600,000 Bitcoin Allegedly Held In Venezuelan Shadow Reserve: Report

Bitcoin entered the geopolitical spotlight over the weekend after a report alleged Venezuela secretly accumulated as much as 600,000 BTC, coinciding with the US capture of President Nicolás Maduro.

A new Whale Hunting investigation landed just as Washington delivered its own shock to Caracas: over the weekend, US forces captured Venezuelan leader Nicolás Maduro and transported him to the United States, where he is expected to face federal charges in New York. Against that backdrop, the report makes a massive claim: that a Maduro-era shadow network may have stockpiled Bitcoin on a scale that would instantly rank among the biggest in the world.

The piece, published by Project Brazen’s Whale Hunting, says Alex Saab, long described as a key financial operator for the Maduro government, “may control $60 billion in Bitcoin” tied to the regime. If you translate that notional value into coins, the figure ricocheting around crypto X has been roughly 600,000–660,000 BTC, though that conversion is coming from social-media extrapolation rather than the report itself.

What We Know About The Venezuelan Bitcoin Reserve

Still, timing matters. The authors frame the US raid as the opening act and the money trail as the real second act. In one of the article’s bluntest passages, Whale Hunting puts it this way: “Nicolás Maduro is in US custody. Where is the money? His name is Alex Saab.”

The report does not present an on-chain attribution proving a $60 billion hoard. It says the allegation comes from HUMINT sources and “has not been confirmed through blockchain analysis.” That caveat is doing real work: the story is written as an intelligence-and-networks narrative, not a blockchain-forensics teardown.

What the authors do supply is a plausibility sketch based on Venezuela’s resource flows and historical BTC price bands. Venezuela exported “73.2 tons of gold in 2018 alone,” the report notes, roughly $2.7 billion at the time, and argues that converting even a fraction into Bitcoin when BTC traded between roughly $3,000 and $10,000 could yield outsized gains if held into the 2021 cycle peak.

They then outline an alleged operational pipeline: gold proceeds routed through Turkish and Emirati intermediaries, passed through mixers, and moved into cold wallets “beyond the reach of Western enforcement,” with access concentrated among a small group around Saab. The implied risk is simple: even if authorities can seize people, they may not be able to seize keys.

The Maduro capture immediately fused two storylines that usually live in different parts of the market’s brain: geopolitics and the strategic-bitcoin-reserve discourse. Former Bitwise exec and now ProCap CIO Jeff Park posted via X, “What if Venezuela is the US Strategic Bitcoin Reserve,” crystallizing the cynical version of that mash-up in a single sentence.

Others ran the arithmetic. Crypto commentator MartyParty (@martypartymusic) suggested: “With the assumed 600-660k $BTC added to the existing 328k in the US Government wallets the total of the SBR would be roughy 928k-988k. Very close to the projected 1m Bitcoin from the original Strategic Bitcoin Reserve Senate markups.”

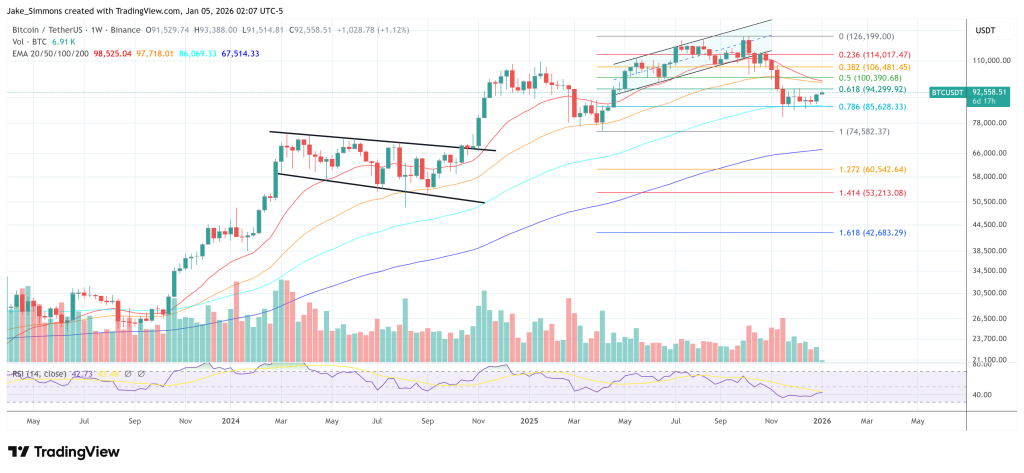

At press time, Bitcoin traded at $92,558.

You May Also Like

Strive Finalizes Semler Deal, Expands Its Corporate Bitcoin Treasury

Why 2026 Is The Year That Caribbean Mixology Will Finally Get Its Time In The Sun