XRP Ledger Upgrade Lays Groundwork for Lending, Tokenization Expansion

XRP Ledger Upgrade Lays Groundwork for Lending, Tokenization Expansion

One of the amendments in the new release corrects an accounting error affecting Multi-Purpose Tokens (MPTs) held in escrow.

What to know:

- The XRP Ledger released version 3.0.0 of its server software, rippled, focusing on amendments, bug fixes and improving accounting accuracy and protocol extensibility.

- Operators must upgrade to the new version to maintain network compatibility because the update addresses ledger inconsistencies and prepares for future upgrades.

- Key changes include fixing token escrow accounting errors, enhancing consensus stall detection and tightening security measures, which are crucial for XRPL's expansion into tokenization and DeFi.

The XRP Ledger (XRPL) released version 3.0.0 of its reference server software, rippled, introducing a wide-ranging set of amendments, bug fixes and internal changes aimed at improving accounting accuracy, developer tooling and long-term protocol extensibility.

Operators running XRPL servers are required to upgrade to the version to maintain network compatibility, according to RippleX, the development arm overseeing the ledger’s core software.

While the release does not introduce headline, user-facing features, it focuses on fixing subtle ledger inconsistencies, tightening API behavior and restructuring code ahead of future protocol upgrades. For a network increasingly positioning itself around tokenization, DeFi and institutional-grade infrastructure, the upgrades matter.

One of the changes is fixTokenEscrowV1, which corrects an accounting error affecting multi-purpose tokens (MPTs) held in escrow.

Previously, when escrowed tokens carrying transfer fees were unlocked, the ledger reduced the issuer’s locked balance by the gross amount instead of the net amount after fees. Subtracting the wrong number when escrowed tokens were released, creating small but compounding accounting errors, would, over time, lead to discrepancies between reported supply and circulating balances.

The fix ensures supply tracking remains consistent, especially as more tokenized assets use XRPL’s escrow and fee mechanisms.

Several other amendments address edge-case issues across automated market makers (AMMs), price oracles and token delivery metadata — areas that are increasingly important as XRPL expands beyond simple payments.

Beyond protocol-level changes, the update improves consensus stall detection, logging clarity, JSON parsing and CI tooling. These upgrades are aimed at operators and contributors rather than end users, and play a critical role in maintaining network reliability.

XRPL version 3.0.0 also raises warning levels for malformed validator manifests and tightens signature verification logic — incremental changes that improve security hygiene without altering consensus rules.

By fixing token accounting edge cases, enforcing stricter APIs and refactoring core systems, the update strengthens the ledger’s foundations as it evolves toward more complex financial use cases.

More For You

Protocol Research: GoPlus Security

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

Crypto Markets Today: Bitcoin Stuck in Post-Fed Range as Altcoins Slump Deepens

Bitcoin remains trapped in a range despite the U.S. rate cut, while altcoins and memecoins struggle to attract risk appetite amid shifting investor behavior.

What to know:

- BTC briefly dipped below $90,000 after Wednesday's 25 basis-point U.S. rate cut before rebounding, but price action lacked a clear fundamental catalyst.

- Tokens such as JUP, KAS and QNT posted double-digit weekly losses, while CoinMarketCap’s altcoin season index fell to a cycle low of 16/100.

- CoinDesk’s Memecoin Index is down 59% year-to-date versus a 7.3% decline in the CD10, highlighting a shift from retail-driven hype to more institutionally led, slower-moving markets.

U.S. SEC Gives Implicit Nod for Tokenized Stocks

Bitcoin's Volatility Meltdown: Crypto Daybook Americas

YouTube Now Allows U.S. Content Creators to Get Paid in PayPal’s Stablecoin: Fortune

Crypto Markets Today: Bitcoin Stuck in Post-Fed Range as Altcoins Slump Deepens

From Lockstep to Lag, Bitcoin Poised to Catch Up With Small Cap Highs

Standard Chartered, Coinbase Expand Crypto Prime Services for Institutions

U.S. SEC Gives Implicit Nod for Tokenized Stocks

YouTube Now Allows U.S. Content Creators to Get Paid in PayPal’s Stablecoin: Fortune

Crypto Markets Today: Bitcoin Stuck in Post-Fed Range as Altcoins Slump Deepens

XRP Lands on Solana, Ethereum and Others, in Boost for Ripple Ecosystem

Bitcoin's Volatility Meltdown: Crypto Daybook Americas

Boring Bitcoin's Green Light Moment Incoming?

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

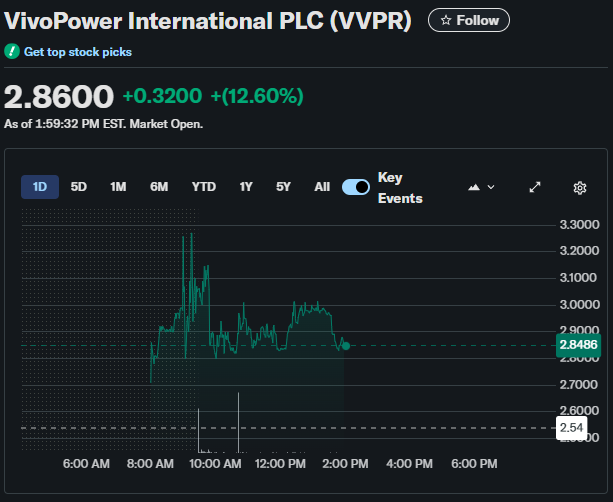

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally