| Disclosure: This content is promotional in nature and provided by a third-party sponsor. It does not form part of the site’s editorial output or professional financial advice. |

Crypto markets are showing renewed strength as total market value stays close to $3.35 trillion and short-term signals lean toward higher risk appetite. Bitcoin trading above $97,000 has lifted confidence across major assets, pulling more liquidity into trending ideas and encouraging traders to take active positions instead of waiting. In such conditions, price moves speed up, reactions become sharper, and capital flows toward projects that can attract attention and volume at the same time.

This backdrop explains why the recent Monero (XMR) price move and Chainlink (LINK) whale behavior remain under focus. XMR is holding close to $705 with strong daily volume, while LINK trades near $14 as large holders move supply away from exchanges. Both show resilience, yet questions remain around upside potential. After visible accumulation and sharp rallies, many wonder how much room is left for late buyers if much of the move is already reflected in price. That uncertainty is why analysts increasingly describe Zero Knowledge Proof (ZKP) as the best crypto for 2026.

Zero Knowledge Proof (ZKP) Presale Auction Pressure Builds

Zero Knowledge Proof (ZKP) is gaining attention as a presale-based project designed around controlled scarcity, where access is managed through a daily presale auction rather than fixed pricing stages. Market observers say this structure supports its growing reputation as the best crypto for 2026, because pricing forms directly from real demand instead of a preset ladder meant to remain stable.

Roughly 200 million units are released every 24 hours before the system resets for the next cycle. With a $20 minimum entry and a $50,000 per wallet daily cap, the presale auction stays accessible to smaller participants while limiting single-wallet dominance. This setup creates a competitive environment where each day becomes a new allocation contest.

Sentiment has shifted due to the pace of participation. Analysts watching presale auction flows report that allocations are absorbed quickly, leaving many participants feeling pressure even when they enter early in the daily window. That imbalance turns pricing into a live pressure signal rather than a slow accumulation phase.

Experts frame the model as a supply contest where the protocol controls all distribution. They suggest that projections of 5000x potential are drawing more attention into the same fixed daily release, raising the likelihood of faster price movement as competition intensifies. This is why Zero Knowledge Proof is repeatedly mentioned as the best crypto for 2026, since demand keeps pressing against a firm ceiling and early positioning may carry more weight as each day resets pricing higher.

Monero (XMR) Price Rally Holds Near $705

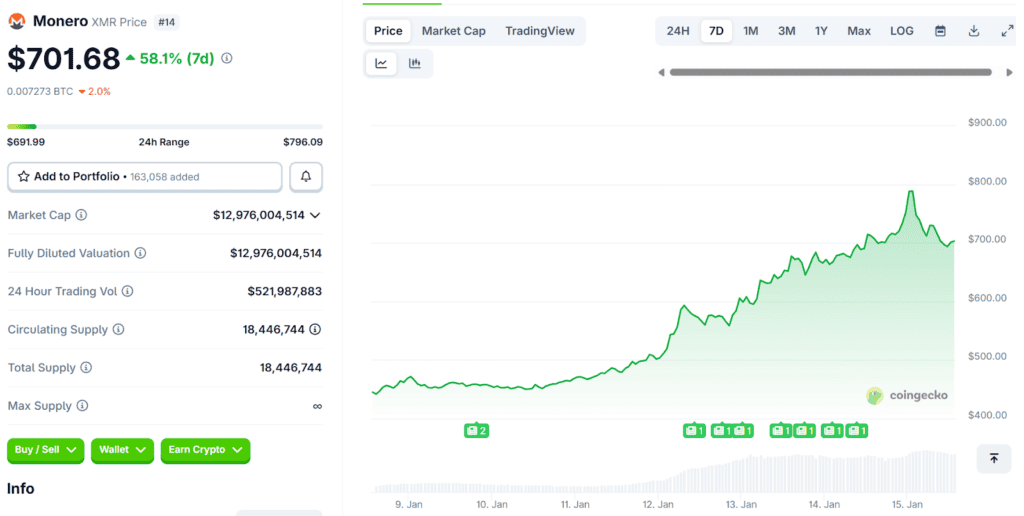

Recent Monero (XMR) trading has remained firm, with price hovering around $705 in the latest period. Daily trading activity continues to show strength at approximately $488M–$503M, confirming that interest remains high even after a sharp upward move. Monero’s market value now sits close to $13.0B, placing it near rank #11 and keeping it among closely watched large-cap assets.

Source: CoinGecko

Source: CoinGecko

This advance has pushed XMR closer to peak zones, with trackers noting a previous high near $797.73. That positioning keeps Monero in focus because price action near these levels can lead to either breakouts or rapid pullbacks. With such volume present, even small shifts in momentum can trigger noticeable swings, making XMR important for traders monitoring short-term movement.

Chainlink (LINK) Whale Activity Points to Supply Tightening

Chainlink (LINK) trading has stayed steady, with price ranging around $13.9–$14.1 as recent whale activity draws attention. Daily volume remains elevated near $573M–$586M, suggesting continued interest while price consolidates. LINK’s market value is close to $9.8B, supported by roughly 708M units in circulation, keeping it firmly in the large-cap group.

Reports highlighted a large holder withdrawing about 342,557 LINK, valued near $4.8M, from Binance across two days. Traders follow such moves because they can reduce available supply on exchanges. Market feeds also noted the Bitwise CLNK ETF launch, adding another narrative alongside ongoing accumulation trends.

Final Verdict

The Monero (XMR) price rally showed how quickly gains can appear when momentum builds, with XMR holding near $705 and strong volume keeping activity high. It confirmed that privacy-focused assets can still move rapidly when liquidity aligns with demand.

Meanwhile, Chainlink (LINK) whale activity reflects a slower but steady shift, with LINK staying near $14 as withdrawals tighten exchange supply. This type of behavior can support future moves if risk-friendly conditions persist.

Analysts argue that Zero Knowledge Proof stands apart because its pricing is shaped directly by competition for daily presale auction supply. When demand consistently presses against fixed release limits, price pressure can build faster than in typical cycles. This structure is why many label Zero Knowledge Proof as the best crypto for 2026, where early access may matter more than waiting for small pullbacks.

Find Out More about Zero Knowledge Proof:

Website: https://zkp.com/

Auction: https://auction.zkp.com/

X: https://x.com/ZKPofficial

Telegram: https://t.me/ZKPofficial

| Disclaimer: The text above is an advertorial article that is not part of coinlive.me editorial content. |