Base's L2 capital game: "plundering" Ethereum liquidity, triple increase in resources, technology and ecology

Author: Nancy, PANews

L2 has shifted from the early technical narrative to the game between ecology and capital. Compared with most L2 projects gradually entering the end of the narrative dividend, Base has recently gained a double increase in capital inflow and attention. Behind Base's growth, it is inseparable from the resource advantages of the US crypto giant Coinbase, the continuous promotion of technological breakthroughs, and the hot promotion of ecosystems such as MEME and RWA.

Ethereum leads the market with $2.8 billion, and Base sucks its blood

With strong capital inflows, Base is leading the L2 market, especially as the Ethereum ecosystem is migrating to the network on a large scale.

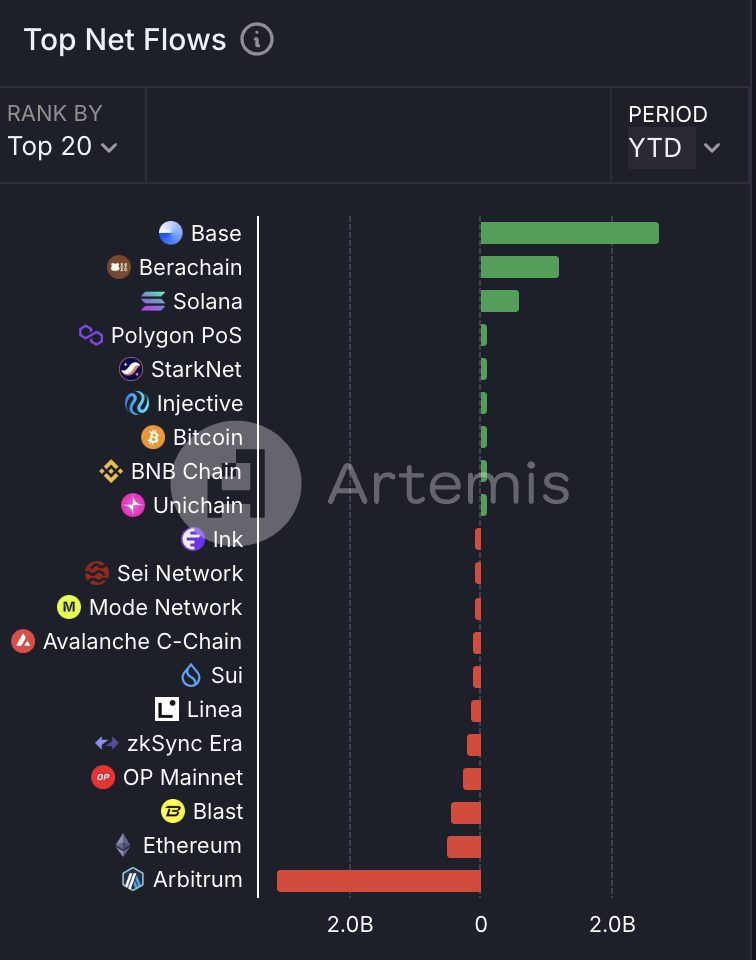

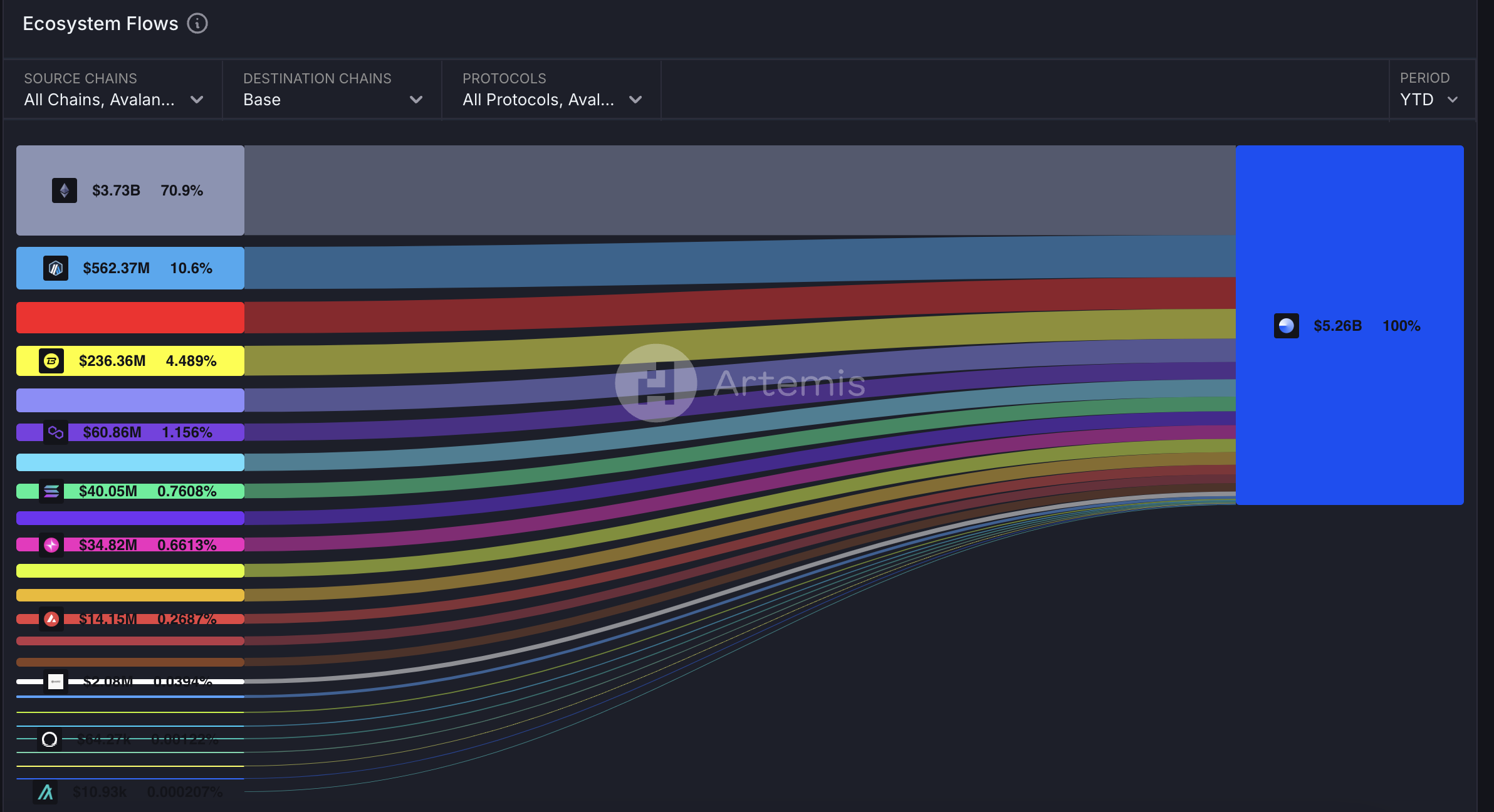

According to Artemis data, the Base network has attracted a lot of funds so far this year, ranking first with a net inflow of about US$2.8 billion, far exceeding other blockchains, and also showing the market's favor for its ecosystem. Specifically, Ethereum is the largest source of inflows to Base, contributing 70.9% of the inflows, about US$3.73 billion. This reflects the trend of Ethereum users and funds migrating to the Base network. Other L2 networks such as Arbitrum, OP Mainnet and Blast also contributed to the inflow of funds to Base.

From the perspective of capital favor, Base has a significant advantage in the L2 competition. In particular, Base is in sharp contrast with Arbitrum, which ranks first in the L2 list by TVL. The latter has a net outflow of US$3.1 billion so far this year, while other L2s such as zkSync Era, OP Mainnet and Linea have also experienced varying degrees of capital outflow.

