showed the World: More Than Just “Small Commodities”