Pi Network Price Prediction Turns Cautious Ahead of January 2026 Token Unlock

This article was first published on The Bit Journal.

Pi Network price prediction discussions have returned to the spotlight as January 2026 approaches, but the tone has changed. What once felt like a story driven by scale and ambition is now shaped by supply pressure, market access, and unanswered questions about real-world use. The coming weeks may reveal whether Pi’s vast community can finally support lasting value.

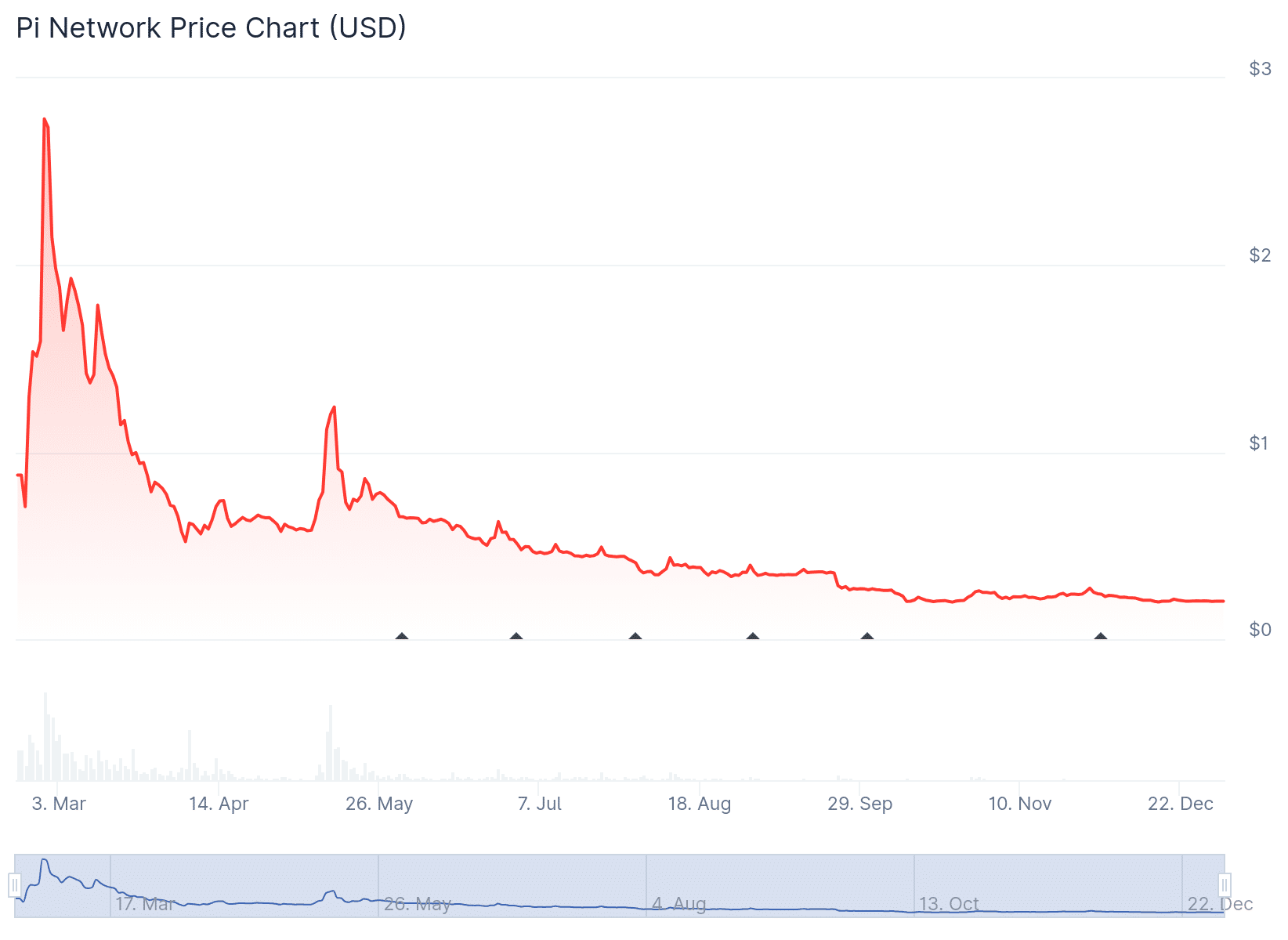

According to the source, market data shows Pi trading close to $0.20 in late December 2025. Price-tracking figures confirm that the asset has lost more than 90 percent of its value from its earlier peaks, despite maintaining millions of active users.