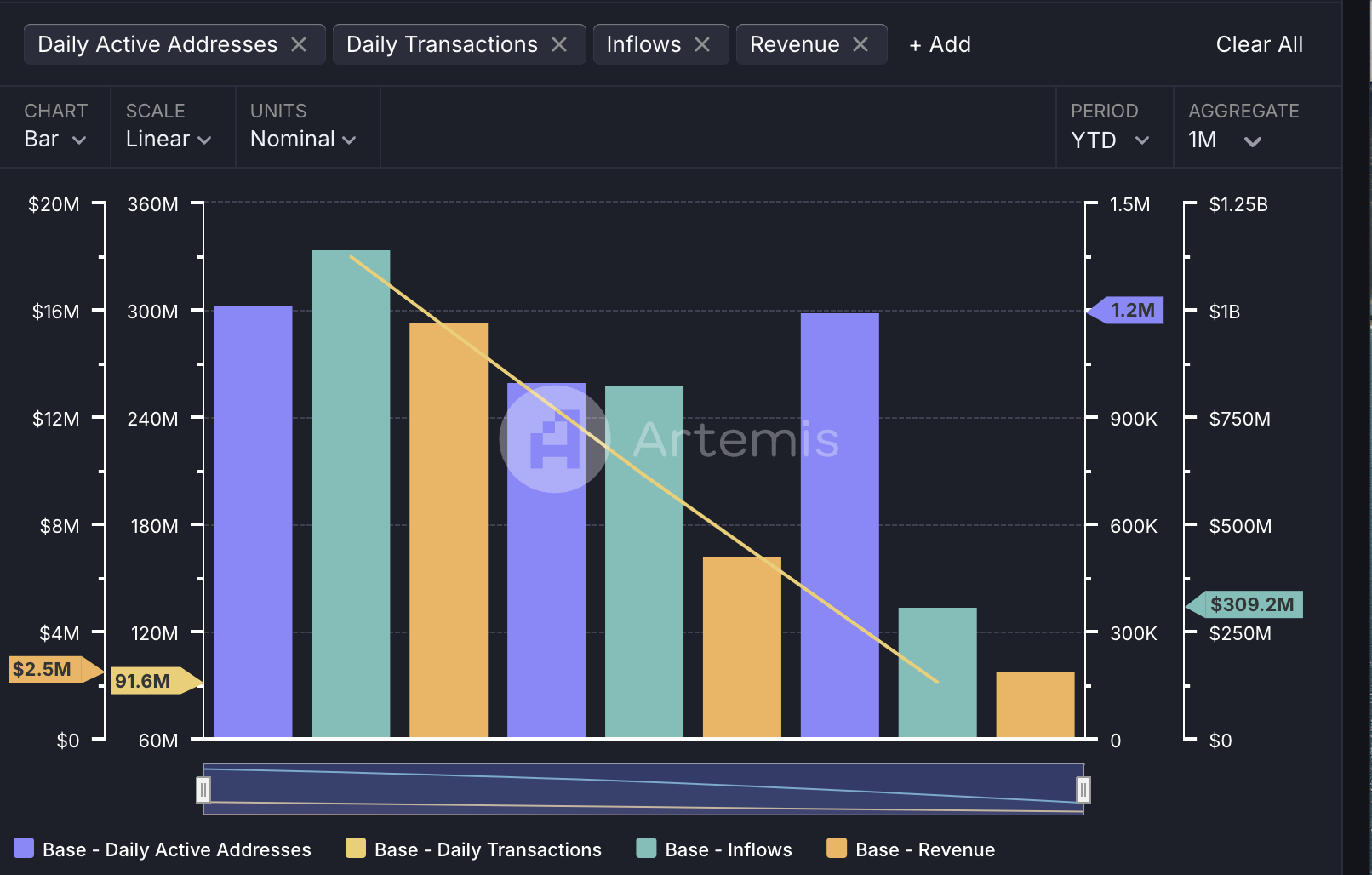

However, Base's on-chain activity has also shown a slowing trend this year, but this is closely related to the overall cooling of the crypto market. Artemis data shows that Base's capital inflow has gradually declined from a peak of US$1.1 billion in January, to US$830 million in February, and further to US$310 million in mid-March. At the same time, the number of on-chain transactions dropped sharply from 330 million in January to 91.6 million in March, a drop of more than 70%. Despite the decline in the number of transactions, Base's number of active addresses has rebounded this month. In the past half month, the number of active addresses has reached 1.2 million, equivalent to the level of the entire month of January. Affected by this, Base's revenue has also declined, from a high of US$15.5 million in January to US$2.5 million in March.

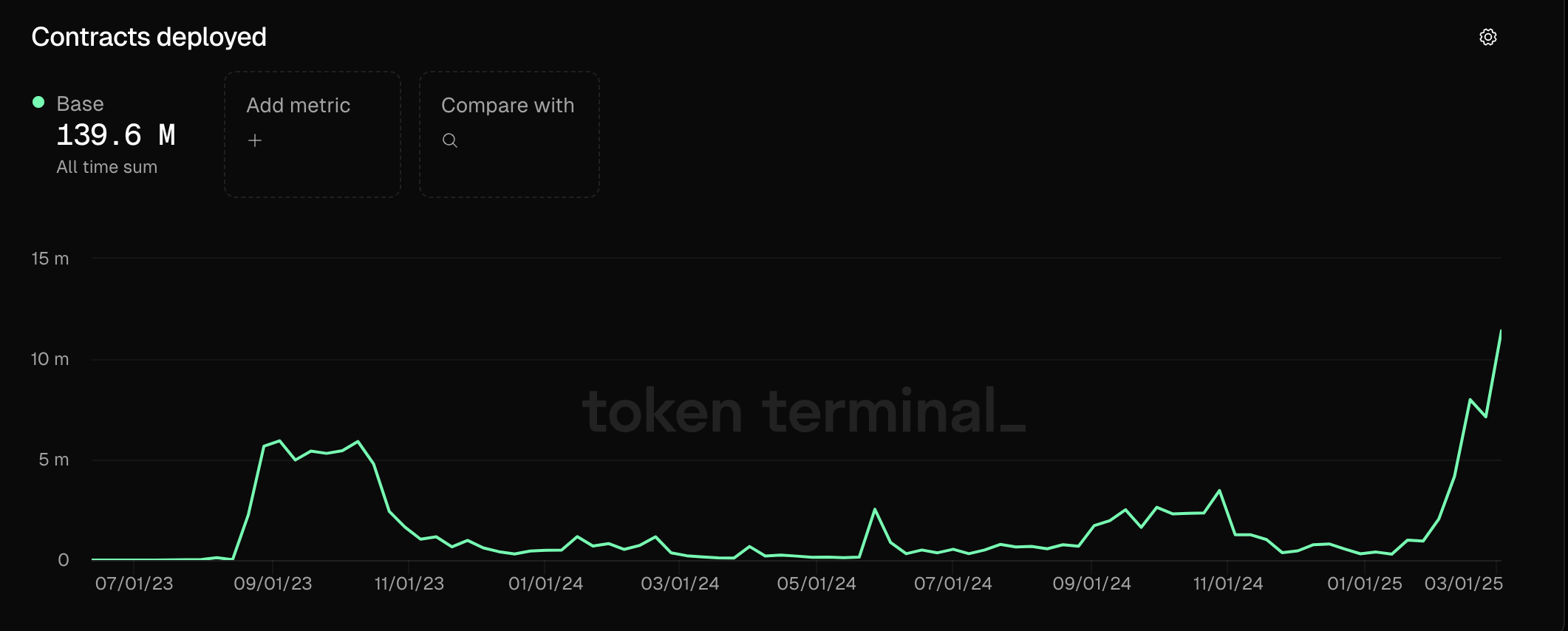

It is worth noting that the current surge in the number of smart contract deployments indicates that Base is attracting a large number of projects and developers to build applications on the chain. According to Token Terminal data, the number of smart contracts deployed on the Base chain has reached an all-time high. Last week, a total of 11.4 million smart contracts were deployed on the L2 network.

With the help of Coinbase, technological breakthroughs and ecological explosion strengthen competitiveness

Right now, Base is accelerating its rise with the support of Coinbase, a giant American crypto-currency platform, as well as the triple tailwinds of technological innovation and ecological heat.

Riding on the favorable wind of US encryption policy, Coinbase, the creator behind Base, is welcoming more development opportunities. In recent months, Coinbase has received multiple positive news, including "VIP" treatment at the White House summit, the SEC's withdrawal of the lawsuit, the restart of the tokenized stock COIN plan, the withdrawal of the pledge service, and even the news that Coinbase has become a target for traditional exchanges to acquire. Base may benefit from the improvement of Coinbase's brand and resources. (Related reading: Coinbase takes advantage of US regulation: VIP treatment at the White House summit, tokenized stocks, expansion, and merger rumors )

At the same time, Base's recent frequent technical actions are also laying the foundation for its large-scale application. In February of this year, Base announced the launch of a number of new technologies, focusing on improving on-chain transaction speed, scalability and user experience, creating an important weight to attract developers and users. Among them, Flashblocks technology has been launched on the Base Sepolia test network, reducing the block confirmation time from 2 seconds to 200 milliseconds, becoming the fastest EVM chain; Base Appchains (L3 chain) can provide exclusive block space for high-traffic applications and improve scalability. At the same time, Base also introduced Smart Wallet Sub Accounts to optimize the user experience, reduce the number of transaction signatures, and provide a safer account management method. Base plans to push Flashblocks and Sub Accounts to the main network in Q2. The following month, Base announced the acquisition of the Iron Fish team to accelerate the research and development of privacy protection technology on Base.

