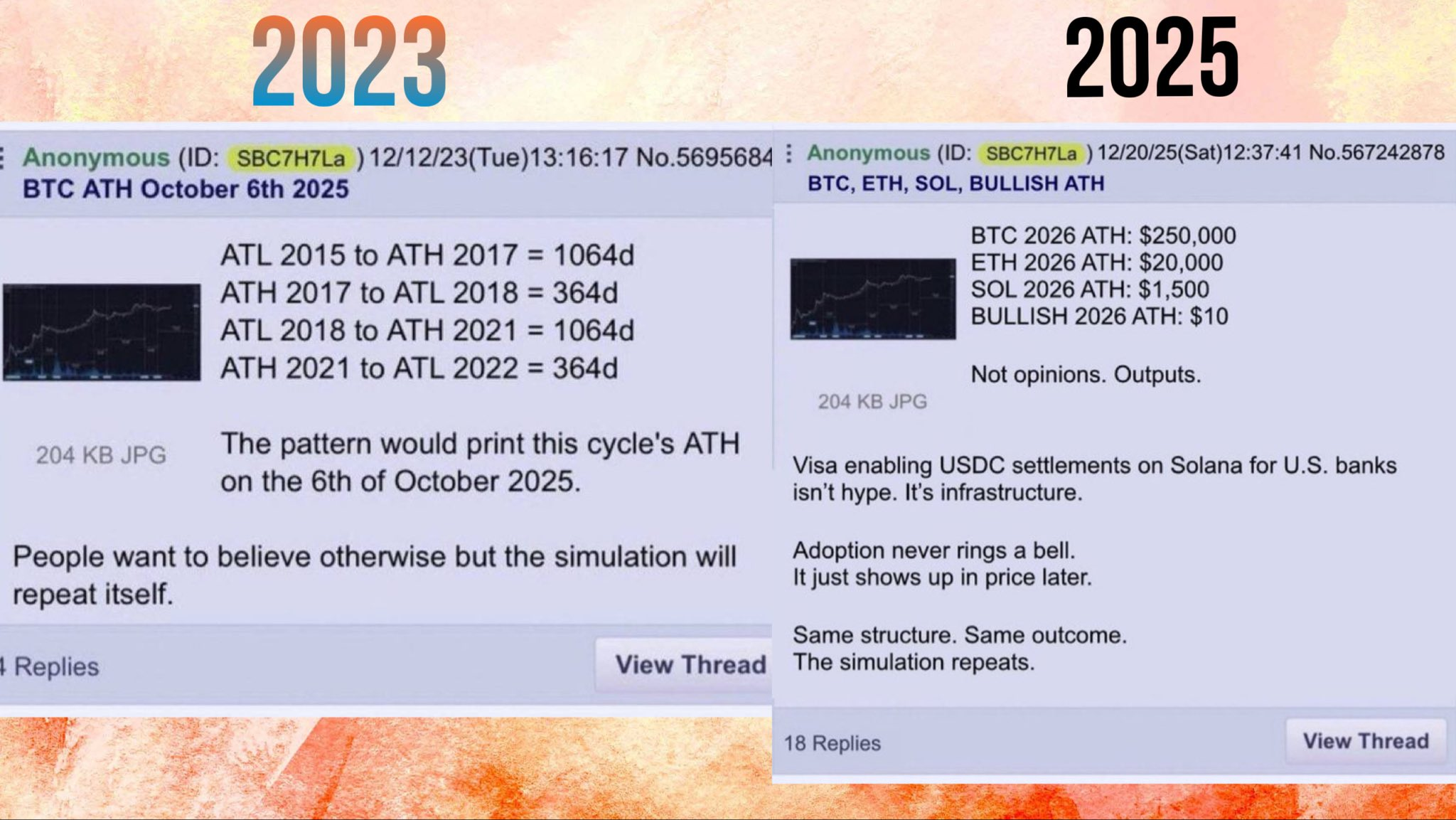

4chan Trader Who Nailed Bitcoin’s October All-Time High Calls $250,000 in 2026

An anonymous poster on 4chan, who correctly flagged Bitcoin’s cycle top on October 6, 2025, nearly two years in advance, has returned with a far more aggressive call. The trader predicts Bitcoin to reach $250,000 in 2026.

The prediction has resurfaced across crypto circles precisely as many on-chain and technical indicators turn bearish.

A Proven Call, Not a Price Target

Back in December 2023, the anonymous poster outlined a time-based cycle model rather than a price forecast. The thesis relied on historical symmetry. Roughly 1,064 days from bear-market lows to cycle highs, followed by nearly 364 days of decline.

That structure projected the next all-time high to land on October 6, 2025, almost exactly when Bitcoin topped near its peak before crashing 4 days later.

Anon 4chan Users Bitcoin Prediction

Anon 4chan Users Bitcoin Prediction

That accuracy has given the new forecast weight, even among skeptics.

In the latest post, the anon argues that the broader structure has not broken.

Instead, the current drawdown represents a reset phase before another expansion leg, with 2026 penciled in as the next price climax.