This gap between adoption and price has become the central tension behind every Pi Network price prediction.

Price Action Signals Fragile Confidence

Recent trading behavior highlights why forecasts remain cautious. Pi Coin has shown limited daily movement, even during broader market rebounds. Weekly gains remain small, while monthly losses hover near double digits.

Verified figures from live market trackers confirm that liquidity remains thin and price discovery remains uneven, especially compared to established cryptocurrencies.

Market structure plays a significant role. Pi Coin still lacks broad access on major exchanges, which limits trading depth and discourages institutional participation.

Research linked here shows that assets with restricted listings often experience muted demand and sharper reactions during supply changes. This structural weakness continues to weigh heavily on Pi Network price prediction models.

Source: Coinmarketcap

Source: Coinmarketcap

Token Unlock Looms as the Biggest Short-Term Risk

The most immediate event shaping Pi Network price prediction outlooks is the scheduled token unlock in January 2026. Roughly 134 million tokens are expected to enter circulation, increasing available supply by a meaningful margin. At current prices, that unlock represents more than $27 million worth of potential selling pressure.

Economic studies examining similar unlock events suggest that sudden supply increases often push prices lower unless new buyers absorb the flow. For Pi Coin, that balance remains uncertain.

Long-term holders may view the unlock as an exit window, while new buyers may wait for clarity, creating a temporary demand gap. These dynamics explain why analysts remain conservative in short-term forecasts.

Utility and Regulation Will Shape the Long-Term Path

Beyond January, Pi Network price prediction narratives depend on execution rather than expectations. Developers and blockchain researchers frequently stress that user numbers alone do not sustain value. Payments, applications, and active ecosystems drive demand. Without visible use cases, even large networks struggle to justify higher prices.

Regulation also matters. Studies by global financial oversight bodies indicate that more explicit rules in key regions, such as the United States, India, and Europe, could unlock new partnerships and listings. Regulatory clarity reduces risk for exchanges and developers alike, improving liquidity and trust over time.

Forecasts Point to Caution, Not Collapse

Short-term projections remain mixed but restrained. Some models suggest a dip toward the mid-$0.15 range following the unlock, while others expect sideways trading near $0.18 to $0.20 through mid-January.

None of the widely cited forecasts point to a breakout. Each Pi Network price prediction reflects a market waiting for proof rather than reacting to hype.

Source: Coingecko

Source: Coingecko

Conclusion

As January 2026 nears, Pi Network price prediction debates reflect a project at a crossroads. Pi Coin still commands attention through scale, but markets now demand delivery.

Token supply management, real utility, broader listings, and regulatory clarity will determine whether Pi stabilizes or continues to drift. The next chapter will be shaped less by promises and more by outcomes.

Glossary of Key Terms

Token unlock: The release of previously restricted coins into circulation.

Liquidity: How easily an asset can be traded without significant price changes.

Market capitalization: Total value of circulating supply at current price.

Utility: Real-world use that creates ongoing demand for a token.

FAQs About Pi Network Price Prediction

What is driving current Pi Network price prediction models?

Supply changes, weak liquidity, and limited exchange access dominate forecasts.

Why is the January 2026 token unlock important?

It increases supply and may put downward pressure on prices if demand remains low.

Does Pi Coin have strong long-term potential?

Potential depends on adoption, applications, and regulatory clarity.

Is Pi Coin considered high risk?

Yes, due to limited listings and uncertain demand dynamics.

Sources

Coinmarketcap

Crypto.news

Investopedia

Read More: Pi Network Price Prediction Turns Cautious Ahead of January 2026 Token Unlock">Pi Network Price Prediction Turns Cautious Ahead of January 2026 Token Unlock

You May Also Like

The Battle for the Next 10x Return

OpenAI Audio AI Bets Big as Silicon Valley’s Revolutionary War on Screens Intensifies