Hyperliquid (HYPE) Price: Large Investors Buy the Dip as Token Drops 56%

TLDR

- Hyperliquid (HYPE) has dropped over 56.5% in less than 90 days, falling from $58 to under $25

- Whale wallets have deposited over $37 million USDC to accumulate HYPE tokens at various price levels

- The platform’s DEX revenue reached highs in October and November despite the price decline

- HYPE needs to break above $30 resistance to confirm a bullish shift, while a drop below $22.5 could push it toward $20

- The token is trading near $23.55 in an accumulation zone with RSI around 33, approaching oversold levels

Hyperliquid (HYPE) has experienced a sharp decline over the past three months. The token has fallen more than 56.5% from $58 to under $25 in less than 90 days.

Hyperliquid (HYPE) Price

Hyperliquid (HYPE) Price

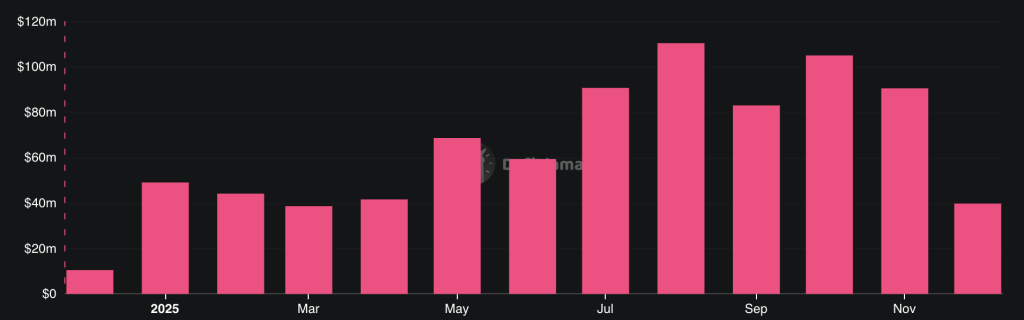

The price drop comes despite strong fundamentals for the platform. Hyperliquid’s decentralized exchange revenue hit record levels during October and November. These months are typically considered difficult periods for the crypto market.

Source: DefiLlama

Source: DefiLlama

The decline has sparked debate about the effectiveness of token buybacks. Vlad Svitanko, CEO of Cryptorsy Ventures, compared buybacks to paying people to stand in line at a restaurant to create false demand. He called it one of the worst strategies in crypto.

Svitanko noted that Hyperliquid generates more profit than many banks. Yet the token remains down on the yearly chart. He suggested the money spent on buybacks could be better used to generate more revenue.

Large Investors Continue Buying

Despite the price drop, whale wallets are accumulating HYPE tokens. Data from Lookonchain shows over $37 million in USDC has flowed into Hyperliquid recently.

One wallet identified as 0x5Ae4 deposited $20 million USDC. The wallet set a limit buy order at $15. Another wallet, 0xE867, deposited $10 million USDC and now holds 926,488 tokens worth approximately $22.4 million.

A third whale wallet, 0x23Af, spent $7.1 million USDC to purchase 277,420 tokens. The average purchase price was $25.6 per token.

The accumulation across different price ranges suggests institutional investors see value at current levels. These buying patterns indicate confidence in the token’s long-term prospects.

Technical Analysis Points to Key Levels

HYPE price currently needs to break above $30 to confirm any bullish reversal. This level represents a psychological resistance point for traders.

The token is trading around $23.55, which sits in what analysts call an accumulation zone. The RSI indicator hovers around 33, close to oversold territory. This could signal a short-term bounce.

However, if the bounce fails to create a sustained rally, the downtrend would remain intact. A break below $22.5 could push the price toward $20. Some analysts see $16 as a possible downside target if selling pressure continues.

Market Structure Remains Weak

The broader crypto market conditions are contributing to HYPE’s struggles. Futures trading volume reached record highs in 2025. Hyperliquid’s position as a leader in this sector makes some investors view the current dip as a buying opportunity.

Crypto analyst Hyper_Up noted that the token still faces strong selling pressure. The overall market structure continues to show downward movement.

A break below $23 could expose the token to further losses. The market needs to establish a weekly fractal before confirming a long-term bottom. Until then, buying remains speculative.

Once a confirmed low appears on weekly charts, a new range could form. Analysts suggest the $33 to $34 region could serve as a correction target. The previous swing high of $50.15 remains a distant goal.

The token remains one of the top 10 largest cryptocurrencies by market cap. As long as platform fundamentals continue improving, HYPE could return to previous highs when the broader market recovers. The current price action shows accumulation by large investors at $23 to $25 levels.

The post Hyperliquid (HYPE) Price: Large Investors Buy the Dip as Token Drops 56% appeared first on CoinCentral.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Mastercard Partners With Polygon to Enable Crypto Payments for Consumers and Merchants