Is Bitcoin’s $126K High the Cycle Top? Fidelity Warns of Possible 2026 Downtrend

- Fidelity warns Bitcoin may have already hit its cycle peak at $126K.

- Historical patterns suggest 2026 could be a down year with support near $65K–$75K.

- Bitcoin cycles show consistent structure: peak, sharp drop, long consolidation, and eventual rebound.

Fidelity’s Jurrien Timmer has suggested that Bitcoin’s October high of $126,000 might represent the top of the current cycle. On a four-year halving cycle schedule, Bitcoin, according to Timmer, could see prices dwindle in 2026, with key support at $65,000 to $75,000.

One thing about this warning is that there is a pattern with Bitcoin, which is that price dips tend to be tests of an investor’s patience rather than their conviction.

However, as per analysts, it’s imperative to understand the cycles of Bitcoin. This cycle remains fairly consistent at all market tops. Hence, after a substantial increase, Bitcoin makes a correction of about 70 to 85% of its peak.

Source: X

This has been seen in the following examples, where the peak was touched at $1,137 in 2013, and it fell to around $230, and when the peak was touched at $14,043 in 2017, it fell to around $3,417. This particular cycle continues, as seen in the most recent peak post-2021.

Also Read: Bitcoin Faces Make-or-Break Zone After Russell 2000 Breakout Toward $101K

Bitcoin Cycles Show Mature Market Behavior Despite Lower Volatility

Historical log charts of long periods, especially 2013 & 2017, provide great insight. These charts provide growth percentage information in an understandable fashion, allowing us to move from small-dollar patterns in early cycles to big-dollar movements in more recent periods.

Prices move in a parabolic fashion to a peak, followed by a sharp decline, then a prolonged period of lateral action. During these periods, markets appear stagnant with incremental advances that can try a trader’s patience.

It’s worth emphasizing, however, that history has always revealed that the largest gains have always been achieved through extensive periods of patience, and not immediately following a bottom.

The ‘green zones’ in these historical situations illustrate these extensive periods before prices begin rising again.

Experts have noted, in fact, that volatility has decreased, yet the overall process of Bitcoin’s movements, up, then pull back, then stabilize, remains the same, indicating market maturation.

2026 First Quarter Could Confirm Four-Year Cycle

As observed by Daan Crypto Trades, the first quarter has traditionally been a supportive environment for Bitcoin, but the past few years have been less consistent.

Source: X

While the big inflows and treasury purchases of 2025 could be countered by the sell-offs of the early cycle whales, the first half of the year could tell an important story as to whether the four-year cycle remains the driver of the Bitcoin price.

Also Read: Bitcoin Under Pressure as Japan’s Rising Yields Signal Global Liquidity Shift

You May Also Like

Santander’s Openbank Sparks Crypto Frenzy in Germany

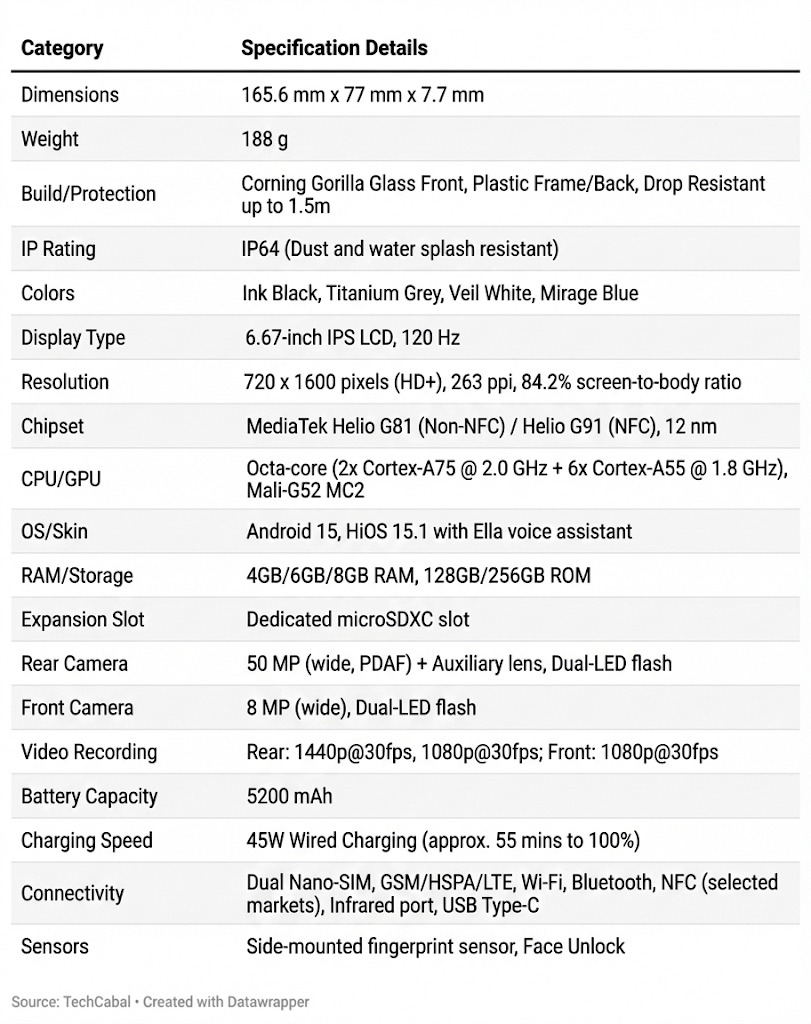

Tecno Spark 40 review: TDV certification, price and full specs