Most Bitcoin Charts Look Bearish Right Now

Short-term data tells a very different story.

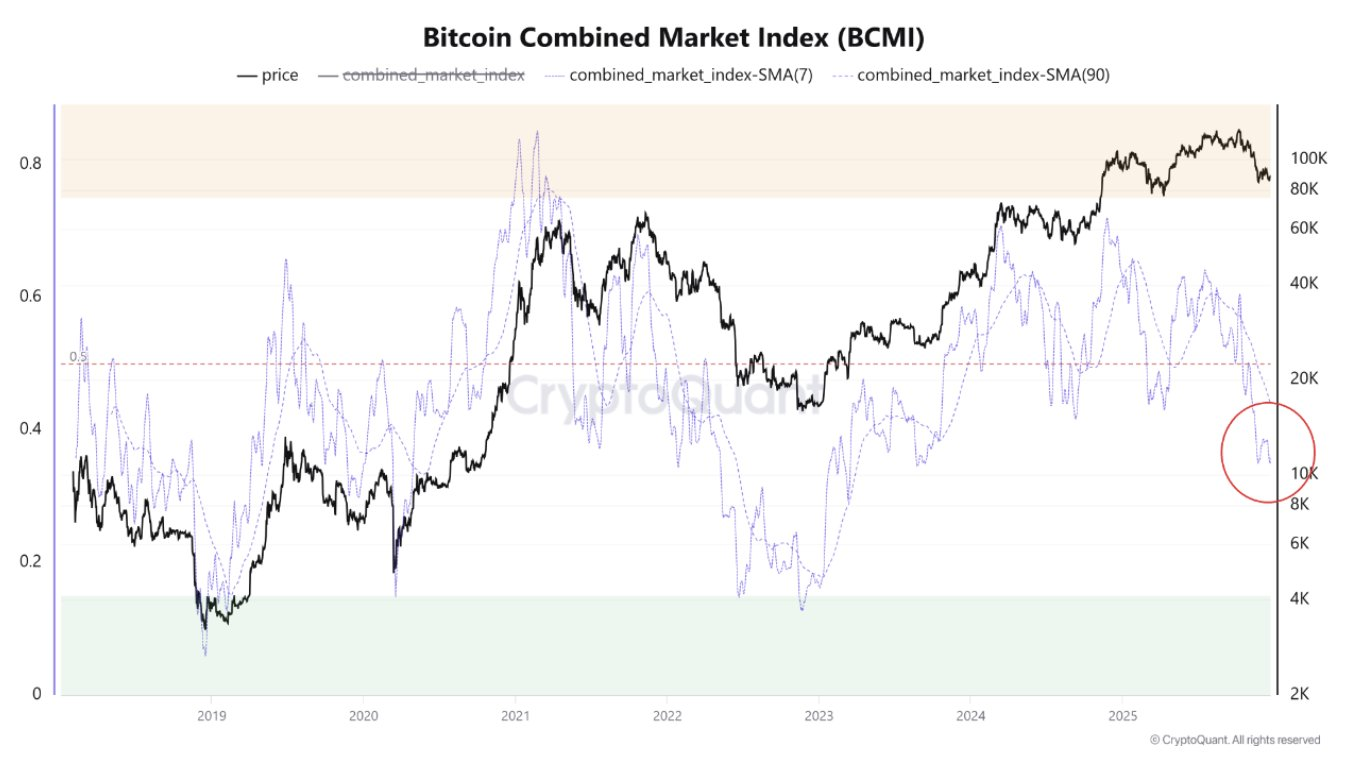

The Bitcoin Combined Market Index (BCMI) has rolled over from elevated levels, historically associated with late-cycle conditions.

Momentum indicators have weakened, and price has struggled to reclaim key psychological zones after the October peak.

Bitcoin Combined Market Index. Source: CryptoQuant

Bitcoin Combined Market Index. Source: CryptoQuant

Meanwhile, apparent demand growth, measured by net new buyer activity, has slowed sharply from early-2025 highs. Similar demand slowdowns preceded major corrections in past cycles, including 2021 and 2017.

From a traditional analytical lens, these signals point to caution.

Why the Bull Case Hasn’t Disappeared

The anonymous forecast challenges the idea that local bearish signals define the full cycle. Previous bull markets also saw multi-month corrections and demand resets before making their final parabolic moves.

Structural tailwinds remain intact. Bitcoin supply growth continues to compress post-halving. Institutional infrastructure, from ETFs to payment rails, remains embedded, even as speculative interest cools.

Historically, the strongest upside phases have followed periods of skepticism, not optimism.

The anon’s $250,000 target for 2026 is not framed as sentiment or opinion, but as a continuation of prior cycle mechanics.

Whether the call proves right or wrong, the episode highlights a familiar pattern in Bitcoin markets. Short-term indicators often turn bearish well before long-term cycles conclude.

For now, Bitcoin price sits in an uncomfortable middle ground.

You May Also Like

Kellervogel Expands Platform Infrastructure to Enhance Scalability Across Global Crypto Markets

Trump’s 15% Global Tariff Hike Fails To Rattle Crypto