XRP Whales Sell $780 Million, Will Price Fall Below $2?

XRP price has returned to the critical $2 level after repeated failed breakout attempts, reflecting uncertainty across the market.

Each attempt to rally above near-term resistance has been met with selling pressure, pulling the altcoin back toward this psychological floor.

XRP Holders Are In A Tug Of War

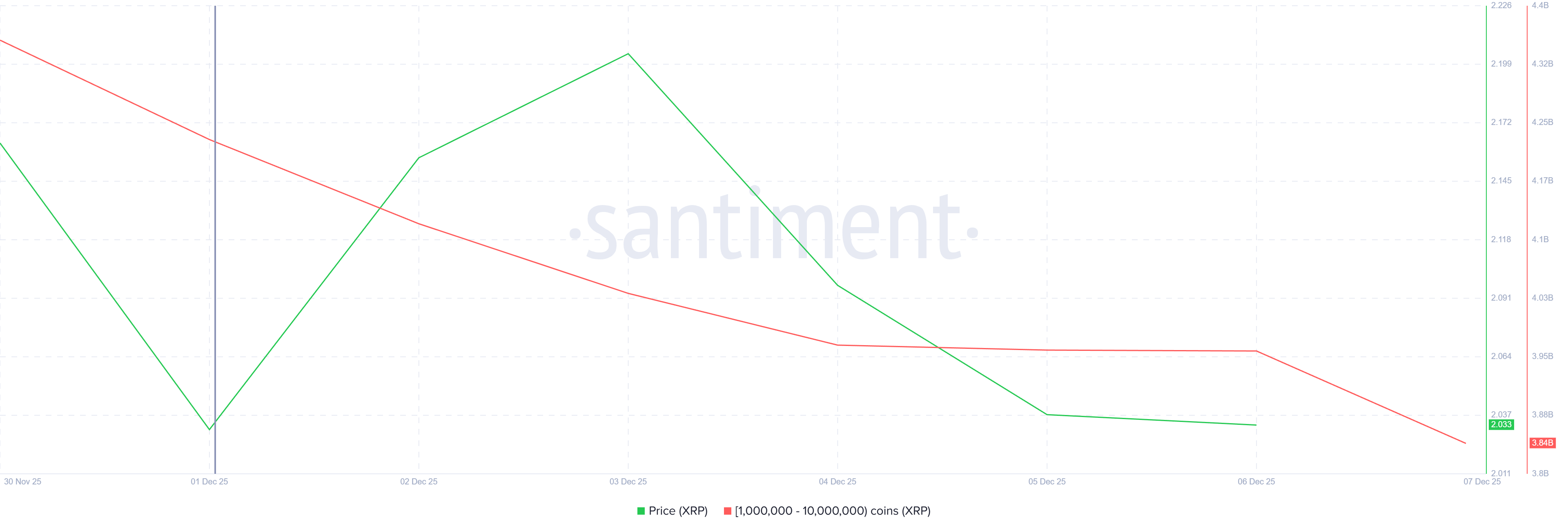

Whales have begun offloading substantial portions of their holdings. Over the past seven days, wallets holding between 1 million and 10 million XRP have sold more than 390 million XRP, worth over $783 million at current prices.

This level of distribution shows clear frustration among high-value holders who expected a stronger recovery. Such selling typically weighs heavily on market sentiment, especially when driven by a cohort that can significantly influence liquidity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Whale Holding. Source: Santiment

XRP Whale Holding. Source: Santiment

Despite whale distribution, long-term holders are counteracting downward pressure. HODL Waves data shows that the share of XRP supply held by the 1-year to 2-year cohort increased from 8.58 percent to 9.81 percent in the past week.

This signals growing conviction among maturing holders who acquired XRP less than a year ago and are now opting to retain their tokens through volatility. This steadiness is helping stabilize XRP at $2, softening the impact of whale selling.

