Crypto Wallets Weren’t Built for Quantum Risk – BMIC Thinks It’s Time to Change That

Crypto has a habit of solving yesterday’s problems really well.

Cold storage solved exchange risk. Hardware wallets solved hot wallet exploits. Multisig helped with internal controls. Each step made sense at the time it appeared. The issue is that most of these solutions were designed in an era when the threat model was relatively narrow.

Quantum risk wasn’t part of that picture.

For most wallet designs, the assumption has always been simple: current cryptography is strong enough, and future problems can be dealt with later. That assumption held up for a long time. It’s starting to feel less comfortable now.

BMIC’s Starting Point Is Different

BMIC ($BMIC) wants to answer this question: What happens if the cryptography wallets that we rely on today aren’t enough tomorrow?

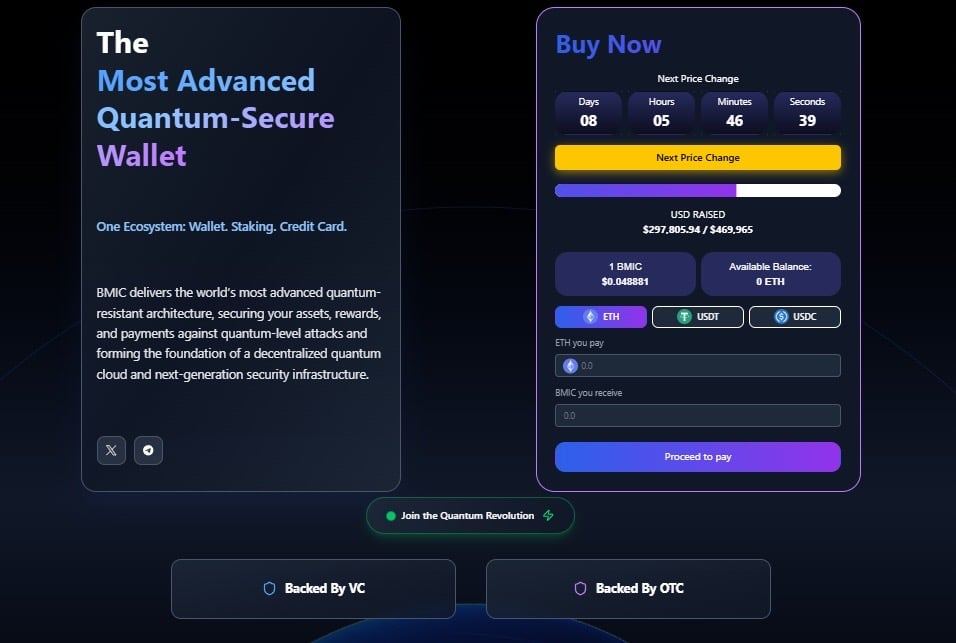

The project just launched a crypto presale for its native token – $BMIC.

BMIC doesn’t assume that today’s security standards will be enough forever. Instead, the team is building the wallet with change in mind from the start. The idea is to allow different cryptographic approaches to work side by side, so new protections can be added as standards evolve, rather than forcing a clean break every few years.

It’s a practical mindset. Rather than tearing everything down when assumptions change, BMIC aims to give users a system that can adjust in place, without turning upgrades into stressful, all-or-nothing moments.

Security That Doesn’t Ask for Attention

One of the quieter ideas behind BMIC is that better security shouldn’t mean more effort for the user. Advanced protections tend to fail when they get in the way of normal behavior.

That’s where AI-assisted monitoring comes into play. Rather than forcing users to constantly think about threats, the system is designed to watch for unusual patterns and risks in the background, stepping in only when needed.

Security, in this model, behaves more like infrastructure than a feature – always present, rarely noticed.

Why This Matters More Than It Sounds

Quantum risk isn’t the only issue BMIC is responding to. It’s also reacting to the simple reality that crypto assets now outlive most of the tools built to protect them.

Devices get replaced. Support ends. Software assumptions change. But private keys don’t expire, and blockchains don’t reset. Over long time horizons, the weakest link isn’t usually price volatility — it’s outdated security models that linger too long.

BMIC’s bet is that wallets need to be designed with that time horizon in mind.

Where the Crypto Presale Fits In

At the time of writing, the project has raised just over $300,000, with $BMIC priced at $0.048881.

The total supply is capped at 1.5 billion tokens, with half allocated to the public presale. The remaining supply is distributed across staking and rewards, liquidity and exchange listings, ecosystem reserves, marketing, and a small team allocation.

The token itself is positioned as part of the security ecosystem, supporting access to advanced features, staking participation, and future security-related services. If you want to know how to buy $BMIC, check out the official website and follow the easy steps.

A Different Kind of Crypto Bet

BMIC isn’t offering a shortcut, and it isn’t pretending to know exactly how the future will unfold. What it’s doing instead is acknowledging something most projects avoid: that crypto security won’t stand still, and neither will the threats around it.

Backing a project like BMIC is less about chasing upside and more about aligning with a long-term view of how custody needs to evolve. That won’t appeal to everyone — and it probably shouldn’t. But for those who believe the next phase of crypto will be defined by resilience rather than novelty, it’s a bet rooted in preparation, not prediction.

Learn more about BMIC

Presale: https://bmic.ai/

Social: https://x.com/BMIC_ai

Telegram: https://t.me/+6d1dX_uwKKdhZDFk

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

OCC Advances Crypto Oversight Ahead Of 2027 GENIUS Act Rollout

3 Paradoxes of Altcoin Season in September