Polymarket Data: Strait of Hormuz Closure Odds Nearly Double After Israel’s Strikes on Iran

As of June 14, the likelihood of Iran blocking or closing the Strait of Hormuz has risen to 47%, nearly doubling from 24% on June 11.

Strait of Hormuz Closure Threatens Global Trade

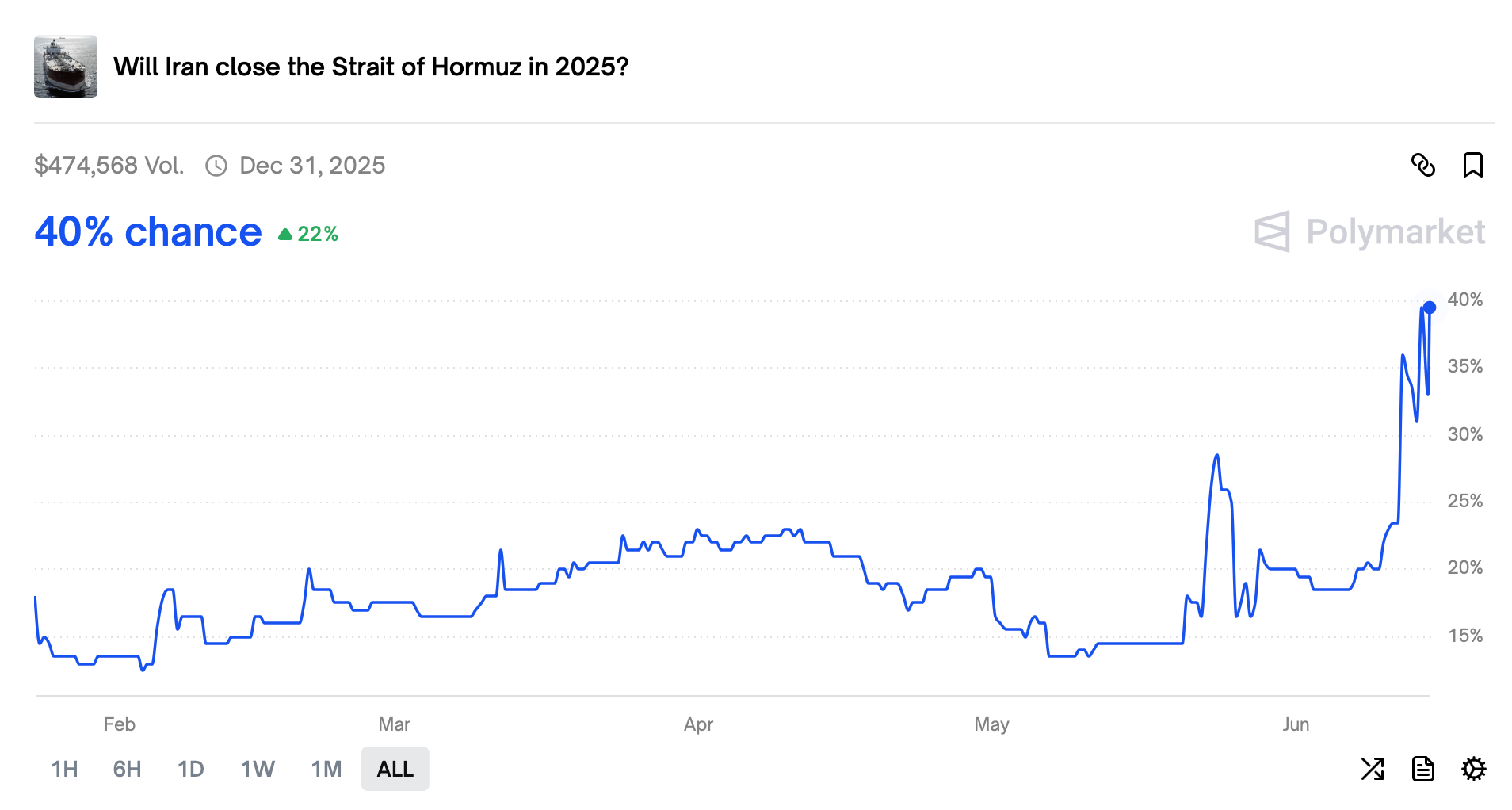

The odds of Iran blocking or closing the Strait of Hormuz, one of the world’s most critical maritime chokepoints, briefly rose to 45% on June 14, according to the latest Polymarket data. The data shows the odds are nearly double the 24% observed on June 11, hours before Israel finally acted on its longstanding threat to hit Iran’s nuclear sites.

Polymarket bet data on June 14, 2025.

Polymarket bet data on June 14, 2025.

Although Iran has never fully carried out the threat before, many fear the scale of Israel’s strikes may prompt Tehran to retaliate by closing the critical chokepoint. The Strait of Hormuz is said to be vital for global trade because roughly one-fifth to one-third of the world’s total oil consumption — estimated between 17 million and 21 million barrels per day — passes through it.

In addition, a significant portion of global liquefied natural gas (LNG) trade, especially from Qatar and the United Arab Emirates (UAE), also transits the shipping channel. Many experts fear its closure or any disruption, even temporary, would cause oil prices to surge dramatically, potentially pushing Brent crude well above $100-$120 per barrel.

Shortly after Israeli warplanes struck targets in Iran, oil prices surged past the $70 per barrel mark for the first time since April 3, 2025. Some observers fear the closure of the channel could lead to even higher oil prices and potential economic stagnation for many countries that rely on the Strait of Hormuz.

The surge in the odds meanwhile points to growing fears that the latest tit-for-tat military attacks between Tehran and Tel Aviv will escalate into a full-blown war. In the last exchange between the two bitter enemies, the strikes appeared to be choreographed, with both Israel and Iran reportedly getting advance warning of the pending strikes. At the time, both countries appeared not to cross red lines set by either, resulting in the confrontation ending with limited damage.

In Israel’s latest strikes, Iranian nuclear sites, including one in Natanz, were struck, with the International Atomic Energy Agency (IAEA) reporting that the above-ground enrichment plant was completely destroyed. Many global mainstream media outlets reported that Iran’s air defenses were also destroyed during the dawn strikes, although such reports appeared to be undercut by videos circulating on social media purporting to show these defenses engaging incoming missiles.

Attacks on nuclear sites and other vital infrastructure suggest that Israel has crossed Tehran’s red line, an act that increases the prospects of Iran finally acting on its threat. However, closing the chokepoint would devastate Iran’s own economy and may provoke a response by other countries dependent on it, including the United States.

You May Also Like

DBS Partners With Franklin Templeton and Ripple for Tokenized Lending Platform

Stacks (STX) Daily Market Analysis 24 February 2026