XRP Is Doing Something It Hasn’t Done Since 2021: Here’s Why It Matters

XRP is flashing a rare relative-strength signal against ETH, according to crypto analyst Matt Hughes (“The Great Mattsby”), who points to a 2-week Ichimoku cloud flip that he says hasn’t meaningfully held as support since 2021. With XRP also boxed inside a defined USD range on lower timeframes, Hughes frames the next phase as a conditional “prove it” moment: reclaim one level, and the market has room to work; fail it, and the breakout narrative stays premature.

XRP Poised To Outperform ETH?

Hughes’ primary claim is anchored to the XRP/ETH pair on a 2-week chart. In his read, there’s a massive regime change: “When looking at the 2-week Ichimoku cloud, you can see that XRP is doing something it hasn’t done since 2021: flipping the 2-week cloud to support. The cloud has been a massive resistance for most of the chart’s history until now (with a notable breakout in 2021, but only a few weeks).”

On Hughes’ chart, XRP/ETH is pressing into the top side of the 2-week Ichimoku cloud, with the latest candle marked around 0.00062. His bullish read is that a clean flip, price holding above the cloud and treating it as a floor on pullbacks, would be a regime change for the pair.

XRP Roadmap To $9

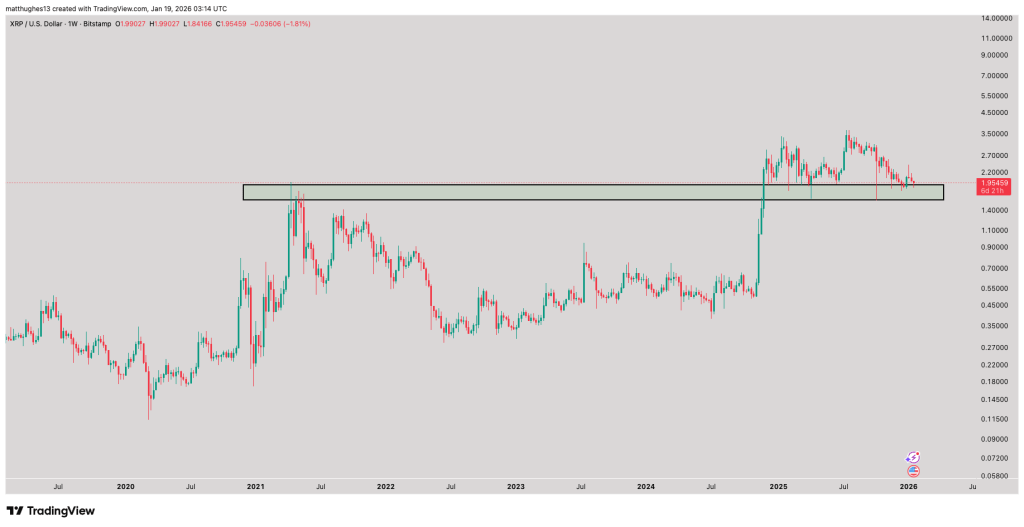

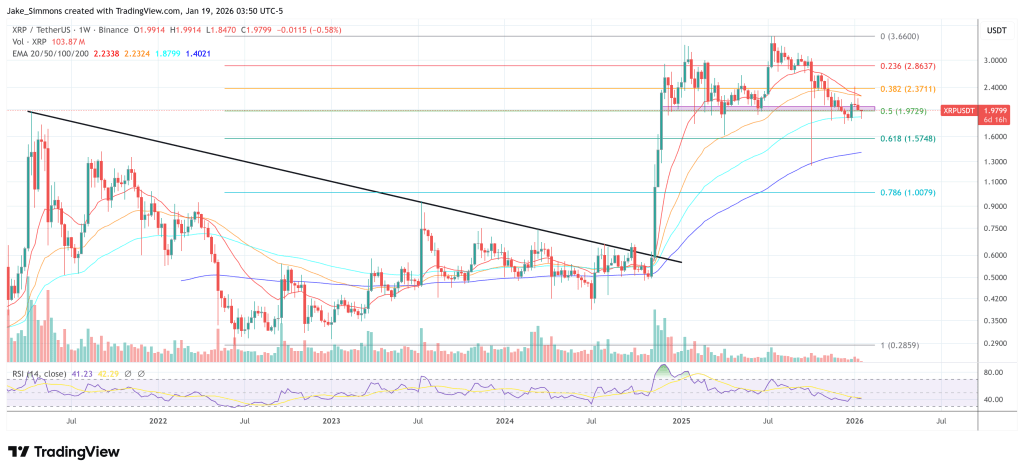

Hughes’ shorter-timeframe work shifts from relative performance to mechanics in spot USD terms. On the daily XRP/USD chart, price is still behaving like a market that has not resolved its larger consolidation, oscillating between stacked horizontal levels while respecting sloping fan lines that visually reinforce why upside attempts have repeatedly stalled.

Hughes boils that structure down to one actionable threshold: “Price moves in increments, and this Gann fan perfectly illustrates why price is stuck in its current range. Once XRP can close candles above $2.30, the move up can continue.” Above that, the next targets on the daily timeframe are $2.59 and $2.95.

The weekly XRP/USD chart adds the next level if that acceptance arrives. Two extension levels (drawn from the 2014 low to the 2017 high) are explicitly marked: 2.272 at $3.09882 and 2.618 at $9.00194, with Hughes’ drawn path stepping first toward the low-$3 area before stretching higher if momentum persists.

Thus, Hughes’ bullish scenario is a two-part sequence: first, clear the USD range trigger (a sustained close above $2.30), then convert the last major zone before the 2025 high into support. He states it in more pointed terms on X: “XRP’s been grinding sideways for 1+ year while many other alts were bleeding. Not IF it hits $9—it’s WHEN. Key flip: $3.09 becomes support and then its go time.”

The failure scenario is simpler and more immediate. If XRP cannot secure closes above $2.30, the fan-and-range framework remains intact: rallies are still just rallies into the same ceiling, and the market risks reverting back towards $1.78.

However, a dip towards this price would not change anything about the long-term bullish chart of XRP. Pointing to a gap between chart structure and crowd sentiment, Hughes wrote:

“An actual infant in diapers and a 120-year-old grandpa who’s forgotten his own name can look at this chart and go, ‘Yep, classic breakout above the 2021 top, now flipping it to rock-solid support.’ Meanwhile, every bear on X, their mailman, their mailman’s dog walker, and that one guy who still thinks it’s 2022 are out here screaming ‘BEARISH! DOOM! SELL YOUR KIDS!’ like it’s still the bear market special. Bro, even my grandma’s bingo partner is bullish at this point. Wake up and smell the bull fuel.”

At press time, XRP traded at $1.9799.

You May Also Like

Pepeto Presale Surges Past $7.4M as Tokenized Stock Trading Tops $2.5B and Exchange Products Near Launch

Niza Labs and Lava Protocol Advance Tokenized Finance