Strategy Sets $1.44B Buffer for Bitcoin Bear Market Risk: CryptoQuant

Strategy, the world’s largest corporate holder of Bitcoin, has set aside a $1.44 billion U.S. dollar reserve as a liquidity buffer against a prolonged market downturn, a move that analysts at CryptoQuant say signals preparation for a potential bear market phase.

The company, the world’s largest corporate holder of Bitcoin, raised the funds through ongoing at-the-market equity sales.

The reserve is designed to cover dividend payments on preferred stock and service interest obligations for at least 12 months, with the stated goal of extending coverage to 24 months or more.

Strategy also disclosed that it may sell Bitcoin or Bitcoin derivatives as part of its risk-management toolkit if market conditions deteriorate.

Strategy Pivots to Dual-Reserve Treasury as Bitcoin Buying Slows

CryptoQuant described the move as a structural change from Strategy’s long-standing playbook of issuing equity and convertibles primarily to buy more Bitcoin.

Instead, the company is now operating a dual-reserve treasury model that pairs long-term Bitcoin exposure with short-term dollar liquidity aimed at reducing the risk of forced BTC sales during market stress.

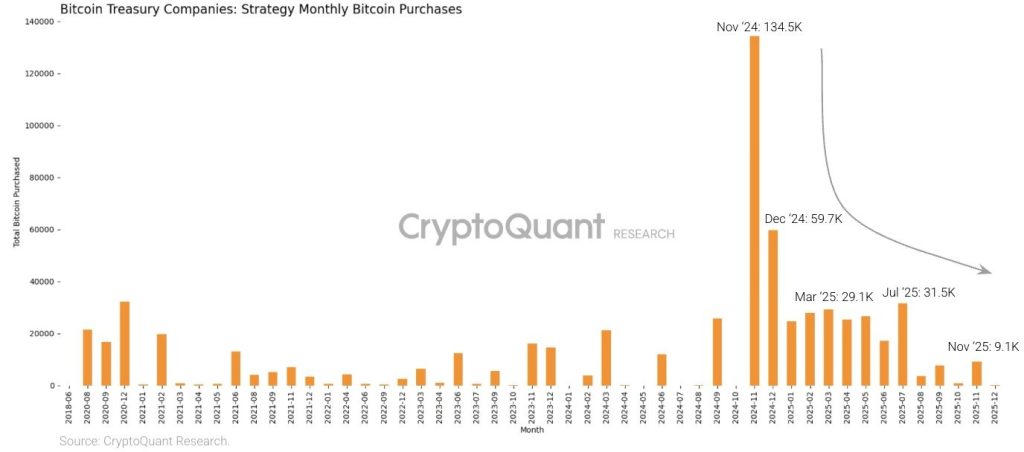

The shift comes as Strategy’s pace of Bitcoin accumulation has slowed sharply through 2025. Monthly purchases fell from 134,000 BTC at the 2024 peak to 9,100 BTC in November 2025, with just 135 BTC added so far this month, according to CryptoQuant.

Source: CryptoQuant

Source: CryptoQuant

The analytics firm said the scale and timing of the dollar buffer signal preparation for a sustained bear market.

Despite the slowdown, Strategy remains deeply exposed to Bitcoin. On Nov. 17, the firm bought 8,178 BTC for roughly $835.5 million in its largest purchase since July, bringing total holdings to about 650,000 BTC.

Strategy’s stock trades under the ticker MSTR, with a basic market capitalization of about $54 billion and an enterprise value near $69 billion.

Market net asset value metrics show the stock trading close to the value of its Bitcoin holdings. Basic mNAV stands at 0.892, diluted mNAV at 0.994, and enterprise-value mNAV at 1.136, reflecting the effect of debt and preferred obligations.

CEO Phong Le has said the company would only consider selling Bitcoin if its shares fall below net asset value and access to new financing dries up.

He described such sales as a last resort to protect what he calls “Bitcoin yield per share,” stressing that selling would occur only if issuing new equity became more dilutive than reducing holdings.

Strategy’s annual fixed obligations tied to preferred shares are estimated at $750 million to $800 million. Le said the new dollar reserve currently covers about 21 months of dividends.

Founder and Executive Chairman Michael Saylor described the reserve as the next stage in Strategy’s evolution as a Bitcoin-focused treasury company, positioning it to navigate market volatility while maintaining its long-term digital-asset strategy.

To reassure investors, the company recently launched a “BTC Credit” dashboard, stating that it has sufficient dividend coverage even if Bitcoin prices remain flat for extended periods.

Strategy also said its debt remains well-covered if Bitcoin falls to its average cost of roughly $74,000 and remains manageable even at $25,000.

The reserve strategy has drawn mixed reactions from the market. Bitcoin critic Peter Schiff argued that the shift shows the company is being forced to sell stock to buy dollars rather than Bitcoin in order to meet its obligations.

Strategy’s share price has fallen more than 60% from recent highs even as Bitcoin has traded between $95,000 and $110,000 in late 2025, adding to investor scrutiny of the model.

Strategy’s stance is also being watched by index providers. MSCI is currently reviewing how companies with large digital-asset treasuries should be treated in major equity indexes.

Any change in classification could force benchmark-tracking funds to rebalance, adding another layer of volatility to a stock that already trades with a high Bitcoin beta.

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim