NFT buyers rise 120% despite sales staying flat at $61.5 million

The NFT market recorded $61.5 million in sales volume over the past week, posting a modest 1.52% increase from the previous period.

- NFT sales hit $61.5M, while buyers surged 121% and sellers rose nearly 99%.

- Ethereum led blockchains with $29M in NFT sales and a 421% jump in buyers.

- Bitcoin NFTs dominated top sales as BTC reclaimed $95K and ETH crossed $3.2K.

While the sales figures show minimal movement, the real story lies in market participation. NFT buyers jumped 120.90% to reach 134,743, while sellers increased by 98.69% to 111,756.

This has happened at a time when Bitcoin (BTC) has staged a recovery to the $95,000 level, while Ethereum (ETH) has reclaimed the $3,200 mark.

The global crypto market cap now stands at $3.22 trillion, up from last week’s $3.09 trillion.

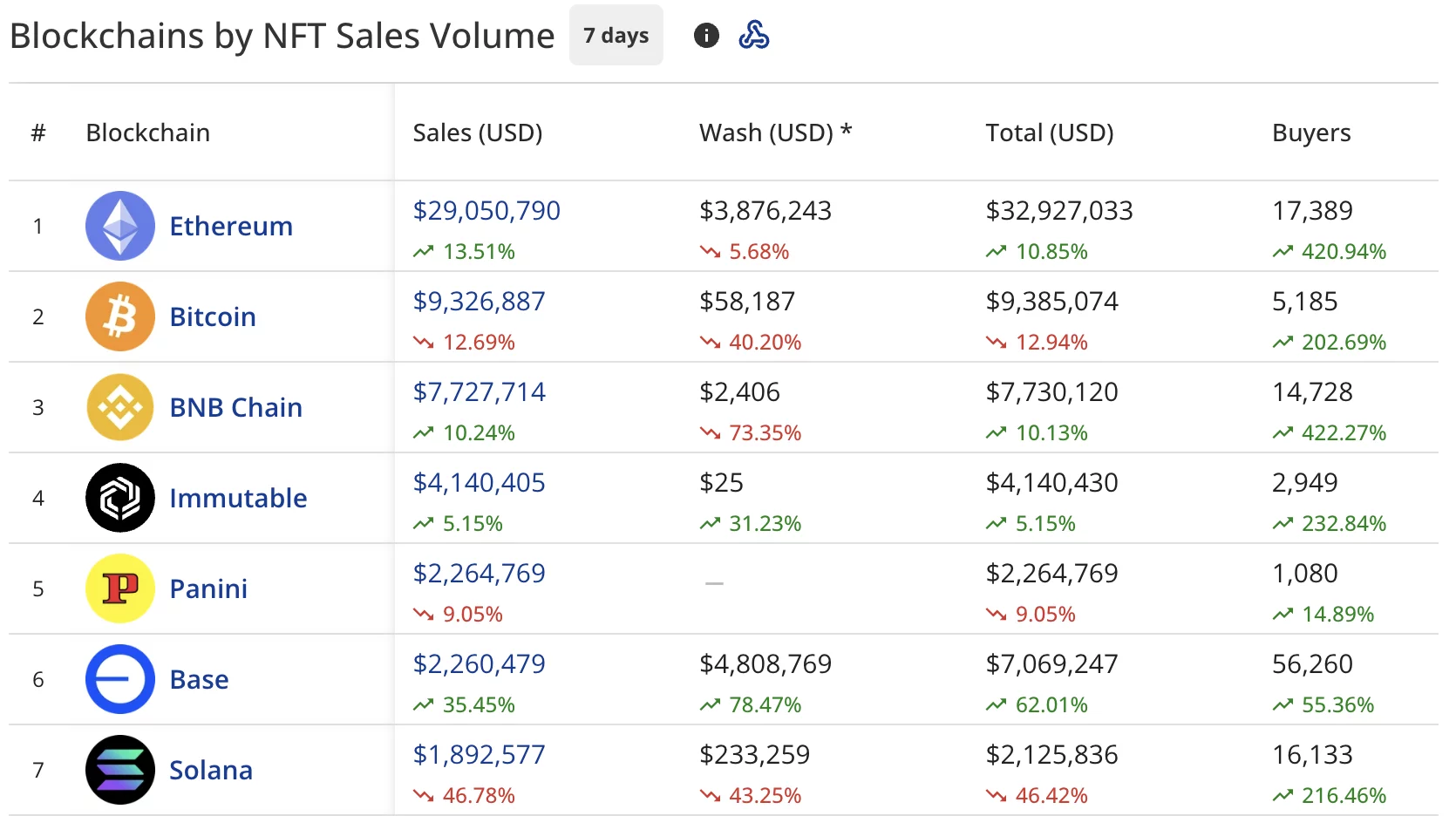

Ethereum maintains dominance with $29 million in sales

Ethereum continues to lead all blockchains with $29.05 million in NFT sales, posting a 13.51% gain over the seven-day period.

The network saw 17,389 buyers, up by 420.94% from the prior week. Wash trading on Ethereum totaled $3.88 million during this timeframe.

Bitcoin claimed second place among blockchains with $9.33 million in sales, though this is a 12.69% decline from the prior week. The network drew 5,185 buyers, up 202.69% week-over-week.

BNB Chain (BNB) ranked third with $7.73 million in sales, climbing 10.24% and drawing 14,728 buyers who increased by 422.27%.

Immutable (IMX) secured fourth position at $4.14 million in sales, up 5.15%, while Panini rounded out the top five with $2.26 million, down 9.05%.

