Trump-Backed GENIUS Act Under Fire: NYAG Urges Tougher Stablecoin Rules Before July Vote

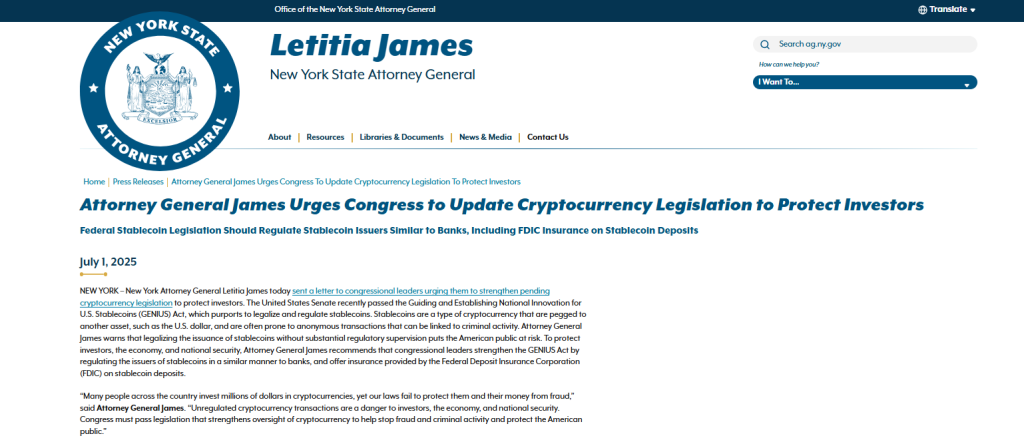

New York Attorney General Letitia James has raised serious concerns over the recently passed GENIUS Act, warning Congress that the bill, in its current form, could leave investors and the U.S. financial system vulnerable.

In a letter sent Monday to congressional leaders, James urged lawmakers to slow down the legislative process and implement stronger guardrails before finalizing any stablecoin regulations.

Attorney General Calls GENIUS Act “A Danger to Investors, Economy, and National Security”

The U.S. Senate approved the “Guiding and Establishing National Innovation for U.S. Stablecoins Act” last month in a 68-30 vote. It marked the first time the chamber passed a comprehensive bill focused solely on stablecoins.

The legislation proposes strict rules for issuers, including full dollar backing and monthly disclosures of reserves. The bill is now headed to the House of Representatives, where lawmakers are preparing for a potential vote in the coming days.

Source: NYAG

Source: NYAG

But Attorney General James says the GENIUS Act does not go far enough to protect the public.

“Many people across the country invest millions of dollars in cryptocurrencies, yet our laws fail to protect them and their money from fraud,” James said in the letter.

“Unregulated cryptocurrency transactions are a danger to investors, the economy, and national security.”

James expressed concern that legalizing stablecoin issuance without stronger oversight will open the door to financial abuse.

She warned that the current bill lacks key protections and could allow stablecoin issuers to operate with less accountability than banks.

Her letter calls on Congress to treat stablecoin issuers like traditional banks. That would include stronger regulatory supervision, capital requirements, and FDIC-backed insurance on stablecoin deposits.

She also recommended digital identity verification for stablecoin users to reduce fraud, prevent money laundering, and limit the ability of bad actors to hide behind anonymity.

James warned that stablecoins are often used in anonymous transactions, which can be exploited by criminal networks and terrorist groups. Without stricter measures, she argued, the GENIUS Act could compromise national security and leave the economy exposed.

The letter also emphasized the need to keep stablecoin issuers within U.S. jurisdiction. Offshore platforms, James said, pose enforcement challenges and make it harder to maintain regulatory standards.

She also urged lawmakers not to undercut community banks, which she said remain essential to rural and underserved communities.

GENIUS and CLARITY Crypto Bills Favor Industry Over Investors

James is not only targeting the GENIUS Act; She has also submitted a statement to the House Financial Services Committee regarding the Digital Asset Market Clarity Act (CLARITY), another crypto bill under review.

In that statement, James criticized the bill for shielding bad actors, allowing market manipulation, and failing to give regulators the tools to stop fraud.

She warned that both the GENIUS and CLARITY Acts, if passed without key revisions, would create a weak regulatory framework that prioritizes industry growth over consumer protection.

In her latest letter, James told Congress: “Take the time necessary to draft legislation that will enhance innovation while protecting our banking system that is the envy of the world.”

The GENIUS Act, while receiving bipartisan support in the Senate, has drawn divided reactions from regulators and state officials. It would limit stablecoin issuance to licensed institutions and impose requirements around asset backing and public disclosures.

Under the bill, stablecoins must be backed by U.S. dollars or equivalent liquid assets, and consumer protections are included in the event of issuer bankruptcy.

President Donald Trump has publicly endorsed the bill. “Get it to my desk, ASAP—NO DELAYS, NO ADD ONS,” he wrote on Truth Social.

Still, James insists the bill needs deeper scrutiny. She warned that pushing stablecoin legislation forward without additional safeguards will leave American investors at risk.

The House of Representatives is expected to hold procedural votes on the GENIUS and CLARITY Acts as early as the week of July 7.

Should either bill pass both chambers, it would represent a major shift in how digital assets are regulated in the U.S.

This isn’t James’ first warning to Congress. In April, she sent letters urging lawmakers to include “common sense principles” in any crypto bill, such as requiring stablecoin issuers to operate onshore and barring cryptocurrencies from retirement accounts.

With momentum building in Washington to establish clear crypto laws, James is pressing for balance. She says investor protection and financial stability must not be traded for speed.

“Congress must pass legislation that strengthens oversight of cryptocurrency to help stop fraud and criminal activity and protect the American public,” she said.

You May Also Like

Cardano, and Hyperliquid Redefining the Crypto Market While BullZilla Leads Among Best Presales with 100x Potential

Paxos launches new startup to help institutions offer DeFi products