Metaplanet Bitcoin Stack Hits $3B After $450M Spree — Revenue Soars

Metaplanet has pushed its Bitcoin holdings past the $3 billion mark after completing another large purchase, as it deepens into a hybrid model of the Bitcoin treasury and income business.

The Tokyo-listed firm disclosed on December 30 that it acquired an additional 4,279 Bitcoin at a total cost of about $451 million, lifting its total holdings to 35,102 BTC.

At current market prices, the stack is valued at roughly $3 billion, placing Metaplanet among the world’s largest publicly listed Bitcoin holders.

The latest purchase was made at an average price of ¥16.33 million per Bitcoin, bringing the company’s cumulative cost basis to ¥559.73 billion, or an average of ¥15.95 million per coin.

Bitcoin Pays Off for Metaplanet as Income Unit Outperforms Expectations

The acquisition capped a quarter marked by continued accumulation through a mix of direct market purchases and Bitcoin option-related activity.

Metaplanet said the strategy reflects its long-standing plan to treat Bitcoin as a core treasury asset rather than a short-term trade.

Alongside the treasury expansion, the company reported that revenue from its Bitcoin Income Generation business has significantly exceeded expectations.

In a regulatory filing, Metaplanet said operating revenue from the segment is now expected to reach ¥8.58 billion, or about $54 million, for fiscal year 2025.

That figure is well above the company’s initial guidance of ¥3.0 billion and its revised October forecast of ¥6.3 billion.

Source: Metaplanet

Source: Metaplanet

The income business relies on option-based strategies that use a dedicated pool of Bitcoin to generate recurring cash flow.

According to the company, these activities are fully segregated from its long-term Bitcoin holdings, which are intended to be held indefinitely.

The derivatives portfolio generates revenue through option premiums and trading outcomes, while the core treasury remains untouched. Any capital generated may later be added to long-term reserves, but the reverse is not permitted.

However, even with the announcement, Metaplanet’s shares are still trading at ¥405 on Tuesday, down nearly 8% on the day.

The Japan Firm Bitcoin Revenue Takes Off as Treasury Strategy Scales

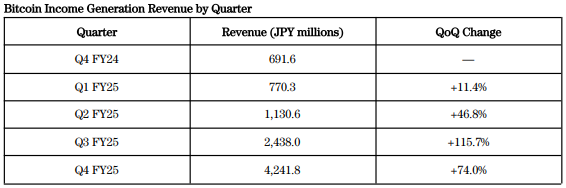

Also, revenue growth accelerated sharply through the year as its Bitcoin income generation revenue rose from ¥691.6 million in the fourth quarter of fiscal 2024 to ¥770.3 million in the first quarter of fiscal 2025.

It then climbed to ¥1.13 billion in the second quarter, ¥2.44 billion in the third, and ¥4.24 billion in the fourth quarter.

Over that period, the compounded quarterly growth rate reached about 57%, with the strongest gains recorded in the second half of the year.

Metaplanet’s broader Bitcoin strategy formally began in December 2024, when treasury operations were designated as a core business line.

Since then, holdings have grown from about 1,762 BTC at the end of 2024 to more than 35,000 BTC by late December 2025.

The company tracks its treasury strategy using proprietary metrics such as BTC Yield and BTC Gain, designed to measure Bitcoin accumulation relative to shareholder dilution.

While BTC Yield has declined as the company’s asset and share base expanded, Bitcoin per fully diluted share continued to rise through the end of December, reaching 0.02405 BTC per 1,000 shares.

To fund its expansion, Metaplanet has leaned heavily on capital markets. During the fourth quarter, it entered into Bitcoin-backed credit facilities totaling $280 million under a broader $500 million program.

It also raised ¥21.25 billion through the issuance of Class B preferred shares to overseas institutional investors while fully redeeming outstanding ordinary bonds.

Metaplanet’s growing exposure has also attracted international attention, with the company recently launching a sponsored American Depositary Receipt program to give U.S. investors easier access to its shares.

You May Also Like

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058

With Fusaka in the rear-view, Ethereum 2026 upgrade comes into focus