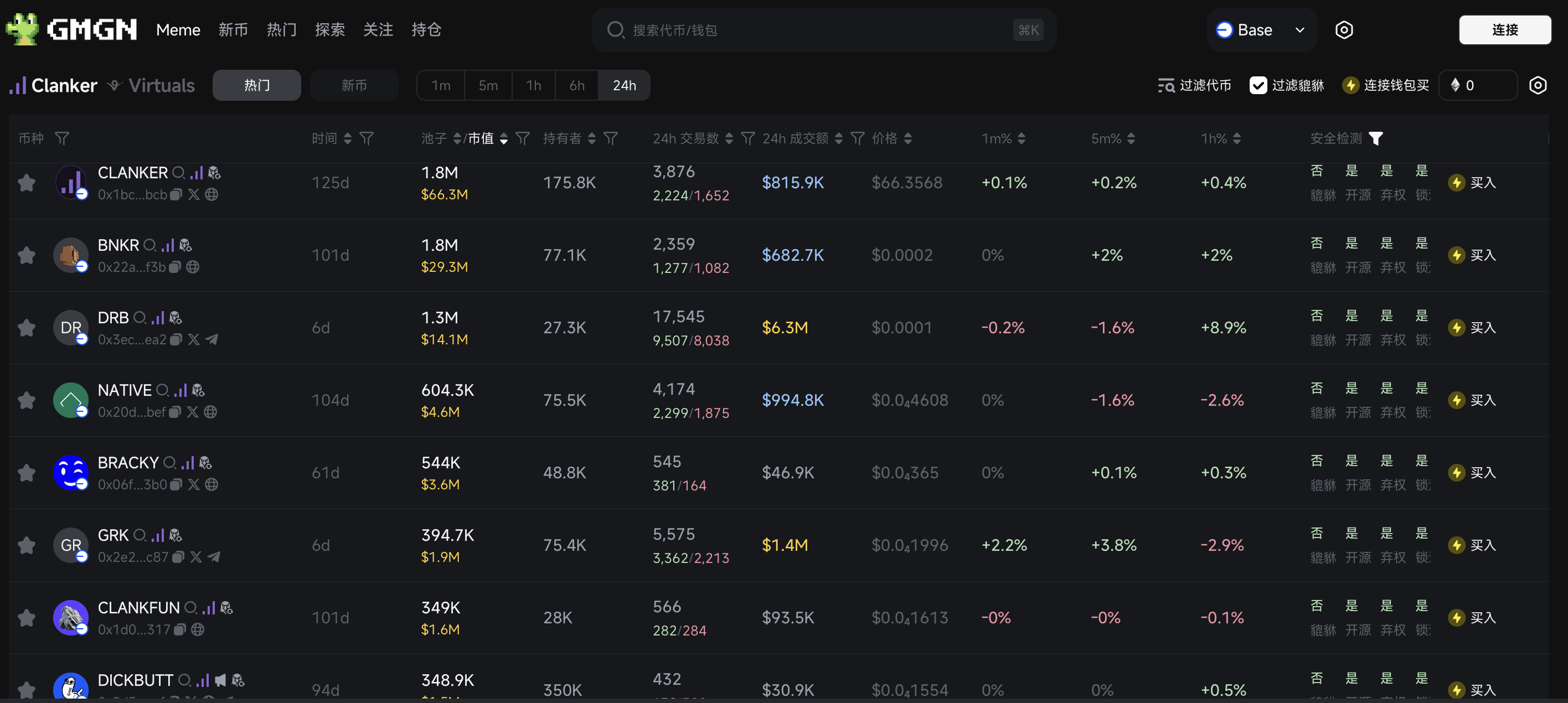

Head MEME on Base Source: GMGN

Compared with the steady progress on the technical level, the ecological heat is the core driving force behind the recent surge in Base inflows. While the MEME market on Solana is weak, the recent popularity of $Cocoro and $DRB has boosted the activity on the Base chain. Cocoro is a new rescue dog adopted by the owner of KABOSU, the prototype of DOGE, and has teamed up with Own The Doge to launch a token of the same name on Base. With the orthodox IP and community sentiment, Cocoro quickly became popular. GMGN data shows that the market value of the MEME coin also exceeded US$100 million at one point, and the transaction volume on the first day reached US$130 million; DRB (DebtReliefBot) is an AI MEME coin proposed by Grok launched by xAI and issued by AI agent Bankr. GMGN data shows that its market value is close to US$42 million at its highest, and the number of currency addresses still reaches 27,000. The rapid rise of these MEME coins has amplified the attractiveness of the Base network. It is worth mentioning that the high increase brought by Coinbase's recent launch of MEME coins such as DOGINME and TOSHI on Base has also increased the attractiveness of the network.

At the same time, the listing of US stocks on the blockchain is also one of the hottest stories nowadays. Base developer Jesse Pollak recently revealed that he is considering providing a tokenized version of Coinbase (COIN) stocks for US users on Base. Although the plan is still in the exploratory stage, Backed, a real-world asset tokenization issuer, has taken the lead in launching a tokenized version, wbCOIN, which tracks the share price of Coinbase Global and is fully guaranteed by its stocks. The exploration of this scenario not only broadens the application scenarios of Base, but also expands the investor group.

To further consolidate the development of the ecosystem, Coinbase Ventures launched the Base Ecosystem Group on March 13 in collaboration with Echo, an on-chain private investment platform. The Group will provide three aspects of support to the Base ecosystem: providing developers with a wider range of funds and expertise; providing Base community members with opportunities to participate in early-stage venture capital; and accelerating the flow of funds through on-chain tracks to promote the construction of an open financial system. Prior to this, the Base Ecosystem Fund had invested in more than 40 Base projects.

Overall, if Base wants to maintain its competitiveness in the L2 liquidity game in the long term, it needs to continue to make efforts in multiple dimensions such as ecological sustainability, continuous technology iteration, market adaptability, and improved user stickiness.

You May Also Like

Solana Price Prediction from Standard Chartered

The Staggering $750M Unrealized Deficit Shaking Corporate Crypto Strategy