Michael Saylor’s Bitcoin Playbook Backfires on 100+ Companies

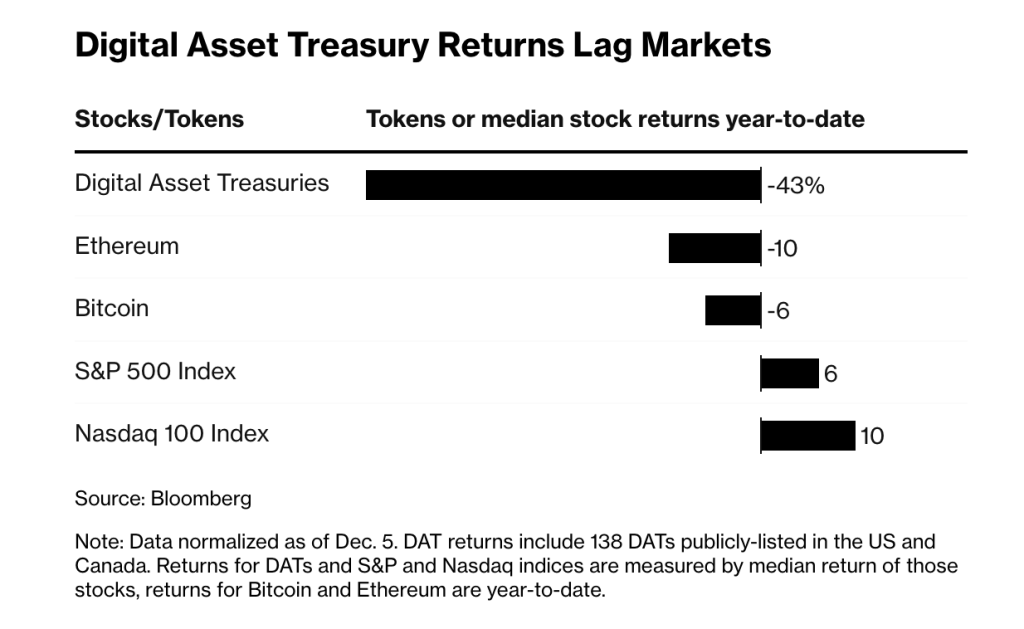

Digital asset treasury companies that rushed to copy Michael Saylor’s Bitcoin strategy are now hemorrhaging shareholder value, with median stock prices down 43% year to date, even as the broader market climbs higher, as per Bloomberg.

Source: Bloomberg

Source: Bloomberg

More than 100 publicly traded companies transformed themselves into cryptocurrency-holding vehicles in the first half of 2025, borrowing billions to buy digital tokens while their stock prices initially soared past the value of the underlying assets they purchased.

The strategy seemed unstoppable until market reality delivered a harsh correction.

Strategy’s Model Spawns Industry-Wide Collapse

Strategy Inc.’s Michael Saylor pioneered the approach of converting corporate cash into Bitcoin holdings, transforming his software company into a publicly traded cryptocurrency treasury.

The model worked spectacularly through the mid-2025, attracting high-profile investors, including the Trump family.

SharpLink Gaming epitomized the frenzy. The company pivoted from traditional gaming operations, appointed an Ethereum co-founder as chairman, and announced massive token purchases.

Its stock exploded 2,600% within days before crashing 86% from peak levels, leaving total market capitalization below the value of its Ethereum holdings at just 0.9 times crypto reserves.

Bloomberg data tracking 138 U.S. and Canadian digital asset treasuries shows the median share price has fallen 43% year-to-date, dramatically underperforming Bitcoin’s modest 7% decline.

In comparison, the S&P 500 gained 6% and the Nasdaq 100 rose 10%.

Strategy shares have dropped 60% from their July highs, even as they have risen by more than 1,200% since the company began buying Bitcoin in August 2020.

“Investors took a look and understood that there’s not much yield from these holdings rather than just sitting on this pile of money,” B. Riley Securities analyst Fedor Shabalin told Bloomberg.

Debt Obligations Expose Structural Flaws

The fundamental problem plaguing these companies stems from how they fund cryptocurrency purchases.

Strategy and its imitators issued massive amounts of convertible bonds and preferred shares, raising over $45 billion across the industry to acquire digital tokens that generate no cash flow.

These debt instruments carry substantial interest and dividend obligations that cryptocurrency holdings cannot service, creating a structural mismatch between liabilities that require regular payments and assets that produce zero income.

Strategy faces annual fixed obligations of approximately $750 million to $800 million tied to preferred shares.

Companies that avoided Bitcoin for smaller, more volatile cryptocurrencies suffered the steepest losses.

Alt5 Sigma, backed by two Trump sons and planning to purchase over $1 billion in World Liberty Financial’s WLFI token, has crashed more than 85% from its June peak.

Strategy attempted to address funding concerns by raising $1.44 billion in dollar reserves through stock sales, covering 21 months of dividend payments.

Saylor Admits Potential Bitcoin Sales

The industry now faces its defining moment. Strategy CEO Phong Le acknowledged the company would sell Bitcoin if needed to fund dividend payments, specifically if the firm’s market value falls below its cryptocurrency holdings.

Those comments sent shockwaves through the digital asset treasury sector, given Saylor’s repeated insistence that Strategy would never sell, famously joking in February to “sell a kidney if you must, but keep the Bitcoin.“

At December’s Binance Blockchain Week, Saylor outlined the revised approach, stating that “when our equity is trading above the net asset value of the Bitcoin, we just sell the equity,” but “when the equity’s trading below the value of the Bitcoin, we would either sell Bitcoin derivatives, or we would just sell the Bitcoin.“

The reversal raises fears of a downward spiral where forced crypto sales push token prices lower, further pressuring treasury company valuations and potentially triggering additional selling.

Strategy’s monthly Bitcoin accumulation has collapsed from 134,000 BTC at the 2024 peak to just 9,100 BTC in November, with only 135 BTC added so far in December.

The company now holds approximately 650,000 BTC, valued at over $56 billion, representing more than 3% of Bitcoin’s maximum supply.

Market participants worry that leveraged traders using borrowed money to invest in these companies could face margin calls, forcing broader market selloffs.

Strategy has created a $1.4 billion reserve fund to cover near-term dividend payments, but shares remain on track for a 38% decline this year despite the company’s massive Bitcoin holdings.

You May Also Like

Trump Crypto Adviser Urges Bipartisan Support After Senate Committee Unveils Partisan Crypto Bill

CME Group to launch options on XRP and SOL futures