Base blockchain recorded $2.26 million in sales with a 35.45% gain, while Solana (SOL) posted $1.89 million in sales but suffered a steep 46.78% decline compared to the previous week.

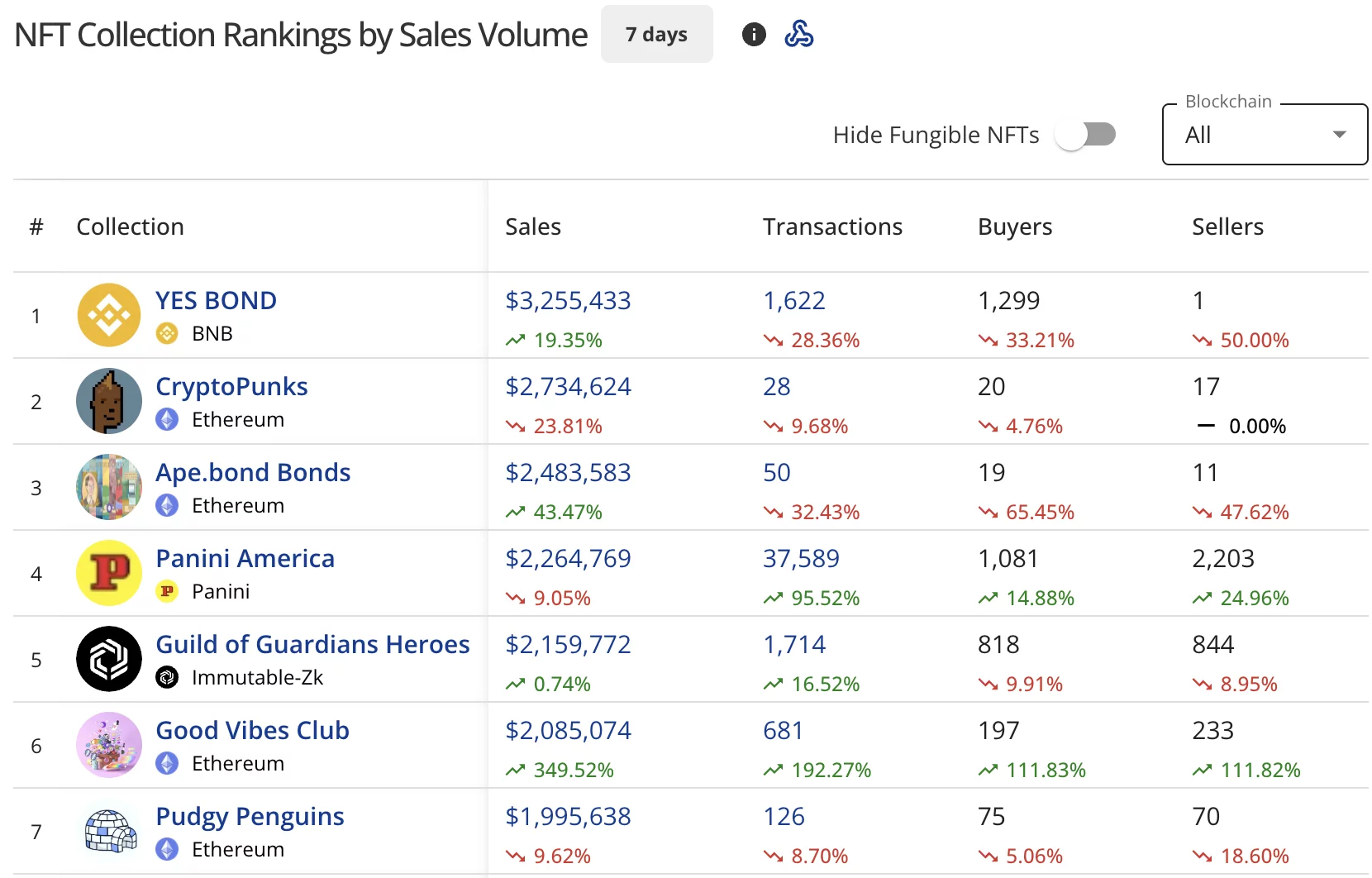

YES BOND tops collection rankings

YES BOND on BNB Chain dominated the collection rankings with $3.26 million in sales, climbing 19.35% over the week. The collection processed 1,622 transactions from 1,299 buyers.

CryptoPunks took second place with $2.73 million in sales despite a 23.81% drop. The blue-chip Ethereum collection completed 28 transactions from 20 buyers. Ape.bond Bonds landed in third with $2.48 million in sales, surging 43.47%.

Panini America generated $2.26 million in sales with a 9.05% decline, while Guild of Guardians Heroes posted $2.16 million in sales, up 0.74%.

Good Vibes Club on Ethereum recorded $2.09 million in sales with a 349.52% gain. Pudgy Penguins rounded out the top seven with $2 million in sales, down 9.62%.

High-value sales led by Bitcoin NFTs

The week’s highest-value sales were dominated by $X@AI BRC-20 NFTs on Bitcoin. The top sale reached $1.10 million (12.0247 BTC), followed by another $X@AI piece at $898,131 (9.8453 BTC). Both transactions occurred three days ago.

CryptoPunks claimed three spots in the top five individual sales.

- CryptoPunks #5705 sold for $163,672 (53 ETH) six days ago.

- CryptoPunks #3043 fetched $123,926 (40 ETH)

- CryptoPunks #4773 brought in $111,223 (35.9 ETH), both selling three days ago.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

XRP Treasury Firm Evernorth Prepares Public Listing to Boost Institutional Exposure