Why The Bitcoin Bear Market Is Almost Finished

Bitcoin Magazine

Why The Bitcoin Bear Market Is Almost Finished

Bitcoin has struggled to maintain a sustained correlation with Gold, recently only moving in unison during market downturns. However, examining Bitcoin’s price action through the lens of Gold rather than USD reveals a more complete picture of the current market cycle. By measuring Bitcoin’s true purchasing power against comparable assets, we can identify potential support levels and gauge where the bear market cycle may be approaching its conclusion.

Bitcoin Bear Market Officially Begins Below Key Support

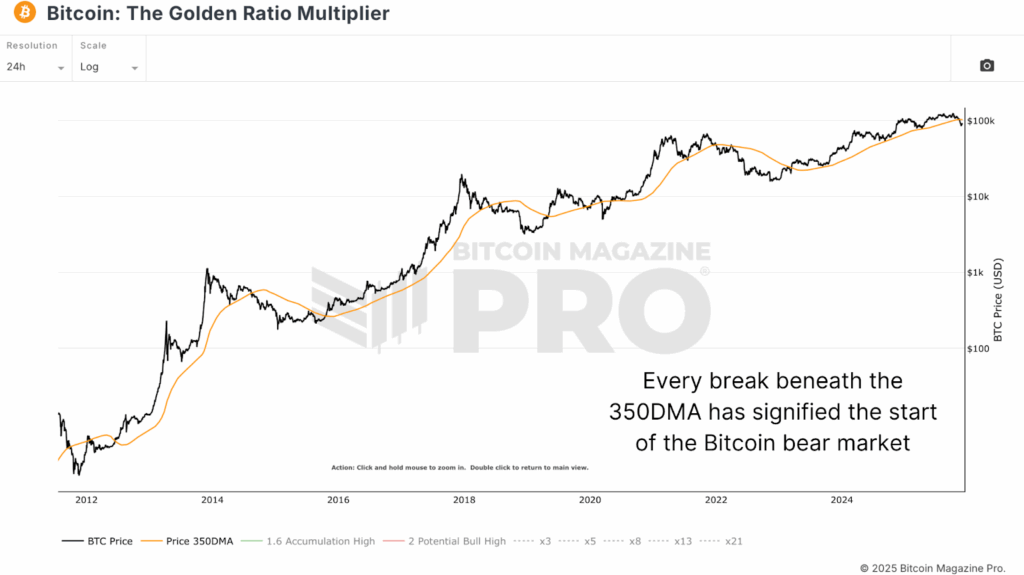

Breaking beneath the 350-day moving average at about $100,000 and the significant psychological 6-figure barrier marked the functional entry into bear market territory, with Bitcoin declining approximately 20% immediately thereafter. From a technical perspective, trading beneath The Golden Ratio Multiplier moving average has historically indicated Bitcoin entering a bear cycle, though the narrative becomes more interesting when measured against Gold rather than USD.

Figure 1: BTC breaking beneath the 350DMA has historically coincided with the start of bear markets. View Live Chart

Figure 1: BTC breaking beneath the 350DMA has historically coincided with the start of bear markets. View Live Chart

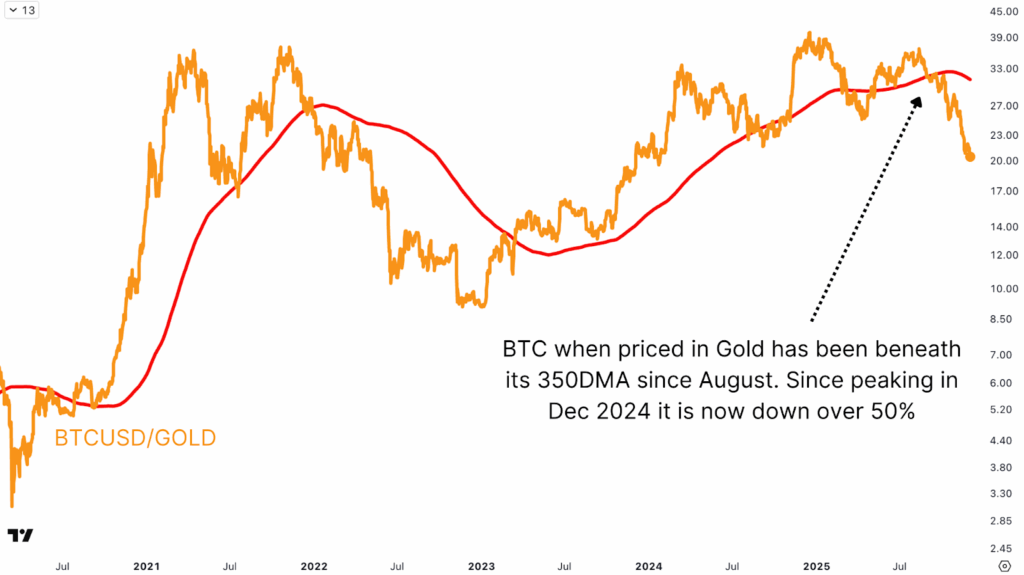

The Bitcoin versus Gold chart tells a notably different story than the USD chart. Bitcoin topped out in December 2024 and has since declined over 50% from that level, whereas the USD valuation peaked in October 2025, significantly beneath the highs set the prior year. This divergence suggests that Bitcoin may have been in a bear market for considerably longer than most observers realize. Looking at historical Bitcoin bear cycles when measured in Gold, we can see patterns that suggest the current pullback may already be approaching critical support zones.

Figure 2: When priced in Gold, BTC dropped beneath its 350DMA back in August.

Figure 2: When priced in Gold, BTC dropped beneath its 350DMA back in August.

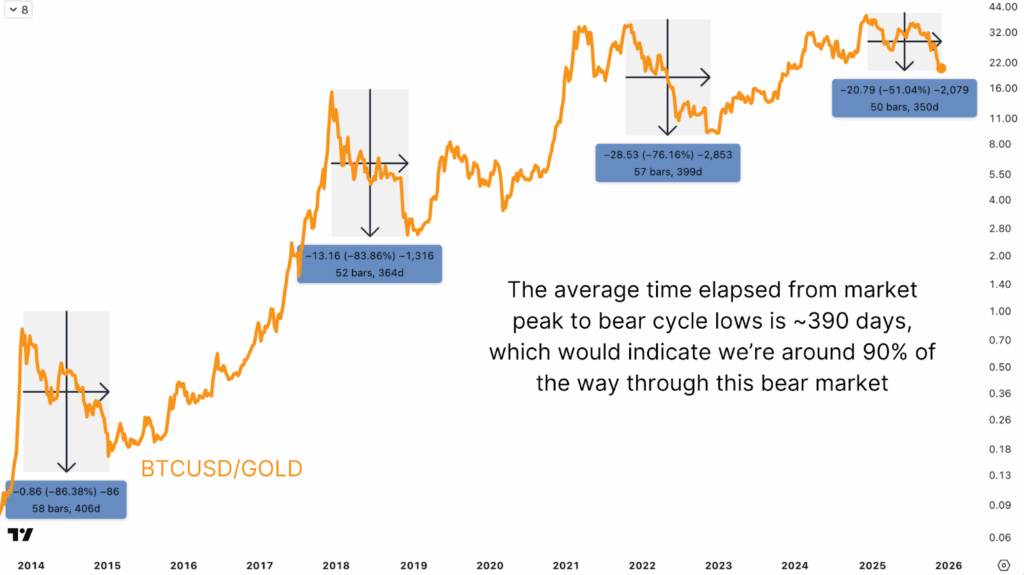

The 2015 bear cycle bottomed at an 86% retracement lasting 406 days. The 2017 cycle saw 364 days and an 84% decline. The previous bear cycle produced a 76% drawdown over 399 days. Currently, at the time of this analysis, Bitcoin is down 51% in 350 days when measured against Gold. While percentage drawdowns have been diminishing as Bitcoin’s market cap grows and more capital flows into the market, this trend reflects the rising tide of institutional adoption and lost Bitcoin supply rather than a fundamental change in cycle dynamics.

Figure 3: Plotting BTC’s value in Gold reveals a cycle pattern that suggests we could already be 90% of the way through this bear market.

Figure 3: Plotting BTC’s value in Gold reveals a cycle pattern that suggests we could already be 90% of the way through this bear market.

Multi-Cycle Confluence Signals Bitcoin Bear Market Bottom Approaching

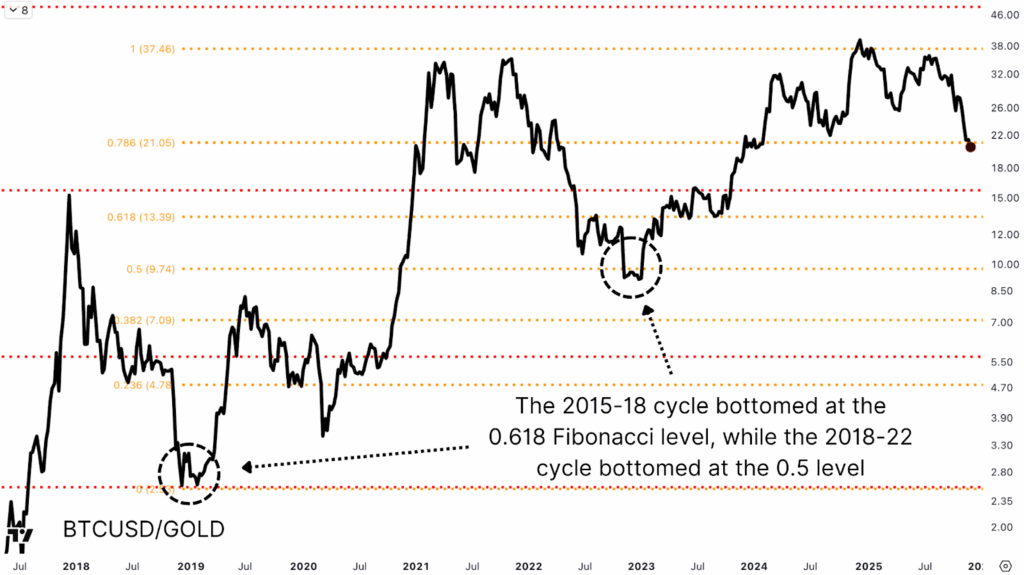

Rather than relying solely on percentage drawdowns and time elapsed, Fibonacci retracement levels mapped across multiple cycles provide greater precision. Using a Fibonacci retracement tool from bottom to top across historical cycles reveals striking levels of confluence.

Figure 4: In previous cycles, bear market bottoms have aligned with key Fibonacci retracement levels.

Figure 4: In previous cycles, bear market bottoms have aligned with key Fibonacci retracement levels.

In the 2015-2018 cycle, the bear market bottom occurred at the 0.618 Fibonacci level, which corresponded to approximately 2.56 ounces of Gold per Bitcoin. The resulting price action marked the bottom with remarkable clarity, far cleaner than the equivalent USD chart. Moving forward to the 2018-2022 cycle, the bear market bottom aligned almost perfectly with the 0.5 level at approximately 9.74 ounces of Gold per Bitcoin. This level later acted as meaningful resistance-turned-support once Bitcoin reclaimed it during the subsequent bull market.

Translating Bitcoin Bear Market Gold Ratios Back to USD Price Targets

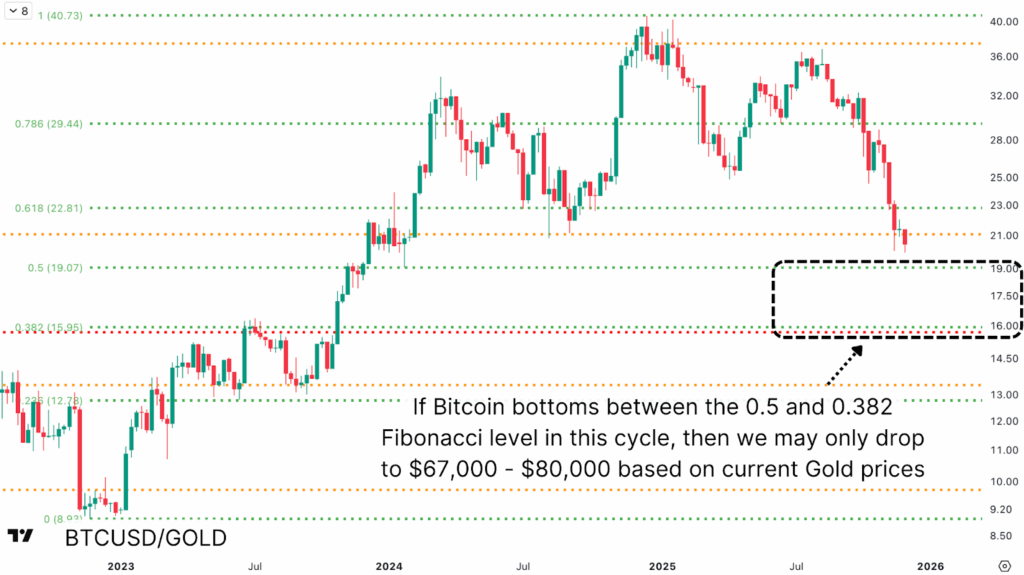

From the previous bear market low through the current bull cycle high, the 0.618 Fibonacci level sits at approximately 22.81 ounces of Gold per Bitcoin, while the 0.5 level rests at 19.07 ounces. Current price action is trading near the midpoint of these two levels, presenting what may be an attractive accumulation zone from a purchasing power perspective.

Figure 5: Applying Fibonacci levels to predict market lows for BTC versus Gold and subsequently pricing these back into USD, illustrates where Bitcoin’s price may bottom.

Figure 5: Applying Fibonacci levels to predict market lows for BTC versus Gold and subsequently pricing these back into USD, illustrates where Bitcoin’s price may bottom.

Multiple Fibonacci levels from different cycles create additional confluence. The 0.786 level from the current cycle translates to approximately 21.05 ounces of Gold, corresponding to a Bitcoin price around $89,160. The 0.618 level from the previous cycle aligns near $80,000 again. These convergence zones suggest that if Bitcoin were to decline further, the next meaningful technical target would be around $67,000, derived from the 0.382 Fibonacci retracement level at approximately 15.95 ounces of Gold per Bitcoin.

Conclusion: The Bitcoin Bear Market May Be 90% Complete Already

Bitcoin has likely been in a bear market for substantially longer than USD-only analysis suggests, with purchasing power already declining significantly since December 2024, when measured against Gold and other comparable assets. Historical Fibonacci retracement levels, when properly calibrated across multiple cycles and converted back into USD terms, point toward potential support confluence in the $67,000 to $80,000 range. While this analysis is inherently theoretical and unlikely to play out with perfect precision, the convergence of multiple data points across time horizons and valuation frameworks suggests the bear market may be approaching its conclusion sooner than many anticipate.

For a more in-depth look into this topic, watch our most recent YouTube video here: Proof This Bitcoin Bear Market May Be OVER Already

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com. Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Why The Bitcoin Bear Market Is Almost Finished first appeared on Bitcoin Magazine and is written by Matt Crosby.

You May Also Like

The Channel Factories We’ve Been Waiting For