FortisX: Yield on a staking base with product liquidity

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

FortisX redefines staking with product-style liquidity, risk controls, and adaptive yields shaped by markets.

- FortisX layers liquidity pools and a risk engine on staking, transforming protocol rewards into a product-style yield system.

- By combining staking, internal liquidity, and risk controls, FortisX makes staking behave more like a financial product.

- FortisX is unifying staking cores, liquidity pools, and risk rules to deliver flexible yield without fixed-return promises.

Staking is easy to grasp at the idea level: an asset participates in a network and earns rewards. In practice, staking has a defining trait — it follows protocol timing. Entering and exiting can take time, and position management does not always resemble a familiar financial product.

FortisX is evolving a staking platform toward product logic: internal liquidity pools add a fast layer on top of staking, while a risk engine and allocation policy provide discipline and resilience. Yield is not fixed upfront and is not presented as a promise: it is formed at the network and market level and changes with conditions.

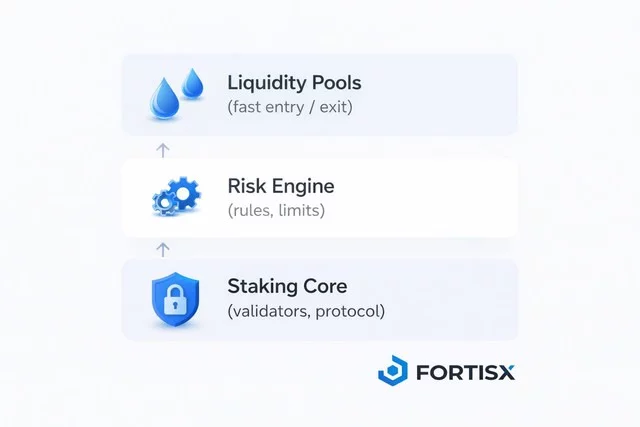

FortisX in simple terms: how pools, staking, and the risk engine work together

FortisX has three layers that operate as a single system: the staking core creates the on-chain foundation, liquidity pools provide “product-grade” liquidity on top of that foundation, and the risk engine sets rules and keeps everything within defined boundaries.

Staking core — the foundation

This base layer forms and maintains staking positions within a specific network. It allocates participation across validators/pools under an allocation policy, monitors diversification and concentration, and reviews the distribution under predefined rules.

Liquidity pools — a product layer on top of staking.

Pools are internal liquidity and operating rules through which users interact with a position. They connect product scenarios (entry, exit, operations with supported assets) to the staking foundation that remains at the core of the model.

Risk engine — shared rules for staking and pools.

The risk engine is a set of metrics and limits used for decision-making. It governs both how the staking portion is distributed and how pool liquidity is used (including buffer sizing and operating conditions), so the product remains understandable and stable across different regimes.

If we translate this structure into practical terms, pools provide investors with several tangible advantages.

What liquidity pools deliver: practical benefits for investors

From an investor’s perspective, pools feel like a more convenient way to work with a staking base: fewer manual steps, faster operations, and clear terms for using liquidity. The value is not a single “speed trick” but a combination of practical properties.

Faster entry and exit within available liquidity.

Pools make it possible to adjust a position more quickly in scenarios where decision speed matters. Execution happens at the time of action within the available liquidity, without being tightly bound to long protocol waiting periods.

Convenient operations via supported assets.

Supported pool assets can be used for entry, exit, and payouts. This simplifies position management and reduces the number of intermediate actions for the user.

Clear operating conditions at the moment of action.

Pool mechanics reduce an operation to a clear execution logic: what happens on entry/exit and which conditions apply right now. This is easier to perceive as a single product-grade operation.

A second layer of economics on top of the staking base.

Beyond the protocol staking component, pools have a layer of liquidity economics that becomes more visible when demand for speed and access to liquidity increases.

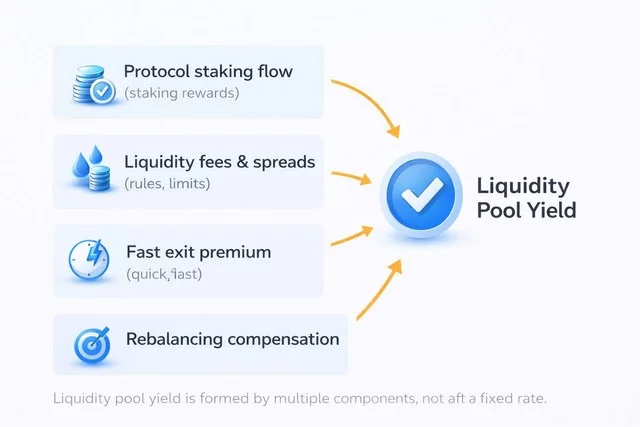

What drives liquidity pool yield

Yield in liquidity pools is variable because it is formed by a combination of sources rather than a single factor. Part of the result comes from the protocol base (staking or staking-derived exposure on the working portion of liquidity). The rest comes from the economics of providing liquidity as a service: users pay for speed, convenience of entry/exit, and asset operations.

To understand the nature of yield correctly, it is best to view it as the sum of the components below — their relative contribution shifts with market regime and user activity.

