Solana (SOL) Price: Whales Buy the Dip as Token Tests $130 Support

TLDR

- SOL price fell below $130 for the first time since January 2, with long liquidations reaching $59.51 million in 24 hours

- Whale addresses holding 1,000 to 10,000 tokens have accumulated 48 million SOL since late November, representing 9% of total supply

- Exchange supply dropped to two-year lows at 26 million tokens, suggesting reduced selling pressure from holders

- Daily active addresses increased 51% over seven days to above 5 million, while transactions climbed 20% to 78 million

- Solana’s stablecoin supply hit an all-time high of $15 billion, up 15% in one week

Solana dropped below $130 this week, marking its lowest level since early January. The decline came as part of a broader market pullback that affected multiple cryptocurrencies.

Solana (SOL) Price

Solana (SOL) Price

Despite the price drop, large holders continue to buy more tokens. Whale addresses holding between 1,000 and 10,000 SOL now control approximately 48 million tokens. This represents about 9% of the total circulating supply.

The accumulation trend extends to larger holders as well. Addresses with at least 100,000 tokens increased their holdings from 347 million in mid-November to 362 million tokens. These wallets now hold 64% of the total supply.

Source: Glassnode

Source: Glassnode

Long-term holders also returned to accumulation mode. The hodler net position change reached 3.85 million SOL on Sunday, the highest level in 15 months. The last time accumulation hit similar levels was in October 2024, which preceded a 95% price rally.

The selling pressure appears to be decreasing based on exchange data. SOL balance on exchanges fell by 5 million tokens to 26,058,693 on Wednesday. This marks the lowest level since January 12, 2023.

Long Liquidations Drive Recent Selloff

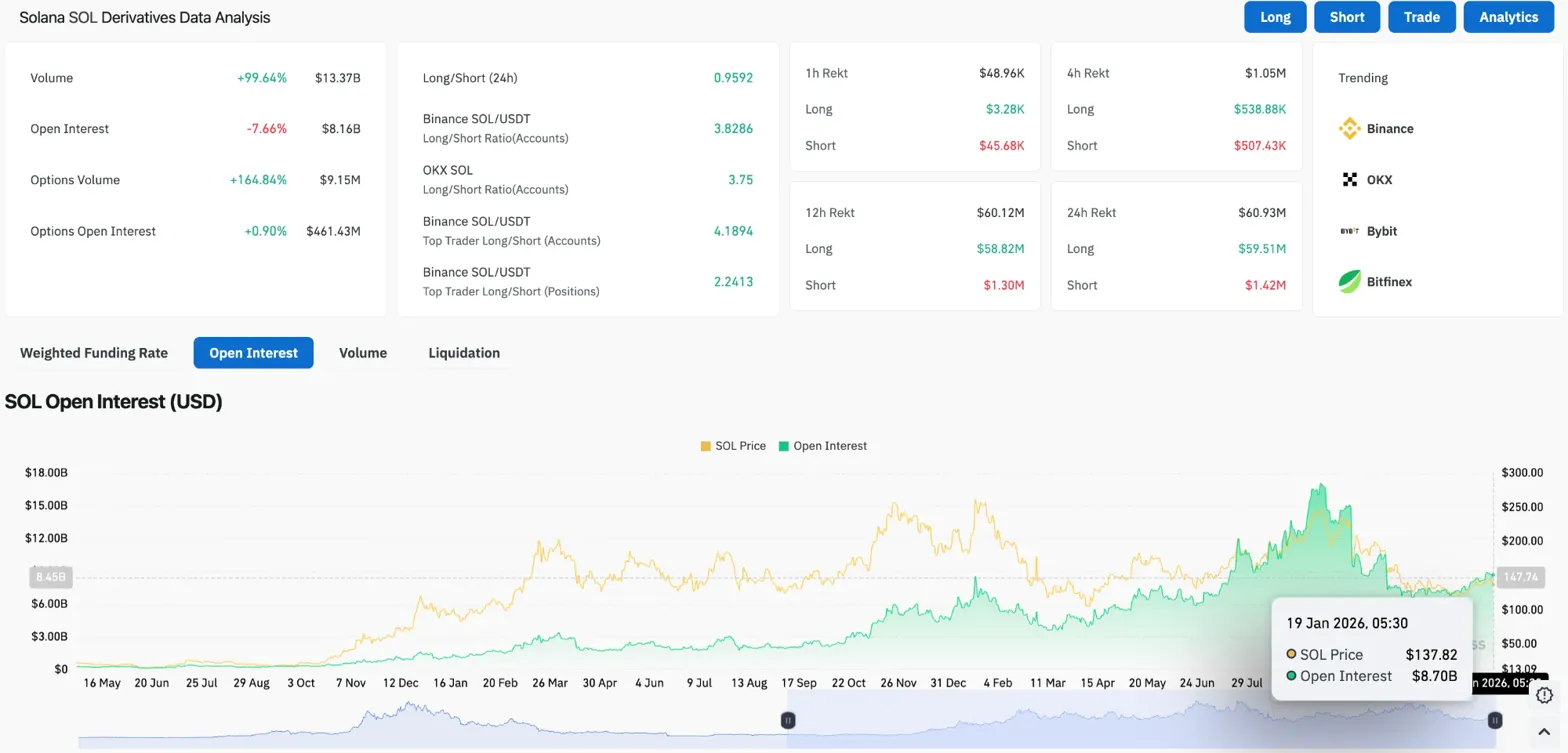

Derivatives markets saw heavy losses over the past day. Long positions worth $59.51 million were liquidated compared to just $1.42 million in shorts. This 42-to-1 ratio shows traders were positioned for upward movement.

Source: Coinglass

Source: Coinglass

Open interest dropped 7.66% to $8.16 billion while trading volume doubled to $13.37 billion. The combination of falling open interest and rising volume typically indicates forced closures rather than organic selling.

Exchange flow data shows $2.37 million in net outflows on January 19. Spot holders are moving tokens off exchanges alongside the derivatives liquidations.

Network Activity Shows Growth

Daily active addresses on Solana increased 51% over the past week. The network recorded more than 5 million active addresses this week, reaching a six-month high.

Transaction volume also climbed during this period. Daily average transactions rose 20% to 78 million on Tuesday. The network last saw this level of activity in mid-August.

Solana’s stablecoin supply jumped to an all-time high of $15 billion. The 15% increase over seven days represents new capital entering the network. More stablecoins on the platform means more funds available for trading and application use.

The RSI indicator on the 30-minute chart dropped to 19.13, well below the oversold threshold of 30. Such extreme readings often lead to short-term price bounces.

SOL broke below both the 20-day and 50-day exponential moving averages. The token fell to $133.42 before finding some support. The wedge lower trendline near $130 represents the next key support level.

The post Solana (SOL) Price: Whales Buy the Dip as Token Tests $130 Support appeared first on CoinCentral.

You May Also Like

White House Publishes Trump’s New Strategy Against Cybercrimes

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings