Michael Saylor Pitched Bitcoin To ‘Every’ Middle East Sovereign Wealth Fund

In a fireside chat with Metaplanet CEO Simon Gerovich at BTC MENA 2025, Michael Saylor turned a technical conversation about Bitcoin treasuries into a direct pitch to the Middle East’s sovereign wealth funds and banks, outlining how a nation or large financial institution could attract tens of trillions of dollars and become the “Switzerland” of digital capital.

Saylor and Gerovich began by framing Bitcoin as “digital capital.” As Saylor put it, “Our company pursued a strategy of accumulating digital capital. Bitcoin is digital capital. What do you do when you have capital? You issue credit against it.” Both MicroStrategy and Metaplanet are building balance sheets of Bitcoin and then issuing perpetual preferred instruments as “digital credit” backed by that capital.

Gerovich described Japan as a massive but yield-starved market. “There’s $7 trillion of cash sitting on personal bank accounts, bank balance sheets earning nothing, and corporates have another $4 or $5 trillion.” A Japanese family that puts money in the bank gets “zero.” Even as deflation fades, investors remain “accustomed to zero” and are “desperately looking for yield.”

Metaplanet’s answer is to connect that idle capital to Bitcoin. It launched “Mercury,” a perpetual preferred paying 4.9% in yen with convertibility into equity, which Gerovich called “probably one of the cheapest call options on Bitcoin out there.” Its follow-up product, “Mars” – Metaplanet Adjustable Rate Securities – is designed as a high-yield, Bitcoin-backed instrument that Japanese investors can hold in their securities accounts as a kind of supercharged bank deposit.

Inside Saylor’s Bitcoin Talks With Sovereign Funds

Saylor used this as a template for the Middle East, explaining that he has been on an intensive tour of the region’s power centers. “I’ve been meeting with all the sovereign wealth funds. I’ve been meeting with, I don’t know, 50, 100 different investors, hedge funds, family office investors… I’ve been meeting with regulators in every jurisdiction.” His message is “very, very straightforward”: “We now have digital capital. Bitcoin is digital capital, is digital gold. On top of digital capital, we have a new asset class called digital credit. Digital credit strips the volatility from the capital and provides yield, income.”

To illustrate the appeal, he contrasted capital and credit. Giving a child $1 million of Manhattan land is pure capital with no cash flow. “Or you can give them a credit instrument that pays them $10,000 a month forever, starting now. And so most people want the credit instrument. They don’t want the capital instrument… They’d rather have 10% non-volatile than 30% volatile with no cash flows.” Treasury companies like MicroStrategy and Metaplanet “exist to convert capital into credit.”

Saylor then laid out the blueprint for any ambitious bank in the region: “Have the bank custody Bitcoin. Everybody talks about self-custody. Self-custody for the bank in the country. Buy Bitcoin, have your bank custody the Bitcoin, and then start to offer credit networks on top of the Bitcoin.” If a national bank extends loans such as “SOFR plus 50 basis point loans on Bitcoin,” he argued, then as Bitcoin’s market grows from $2 trillion to $20 trillion, that bank could attract “5% or 10% of it,” pulling in “a trillion dollars or a few trillion dollars” simply because “most big conventional regulated banks don’t handle Bitcoin.”

The “biggest idea” is to turn Bitcoin-backed credit into a bank account that outcompetes the entire global deposit system. By taking digital credit instruments like Stretch or Mars, placing them in a fund that is mostly credit with a currency buffer and reserve layer, Saylor envisions a regulated account that pays around 8% with “vol of zero.” In that setup, “I wire you my billions of dollars or tens of billions of dollars, and you pay me 8% interest every day, zero vol, in a regulated bank, powered by digital credit, which is in turn powered by a treasury company with 5x as much digital capital, over-collateralized.”

In such a regime, he argued, “you could presumably attract 20 trillion dollars or 50 trillion dollars.” For depositors, “the perfect product is a bank account with zero volatility that pays you 400 basis points more than the risk-free rate in your favorite currency.” For Saylor, that account is “the lightsaber of money, the laser beam of money, the nuclear fusion reactor of money.”

He framed it as an open race: “The question is, who wants to be the Switzerland of the 21st century and attract all the money in the world?” In his view, “the answer is going to be whoever appreciates money the most, wants the money the most, that understands technology the best, that is willing to take a courageous stance of conviction with a degree of clarity,” he said.

He concluded: “That is the opportunity, and all the conversations have been extraordinarily energetic, enthusiastic, and I couldn’t be more excited. I think it will happen somewhere in this region. We’ll see where.”

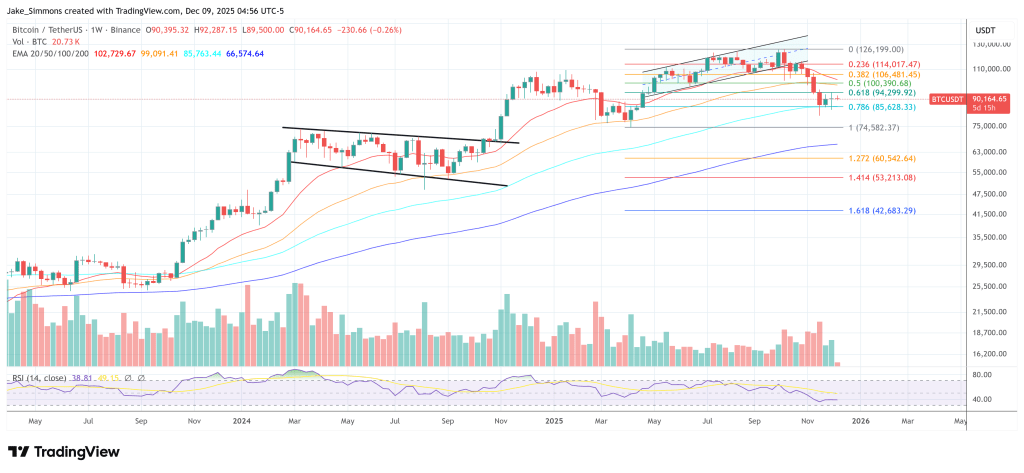

At press time, Bitcoin traded at $90,164.

You May Also Like

Zero Knowledge Proof’s 200M Daily Presale Auction Is Driving The Rush, While ZCash and Hedera Look Lost

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings