XRP Price Set For Major Move as Exchange Balances Plunge 45%

The post XRP Price Set For Major Move as Exchange Balances Plunge 45% appeared first on Coinpedia Fintech News

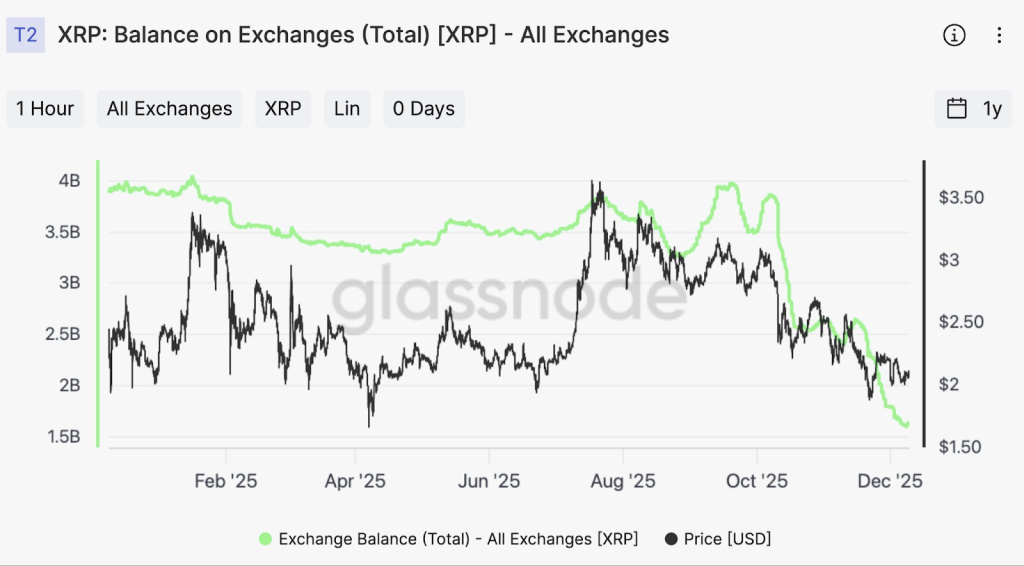

XRP is undergoing a major shift as over 1 billion tokens have moved off exchanges in just three weeks, according to Glassnode. Despite this large supply drop, the XRP price has stayed mostly flat, showing a clear gap between what’s happening with available supply and how the market is pricing XRP.

XRP’s total balance on exchanges has dropped sharply, falling from 3.95 billion tokens to around 1.6 billion. This represents a 45% decline in less than 60 days, with roughly 1.35 billion XRP removed from public exchange order books.

Historically, exchange balances show how much traders are buying and selling in the short term. When tokens leave exchanges in large amounts, it usually means they are being moved for long-term holding or private custody.

This kind of activity is rarely driven by retail traders and instead suggests liquidity is shifting away from public exchanges toward OTC desks, custody platforms, and institutional systems.

Institutional Adoption Reduces XRP Exchange Supply

Several recent developments back this view. In a short period, XRP has been included in multiple institutional filings and investment products. Crypto index funds now carry meaningful XRP weightings, and new ETF-related filings explicitly mention the token.

At the same time, regulators have relaxed rules for banks engaging in crypto, while payment platforms have added easier ways to buy XRP. Together, these steps point to growing institutional integration, not short-term price speculation.

This kind of setup can change how prices move. When there is less XRP available on exchanges, even small buying pressure can push prices higher. With limited supply for sale, price moves tend to be quicker and more volatile once demand picks up.

XRP Price Predictions For Next 3 Weeks

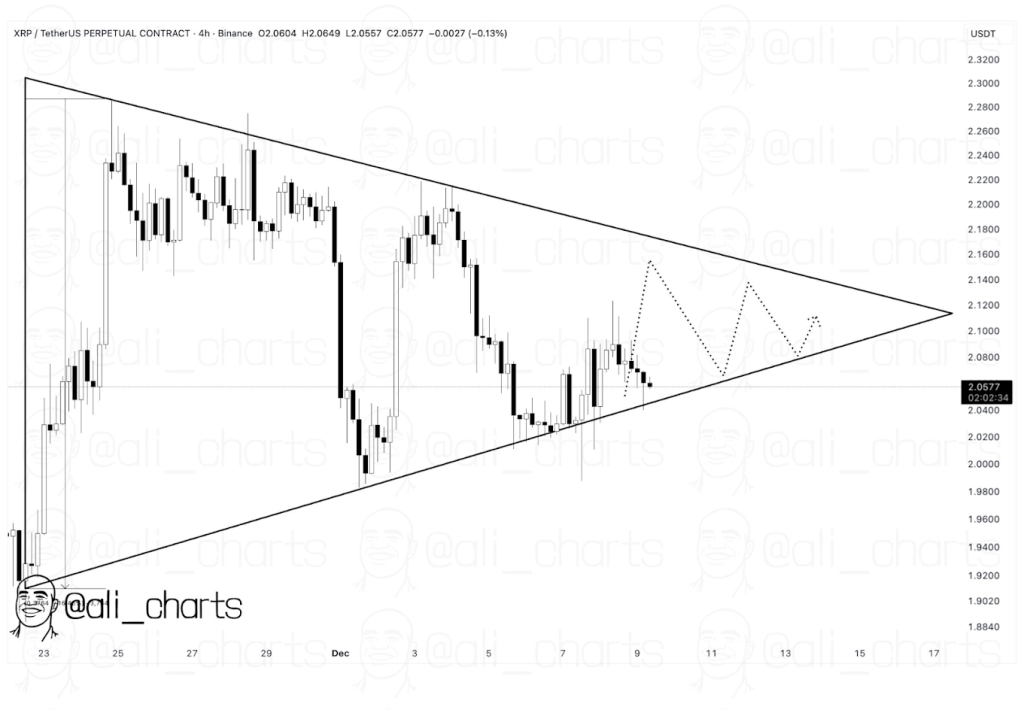

XRP price is currently trading near $2.05, consolidating within a symmetrical triangle pattern. According to Alicharts, this formation reflects a tightening range, with buyers stepping in at higher levels and sellers capping price advances at lower highs.

These patterns usually lead to a strong move once the price breaks out. If XRP rises above $2.12–$2.15, it could trigger an upward rally, while a drop below $2.00 may cause short-term weakness.

For now, XRP is still moving sideways. However, with exchange liquidity falling, institutional activity increasing, and price tightening into a narrow range, the data suggests a major move is coming. The direction will depend on which side the price breaks out next.

You May Also Like

The Ultimate Guide to Online Sports Betting: Why TrustDice is the Future

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement