- User profits from rumors of Maduro’s capture by U.S.

- Polymarket’s leadership remains silent on the incident.

- No official confirmation of insider trading action.

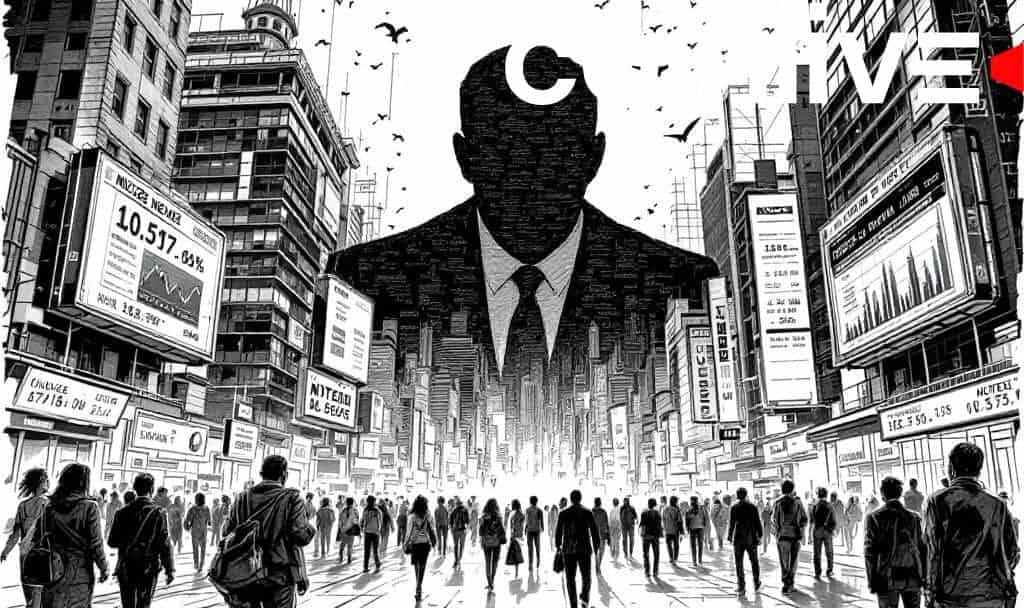

Profit from Rumors of Maduro’s Capture

Profit from Rumors of Maduro’s Capture

A Polymarket account reportedly transformed $30,000 into $400,000 just as the U.S. captured Nicolás Maduro, drawing attention to potential insider trading in crypto prediction markets.

The incident raises concerns about market manipulation risks in crypto, though no official statements or actions confirm such allegations, reflecting challenges in regulating decentralized finance.

A Polymarket account reportedly turned $30,000 into $400,000 amid rumors of Nicolás Maduro’s capture. No official confirmation or enforcement action has been announced, leaving market participants and observers in a state of speculation.

Involved in this controversial trade is an unnamed account on Polymarket. Despite rumors of insider trading, no statement or admission has been made by connected authorities or individuals. Polymarket leadership, including CEO Shayne Coplan, has not commented on the matter.

The incident leaves the cryptocurrency community questioning potential impacts on market trust. While no immediate official response has occurred, industry insiders remain attentive to any developments that could sway public perception of prediction markets.

Financial implications remain uncertain; however, the lack of policy response could weaken confidence in the regulatory framework surrounding prediction markets. Comparisons to similar unverified events prompt discussions on the future of such platforms.

Polymarket has observed stable on-chain activity despite the rumored trade event, according to public dashboard data. This stability suggests no immediate financial fallout, although continued scrutiny could influence user behavior.

Potential regulatory and technological outcomes remain speculative, with ongoing monitoring by traders and regulators alike. The absence of confirmed insider activity leaves questions open regarding transparency but highlights the need for robust compliance structures.