Chainlink Price Prediction January 2026: Is LINK Quietly Preparing for a 120% Move?

The post Chainlink Price Prediction January 2026: Is LINK Quietly Preparing for a 120% Move? appeared first on Coinpedia Fintech News

The Chainlink price prediction January 2026 remains a hot topic, despite half the month having passed, due to the increasingly clear alignment of on-chain accumulation, institutional participation, and even long-term technical price structures. While short-term volatility persists across crypto markets, hurting investor sentiment, but beyond this LINK’s underlying data suggests demand is building quietly, that is setting the stage for a potentially decisive move as liquidity dynamics tighten.

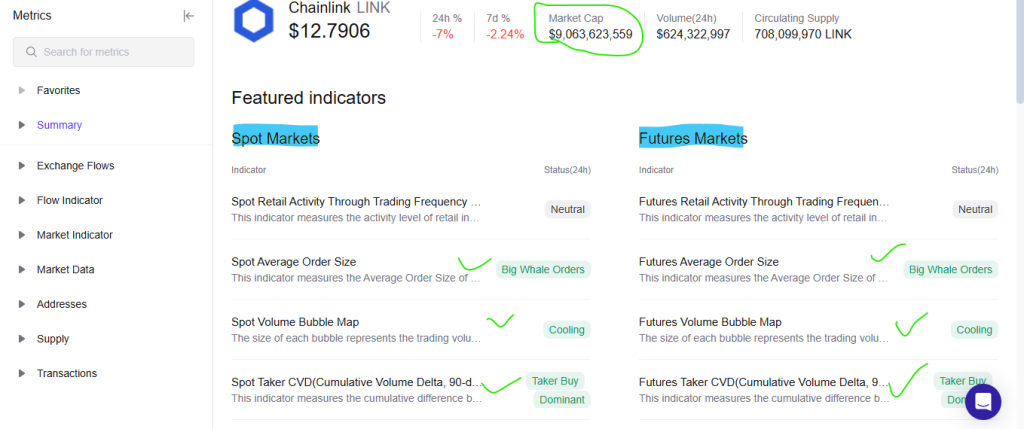

Spot and Futures Markets Signal Aggressive Demand

One of the most notable developments influencing the Chainlink price prediction January 2026 is the behavior of both spot and futures markets, per CryptoQuant’s insights. Currently, both are firmly in a Taker Buy Dominant phase, meaning buyers are executing at market prices rather than waiting for pullbacks. This behavior typically reflects urgency and conviction rather than speculative positioning.

Furthermore, the Average Order Size across spot and futures has shifted into a “Big Whale” zone. This confirms that institutional-scale participants are present that are driving LINK’s current market structure, rather than retail flows.

As a result, selling pressure is being absorbed more efficiently, altering the short-term supply-demand balance that’s visible to some extent on the Chainlink price chart, as well.

