LISA Crashes After Team Wallet Dumps $1.65M on Binance

LISA token dropped 76 percent when a wallet attached to the team deposited $1.65 million of tokens into Binance Alpha, leading to a panic sell and enraged community members.

The LISA token dropped down 76 percent in less than 24 hours, killing the Solana-based AI project and placing the project team in the limelight of community members.

0xXIAOc on X claimed that the crash was unparalleled. The crash occurred when LISA entered the market, bros do not spam this, they tweeted. It is inhuman, reaping so wantonly. They questioned who, other than the project team, was dumping so many tokens.

The $1.65 Million Deposit That Started Everything

Two notable Chinese opinion leaders tracked the crash down to suspicious activity on the chain. At around 01:50 UTC, a safe proxy wallet, 0x358…eC57c, deposited 10 million LISA tokens into Binance Alpha, which was worth approximately 1.65 million at the time.

Sales began 25 to 30 minutes later. In 28 seconds, at 10:22UTC, three swift moves at a total of 170,000 struck the market. The dumps were 39,540,45,440, and 85,66,8, which flooded the books, the order books.

LISA dropped to varying degrees of 0.165 to 0.02, with some reports stating that the price even dropped to as low as 0.01 at the peak volatility.

Why Point Farmers Made It Worse

The liquidity of the token was weak. Actual demand was low relative to point farmers speeding towards the 4x trading rewards of Binance Alpha. The project awarded 236 Alpha points on a first-come, first-served basis of 230 tokens.

The on-chain was concealed under limit orders. This rendered the attempt by community members to trace the source of the dump almost impossible, leading to panic selling by the holders.

The trading volume increased following the crash. The community dubbed the project a potential rug pull, and yet the team remained silent all through the hype.

You might also like: Cardano Founder Teases Bitcoin and XRP DeFi on Midnight Protocol

The Volatile Trend of Binance Alpha emerges.

LISA belongs to a list of increasingly crashed Binance Alpha tokens. In October 2025, the AB token plummeted by 99 percent during Asian trading hours, dropping from 0.0083 to 0.0000051 in just two minutes.

Other tokens, such as SOMI, U, and LINEA, also decreased by over 50 percent daily soon after their introduction. These projects are characterized by panic every so often due to low liquidity and quick selling.

Regardless of this trend, project teams continue to be listed on Binance Alpha. The visibility of the platform in the short term is more appealing to the developers than the dump risks. Members of the community continue to raise concerns about these cases.

The LISA crash highlights the dangers of the low-liquidity token launch. Insiders can take advantage of thin order books to make heavy losses to investors. The silence of the AgentaLISA staff members further fuelled the suspicions in the community that there was some form of insider influence.

The post LISA Crashes After Team Wallet Dumps $1.65M on Binance appeared first on Live Bitcoin News.

You May Also Like

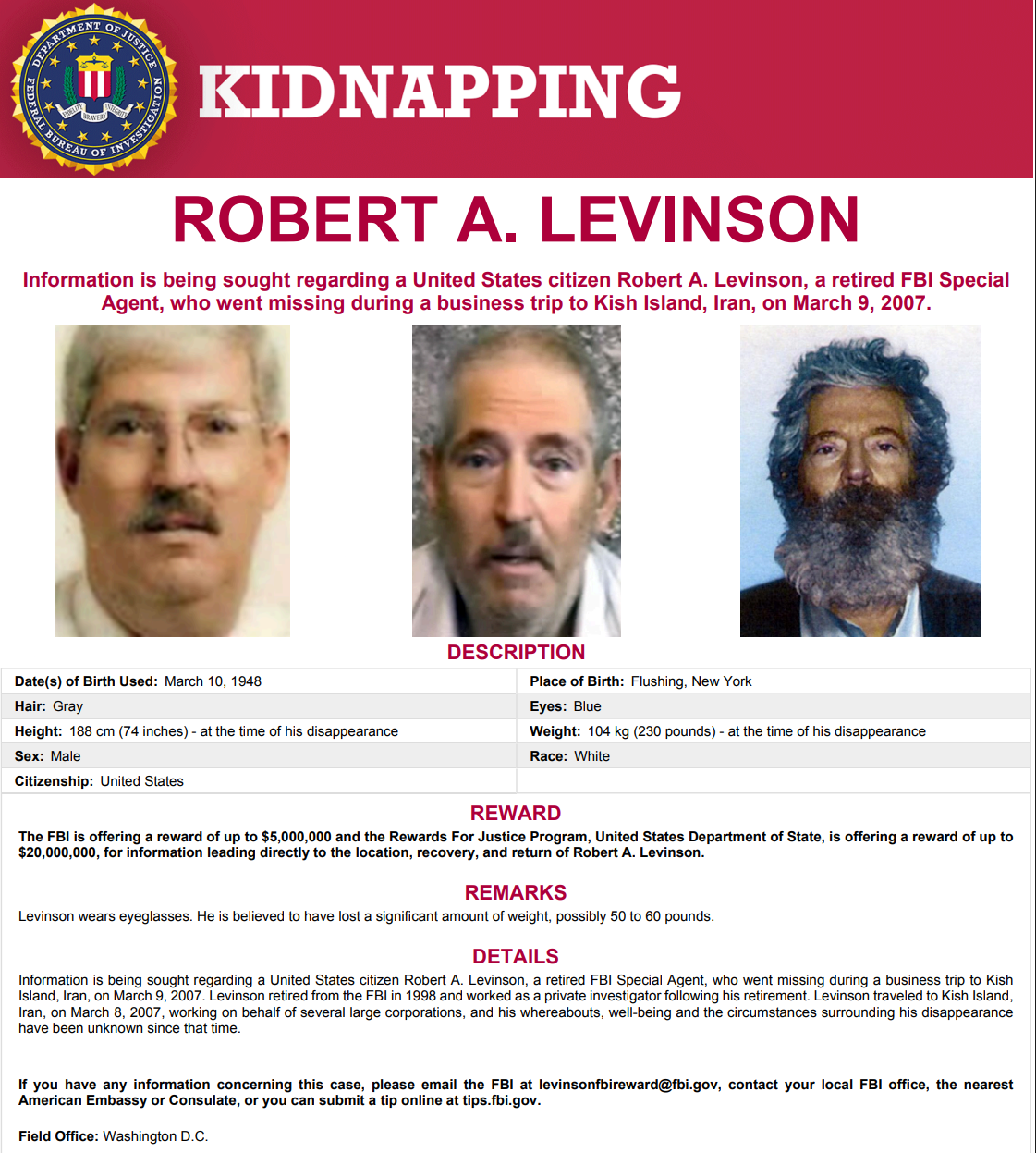

US–Iran War Risk Grows as FBI Accuses Kidnapping of American Citizens

My one-person OpenClaw company architecture v1.0 delegates all company accounting, compliance, and operations to AI.