Protocol staking flow on the working portion of liquidity

A portion of liquidity that the policy allows to run in “working mode” is placed into staking within a given network. This component forms the base flow, tied to the network’s parameters and reward model.

Operating economics: fees and spreads

The pool services user operations (entry, exit, movements between supported assets). These operations produce economic results via fees and spreads, reflecting the cost of liquidity and conversion conditions at a given moment.

Premia for fast exit (instant liquidity)

When a user needs to exit without waiting for network periods, they are effectively buying access to liquidity “here and now.” In such moments, a speed premium forms and becomes a separate source of pool results.

Premia and compensations related to rebalancing and liquidity maintenance

The pool maintains a target liquidity structure and distribution: part of the capital works in staking, and part remains available for operations. When the system needs to bridge timing gaps between fast operations and slower network processes, additional economic effects can appear (premia/compensations) tied to maintaining continuity of liquidity.

Smoothing effects as a product-level premium

Part of the pool value can manifest as a more even payout dynamic at the product level compared to uneven protocol flows. When users choose scenarios with more regular dynamics, an additional economic effect can appear as a premium for the payout/flow format, complementing the base sources above.

FortisX platform advantages

Start staking in a chosen network without first buying its native coin

Starting is possible from another supported asset: a liquidity buffer can form the position in the target network without extra intermediate steps.

Position review and maintenance rely on distribution policy and risk signals

Allocation and review rules are set within a single management contour. This supports more predictable behavior across periods and reduces part of the manual workload.

Data and metrics are available via API

Key indicators used by the engine (across networks, pools, and conditions) are available via API, which is useful for reporting, monitoring, and integrations.

Pools add management flexibility while keeping the staking base intact

Faster position workflows become available, while the foundation remains staking-based and does not require changing approach when regimes shift.

Comparison with familiar alternatives

Exchange earn products (Binance Earn, Coinbase, and similar)

Entry is simple and the interface is familiar. Investors often see a headline number and basic terms, while the mechanics of results and behavior across regimes are less explicit. FortisX puts more emphasis on pool rules, liquidity buffers, and management logic — helping explain why dynamics change.

DEX liquidity pools

Classic LP participation usually requires more hands-on work: pair selection, risk assessment, and close attention to regime changes. FortisX is closer to product-grade liquidity: pools sit on a staking foundation, and allocation reviews follow predefined rules. This reduces the number of manual decisions and makes the product simpler to operate.

Liquid staking (Lido, Rocket Pool; on Solana — Marinade/Jito, etc.)

LST provides liquidity via a tokenized position and is often used as a bridge into DeFi. FortisX offers a different format: pools where entry/exit speed and operating economics are built into the product, while the staking portion is managed under a single set of rules. This can fit users who want liquidity as a service with a clear position-management logic.

Constraints and trade-offs

As with any model, FortisX has characteristics worth understanding upfront. They help align expectations with product mechanics.

Result dynamics change with market regime

The staking base depends on network parameters, while pools also depend on liquidity demand and execution conditions. Outcomes can differ noticeably across periods.

Speed and convenience are reflected in execution conditions.

During elevated demand, fees, spreads, or fast-operation premia can become more visible. For active position management, this is an important part of the overall picture.

Auto-compounding should match your horizon and usage pattern.

Automatic reinvestment simplifies the process, but its effect depends on how often you plan to adjust a position and how important liquidity is at a given moment.

Network events remain a factor.

Protocol parameter changes and network-level events can affect results. Management contours reduce the chance of undesirable imbalances, but network conditions remain part of the model.

How to register and start using pools

On FortisX, the path to the first pool operation is predictable and takes a few minutes.

- Open the FortisX website.

- Create an account: click Start for free and choose email + password or Google (OAuth).

- Check funds: in Wallet, review available balance.

- Pick a pool: open Liquidity Pool, find an asset via Search assets. The pool card shows key reference points.

- Add liquidity: on the pool card, choose Add liquidity, enter an amount, then enable Reward compounding. After confirmation, the position appears under “Your liquidity”, and operations are listed in Transactions.

This format lets you start with a small amount and quickly understand a specific pool’s mechanics: entry conditions, liquidity behavior, and how results behave across periods.

Verdict

FortisX comes across as a platform focused on managed product behavior — in the areas where practicality and control matter: liquidity, operation speed, and clear pool rules. If you view liquidity pools as an instrument for earning through liquidity on a staking foundation, the FortisX logic is cohesive.

Importantly, it does not rely on showcasing fixed percentages. Results are formed by network and market conditions, liquidity demand, and execution rules. This approach tends to resonate with those who have seen how “headline numbers” can shift as regimes change.

Should you enter FortisX pools? The decision always depends on your horizon, risk tolerance, and liquidity expectations. If your goal is to keep capital working while retaining the ability to adjust a position reasonably quickly, FortisX liquidity pools look like a practical format: a product with understandable mechanics, where results come from real underlying sources.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

SRx Health Solutions Launches EventHorizonIQ Subscription for Individual and Institutional Traders

Pi Network Pioneers Urged to Complete V20.2 Protocol Upgrade by March 12

Pi Network Pioneers Urged to Complete V20.2 Protocol Upgrade by March 12

As Pi Network continues to grow a