Polymarket Partners With Parcl to Launch Real Estate Prediction Markets

TLDR

- Polymarket and Parcl have launched real estate prediction markets using Parcl’s independent U.S. housing price indices.

- Traders can take positions on home price movements across major U.S. metros without owning property or using leverage.

- Markets will settle using Parcl’s real-time index data, supported by public resolution pages showing values and calculation methods.

- Templates include monthly, quarterly, and yearly markets tied to threshold-based or directional housing outcomes.

- Standardized market structures aim to improve clarity, reduce creation friction, and boost user confidence in housing forecasts.

Polymarket and Parcl have partnered to launch real estate prediction markets based on U.S. housing price indices. The new markets will allow traders to take positions on price movements using Parcl’s independently published benchmarks. This announcement follows Polymarket’s expansion into accessible onchain forecasting tools.

Real Estate Trading Begins With Transparent Index Data

The partnership will introduce markets that track home price changes across major U.S. cities using Parcl’s real-time index data. Traders can speculate on whether prices in selected metros will move up or down over set timeframes. Each market will link to a resolution page showing the final settlement value and index methodology.

These housing-focused markets aim to simplify exposure to real estate trends without the need to hold physical property or use leverage. They provide a new format for directional trading based on regional housing data. Parcl’s daily indices serve as the reference for outcome verification across all markets.

Trevor Bacon, CEO of Parcl, said, “Parcl is the source of truth for real-estate pricing, and we believe real estate should be a major category within the prediction-market ecosystem.” Market templates will include monthly, quarterly, and yearly periods tied to price thresholds and directional outcomes. The rollout begins with high-liquidity metros and may expand based on user activity.

Matthew Modabber, CMO of Polymarket, said, “Prediction markets work best when the data is clear, and the outcome can be verified without debate.” Both teams plan to create standardized terms for ease of use and lower market creation friction. This structure is expected to support consistent settlement logic and drive user confidence.

Parcl Joins Growing Polymarket Ecosystem Following MetaMask’s Initial Integration

Polymarket’s expansion into housing follows MetaMask’s recent integration of in-app access to prediction markets. MetaMask now allows users to place bets on real-world events directly inside the mobile wallet interface. As we had reported, the MetaMask partnership eliminates the need for external logins or long registration steps.

The system supports deposits from all EVM-compatible blockchains and maintains user custody of assets during trading. Each prediction also rewards MetaMask points, adding a gamified layer of interaction. Market topics range from cryptocurrency movements to politics, sports, and macroeconomics.

Users can switch between open markets, check real-time outcomes, and claim results to their wallets within a few taps. The company said its aim is to streamline engagement while protecting self-custody principles. With both Polymarket integrations now live, the range of available event-driven markets continues to expand.

The post Polymarket Partners With Parcl to Launch Real Estate Prediction Markets appeared first on Blockonomi.

You May Also Like

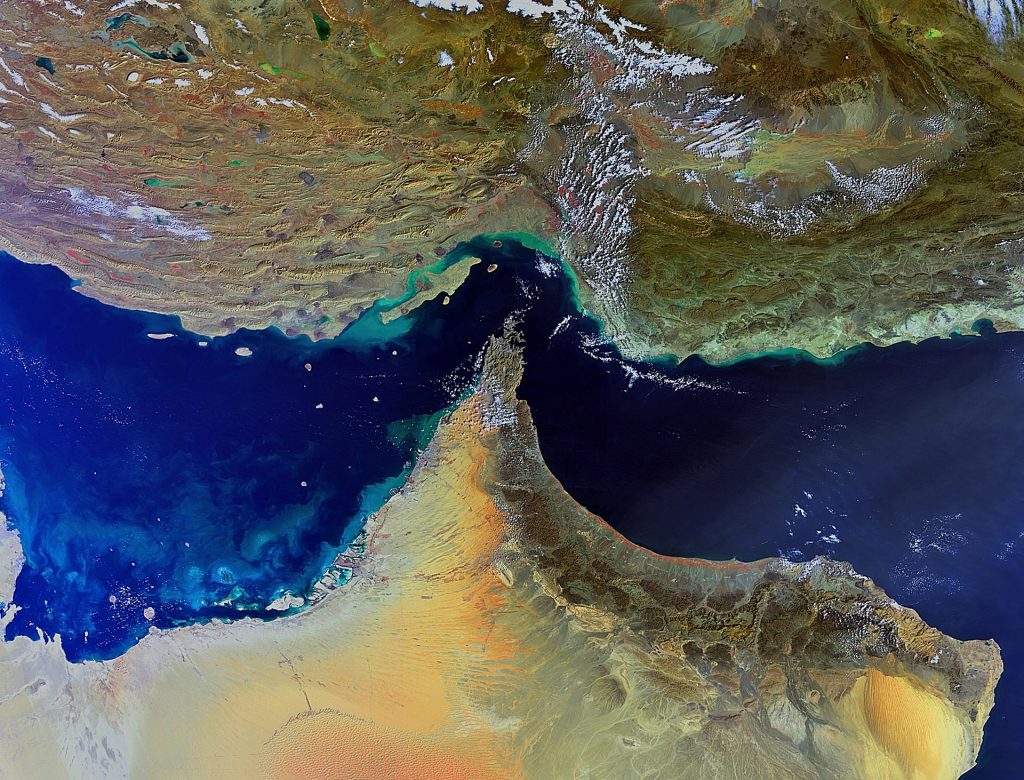

İran Hürmüz Boğazı’nı Kapatırsa Ne Olur? Verilerin Gösterdiği Tek Bir Şey Var!

TON Station Daily Combo 01 March 2026: Maximize Your $TONS Rewards Today