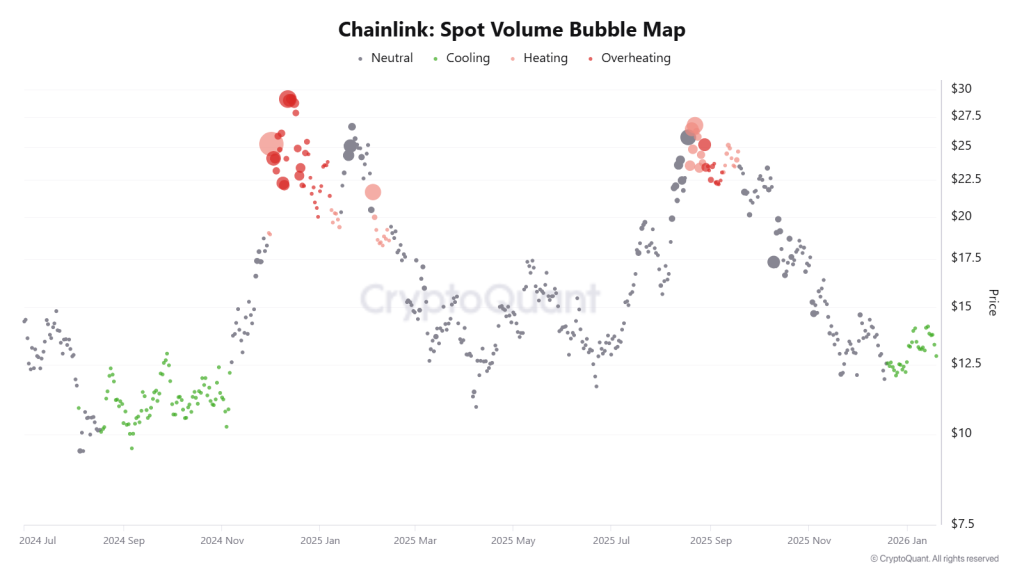

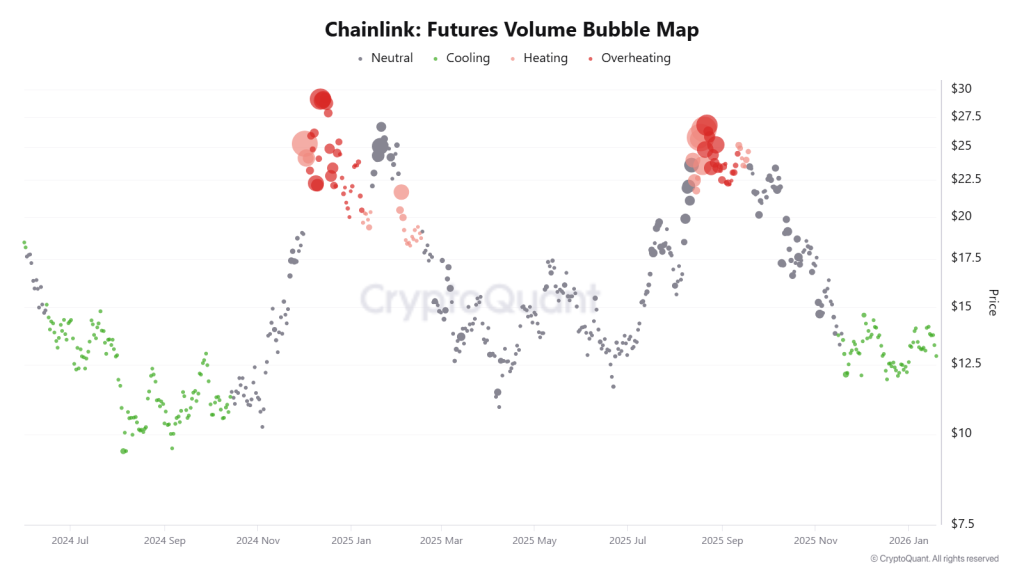

Volume Cooling Phase Hints at Silent Accumulation

At the same time, volume dynamics provide additional context. The Volume Bubble Map for LINK indicates that both spot and futures markets have entered a cooling phase.

Historically, such conditions have preceded strong directional moves, especially when accompanied by aggressive taker buying.

In prior cycles, similar cooling periods masked quiet accumulation before sharp upside expansions.

Therefore, this combination of lower visible volume and high-conviction buying suggests that smart money may be positioning ahead of a liquidity inflection point, influencing the broader Chainlink price forecast narrative more clearly then ever.

Chainlink Reserve Growth Reinforces Long-Term Confidence

Beyond trading activity, ecosystem-level fundamentals continue to strengthen, as well. The Chainlink Reserve funded by on-chain and off-chain revenue sources, has grown to 1.59 million tokens. This size keeps growing, and the latest inflow was over 82,000 LINK, while this accumulation trend has been ongoing since August 2025, reflecting a more strategic approach to long-term ecosystem sustainability.

Similarly, its adoption data further reinforces this narrative. As of January 2026, Chainlink’s Transaction Value Enabled has reached approximately $27.75 trillion, while Total Value Secured stands near $83.27 billion. Additionally, Total Verified Messages have crossed 19 billion, highlighting sustained oracle usage across decentralized applications.

These metrics underline Chainlink’s role as core infrastructure, providing fundamental support beyond speculative price movement.

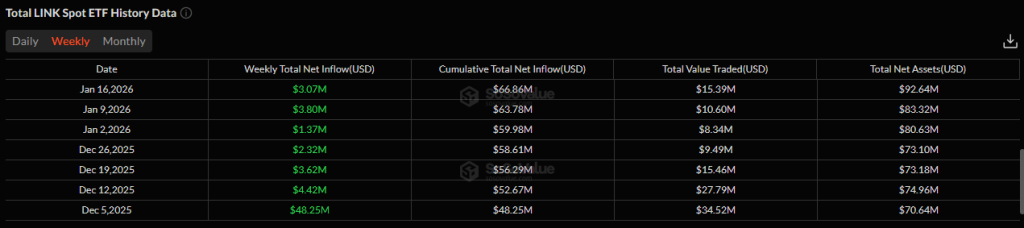

ETF Inflows and Technical Structure Add Conviction

As per sosovalue’s data, the institutional exposure via the Chainlink ETF has also improved bullish sentiment. Weekly inflows have remained consistently positive, lifting total net assets close to $92.6 million, nearly 1% of LINK’s market capitalization. This steady accumulation contrasts with broader market hesitation.

From a technical perspective, LINK price continues to consolidate along a multi-year ascending trendline that has historically preceded strong rallies.

Meanwhile, the broader structure resembles a long-term cup-and-handle formation, with price trading near the upper boundary of the handle. Once it breaks, a rise to $28.69 could be the next target, representing over 120% upside.

That said, if this structure resolves upward, projections onthe Chainlink price prediction January 2026 mostly tilt on the upside, once momentum confirms the price action will follow.

You May Also Like

Let insiders trade – Blockworks

ZKP Might Be The Next 100x Crypto You Should Watch While ETH Demand Builds, & XRP Stalls in January