XRP HODL Waves. Source: Glassnode

XRP HODL Waves. Source: Glassnode

XRP Price Notes A Dip

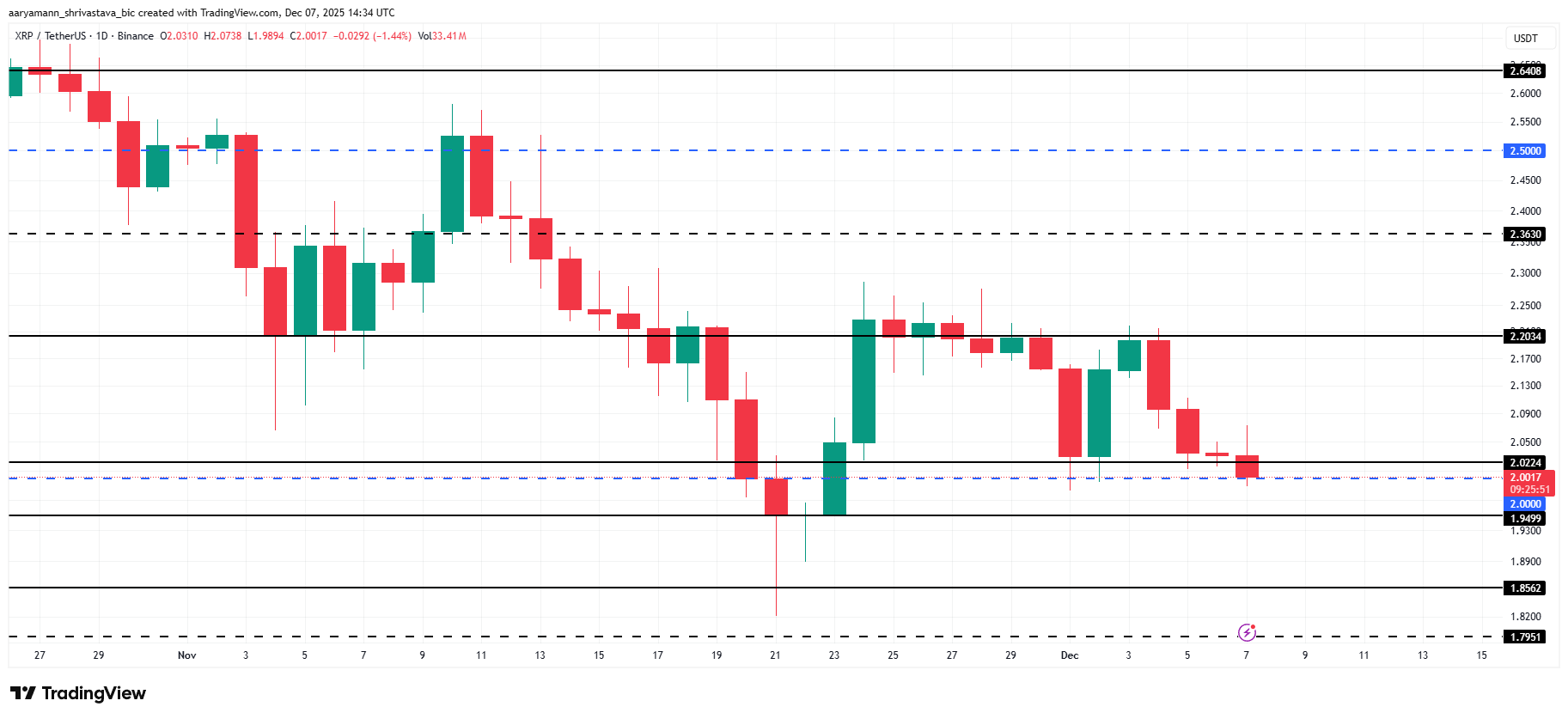

XRP is trading at $2.00 at the time of writing, a crucial psychological and technical support level. In recent days, price movements have repeatedly gravitated back to this point, confirming its importance in maintaining market structure.

Given the opposing pressure from whale selling and long-term holder accumulation, XRP will likely remain rangebound between $2.00 and $2.20 until a clear directional catalyst emerges. A shift in sentiment or improved market conditions would be needed to break this consolidation pattern.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

However, if bearish momentum strengthens and whale selling accelerates, XRP could fall through the $1.94 support. Such a breakdown would expose the price to a deeper decline toward $1.85, invalidating any near-term bullish expectations.

You May Also Like

Robinhood set to enter Indonesia, targeting 17M crypto traders

Robinhood acquired an Indonesian brokerage and digital asset trading firm to access a market with 17 million crypto investors. Crypto and stock trading platform Robinhood is set to tap into Indonesia’s burgeoning cryptocurrency trading market after an agreement to acquire two local fintech companies.In an announcement on Sunday, Robinhood said it has entered into agreements to acquire Buana Capital, an Indonesian brokerage, and PT Pedagang Aset Kripto, a licensed Indonesian digital financial asset trader, “marking our entry into one of Southeast Asia’s fastest-growing markets.”It said that Indonesia has more than 19 million capital market investors and 17 million crypto investors, making it a “compelling market for equities and crypto trading.”Read more

PIF-backed Lucid expands network in Saudi Arabia