Bitcoin Price Surges Past $95,000 as Ether, Solana and Cardano Jump 8%

This article was first published on The Bit Journal.

The Bitcoin price jumped back into focus this week after a sharp rally drew fresh attention from traders, students and developers. The move raised curiosity about how digital assets react when economic pressure shifts.

According to the source, softer inflation in the United States and new tensions around the Federal Reserve created conditions that pushed risk assets higher. Bitcoin moved toward the 95000$ level, signaling a stronger shift in market sentiment.

This surge hinted at renewed confidence across the crypto market, where investors watch liquidity and policy expectations with growing focus. The moment offered a clear example of how quickly sentiment can change in digital finance.

Inflation Cools, and Bitcoin Responds Quickly

Lower inflation became the main driver of the week as fresh consumer data showed slower price growth. This eased pressure on yields and improved liquidity across markets. The Bitcoin price reacted quickly as traders shifted toward assets viewed as separate from central bank influence.

Analysts noted that cooling inflation often supports digital assets during fragile macro periods. This view strengthened after the official update confirmed that cost pressures eased more than expected, a point reinforced by real-time reporting from this market analysis. The shift pushed investors who expected downside pressure to rethink their outlook.

Political Shock: DOJ Subpoenas Add Fuel to the Rally

Another unexpected catalyst emerged as reports confirmed that the U.S. Justice Department had issued grand jury subpoenas to the Federal Reserve earlier in the week.

This development unsettled traditional markets and weakened the dollar, increasing demand for assets seen as insulated from central bank risk. The event amplified political uncertainty surrounding monetary policy, further supporting the Bitcoin price as investors looked for non-sovereign alternatives.

A Cascade of Liquidations Adds Fuel to the Rally

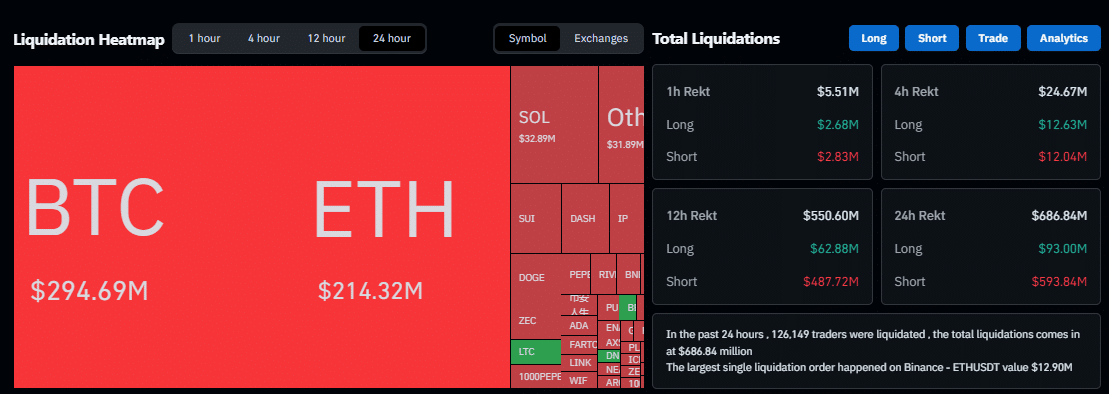

Derivatives markets delivered the second spark as more than $688 million in crypto futures positions were liquidated, including about $603 million in shorts. Many traders had bet on a weaker market before the inflation release.

When the data shifted, heavily leveraged positions were forced to close, pushing prices higher. Nearly 126,000 traders were wiped out, including a single $12.9 million ETHUSDT position on Binance. The rapid unwind showed how fast the crypto market can reverse when leverage collides with unexpected news.

Source: Coinglass

Source: Coinglass

Altcoins Follow Bitcoin’s Lead as Market Confidence Returns

The rally extended beyond Bitcoin. Ether climbed above $3,300, while Solana, Cardano, XRP and BNB recorded strong gains. Real-time data showed that the total crypto market valuation expanded as liquidity improved and sentiment brightened.

Developers and students studying market structure viewed these synchronized moves as a sign of broader confidence returning. The Bitcoin price often serves as a benchmark during such phases, guiding capital flows across ecosystems. This time proved no different as altcoins mirrored Bitcoin’s strength with notable precision.

Global Markets Add Momentum as Investors Seek Stability

Outside digital assets, traditional markets also played a supportive role. Asian equities reached record highs, and silver climbed past $90 per ounce. Gold hovered near its all-time peak as investors searched for stability. These global movements highlighted rising demand for assets linked to currency sensitivity.

This shift gave the Bitcoin price added support as investors explored tools for navigating uncertain monetary conditions. The crypto market reflected this broader pattern, showing how strongly it reacts when global sentiment aligns with digital-asset trends.

Conclusion

This week’s surge showed how economic signals, political tension and rising leverage shape digital-asset behavior. The Bitcoin price climbed as cooling inflation, uncertainty around the Federal Reserve and heavy liquidations shifted market expectations.

For readers tracking the crypto market, the move highlights how fast sentiment can turn when macro conditions change. Whether this rally lasts or fades will depend on upcoming economic data, making it important for investors to stay alert and informed.

Glossary of Key Terms

Bitcoin price: The real-time trading value of Bitcoin.

Crypto market: The full ecosystem of digital currencies and tokens.

Liquidations: Forced closure of leveraged trades when prices move sharply.

Inflation: Increase in average consumer prices over time.

FAQs About Bitcoin Price

Why did Bitcoin rise so suddenly?

Cooling inflation and forced liquidations helped drive the rally.

Did altcoins follow the same trend?

Yes, many top altcoins surged as sentiment strengthened.

How did inflation influence digital assets?

Lower inflation encouraged traders to shift toward scarce assets.

Will volatility continue?

Likely yes, as leverage is already rebuilding across the crypto market.

References / Sources

Coindesk

Coinglass

Coinmarketcap

Reuters

Read More: Bitcoin Price Surges Past $95,000 as Ether, Solana and Cardano Jump 8%">Bitcoin Price Surges Past $95,000 as Ether, Solana and Cardano Jump 8%

You May Also Like

SEC Decision Sparks 12% Jump In ZEC Price

Zcash Foundation says SEC has closed the book on its years-long probe into the organization