Vitalik Buterin: Ethereum’s Independence Hinges on Better Decentralized Stablecoins — Here’s Why

Ethereum co-founder Vitalik Buterin has reopened debate over the role of stablecoins in Ethereum’s future, warning that the network’s long-term independence may depend on developing decentralized alternatives that rely less on the U.S. dollar and centralized issuers.

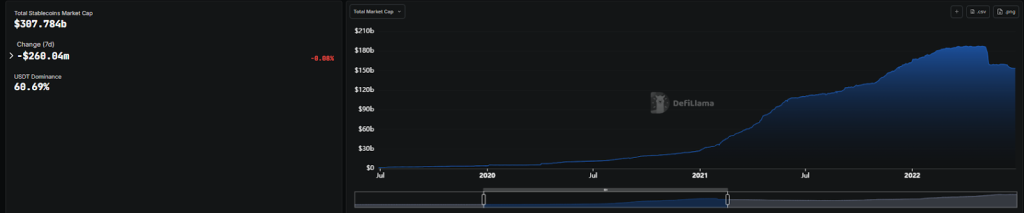

Stablecoins have become core infrastructure for crypto markets, with a combined market value of about $307.8 billion, but yet the sector remains heavily concentrated around centralized, dollar-backed products.

Tether’s USDT dominates the market with roughly $186.8 billion in circulation, accounting for more than 60% of total supply, while Circle’s USDC follows at about $74.6 billion.

Source: DefiLlama

Source: DefiLlama

Decentralized stablecoins remain far smaller by comparison with Ethena’s USDe and Sky Dollar, each hovering around $6.3 billion in market value, while Dai, once Ethereum’s flagship decentralized stablecoin, has declined to roughly $4.5 billion in circulation after years of contraction.

Buterin’s comments came in response to Gabriel Shapiro of Delphi Labs, who described Ethereum as an increasingly “contrarian bet” against venture-backed trends.

While acknowledging the short-term usefulness of dollar-pegged assets, Buterin argued that deeper reliance on the U.S. dollar exposes Ethereum-based finance to monetary policy decisions and geopolitical risks beyond its control.

Over a longer horizon, he has questioned what happens if the dollar experiences sustained inflation or loses credibility, noting that Ethereum’s vision of nation-state resilience implies independence even from dominant fiat price references.

Beyond the peg itself, Buterin identified two deeper technical challenges that have repeatedly undermined decentralized stablecoins.

The first is oracle design, which stablecoins rely on price feeds to manage collateral and liquidations, but if those feeds can be manipulated by well-funded actors, protocols must resort to expensive economic defenses.

Buterin noted that those costs are often passed on to users through higher fees, inflation, or aggressive value extraction, weakening usability and trust.

Another issue is Ethereum’s staking economy, with rising staking yields competing directly with stablecoin designs that require ETH as collateral, making it less appealing to lock assets unless protocols can offset or integrate those returns.

Lessons From Terra Still Shape Stablecoin Design

Buterin outlined possible paths forward, ranging from sharply reducing staking yields to creating new staking categories with lower slashing risk to redesigning collateral systems so staking and stablecoin use are compatible.

He also emphasized that stablecoins cannot rely on fixed collateral ratios and must be able to rebalance during sharp market moves, even if that means temporarily sacrificing yield.

The debate is not theoretical, as past attempts at decentralized stablecoins have ended badly.

Terra’s UST collapse in 2022 wiped out tens of billions of dollars, and Terraform Labs founder Do Kwon was sentenced last month to 15 years in prison, reinforcing skepticism around high-yield, algorithmic designs.

Since then, progress has been cautious, with MakerDAO’s DAI remaining widely used, but its growth has slowed, and newer designs have yet to reach a comparable scale.

Reflexer’s RAI, an ETH-backed stablecoin not pegged to fiat, was once praised by Buterin as an ideal model, yet its limited adoption and trade-offs around staking yield highlighted how difficult these designs are to sustain.

The comments sparked wide discussion within the Ethereum community, with some developers and users arguing that non-USD stablecoins are conceptually appealing but lack real demand, pointing out that most users still default to dollar-pegged assets for payments and savings.

Others pushed back, saying the difficulty of the problem does not make it unsolvable and that a truly decentralized, free-floating stablecoin with resilient oracles is consistent with Ethereum’s long-term mission, even if mass adoption remains years away.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Bhutanese government transfers 343.1 Bitcoins and may deposit them again on CEX