CFTC Launches Pilot Program Allowing Crypto as Collateral in Derivatives Markets

- The CFTC has authorized the use of bitcoin, Ethereum and USDC as collateral for derivatives trading.

- The regulator launched a pilot program with enhanced monitoring and reporting.

The US Commodity Futures Trading Commission (CFTC) has announced the launch of a pilot program that allows digital assets to be used as collateral in derivatives trading. In the first phase, only bitcoin, Ethereum and USDC are allowed.

In addition, the regulator has issued guidance on tokenized collateral and repealed outdated requirements that became obsolete when the GENIUS Act went into effect. The program provides for enhanced reporting and increased monitoring by the regulator.

Market participants will be able to use tokenized assets, particularly U.S. Treasury securities and money market funds, as collateral for derivatives trading. According to CFTC Acting Chair Carolyn Pham, the initiative is a continuation of the previously launched tokenized collateral project introduced in September as part of the Crypto Sprint.

The introduction of the new rules has already been supported by key market players. Coinbase general counsel Paul Grewal called the decision “an important recognition of digital assets as a financial instrument.”

Circle President Git Tarbert noted that the new CFTC policy “strengthens the leadership of the U.S. dollar” and reduces risks in settlements.

Recall, earlier we reported that futures exchanges with a CFTC license will launch trading in spot crypto products.

You May Also Like

Sygnum’s new bitcoin fund pulls in $65 million from investors looking for steady yield

Copy linkX (Twitter)LinkedInFacebookEmail

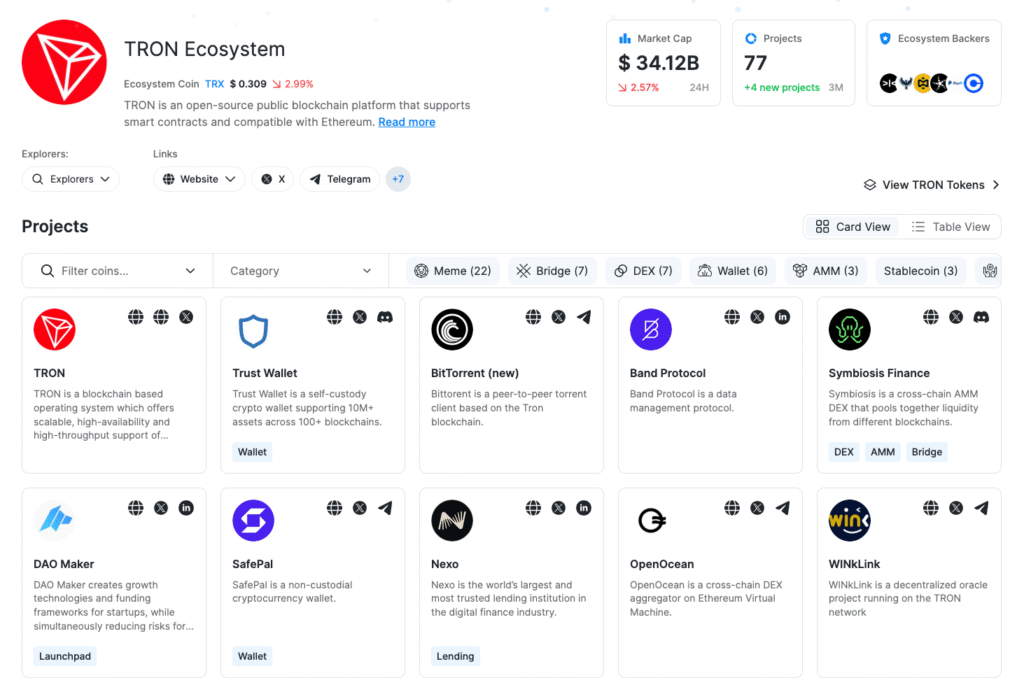

The State of TRON H2 2025: Stablecoin Settlement at Scale Amid Rising Competition