Dow Jones down 200 points amid tariff threats, Fed uncertainty

Major U.S. stock indices hovered near record levels as markets assessed the latest attacks on the Fed Chair

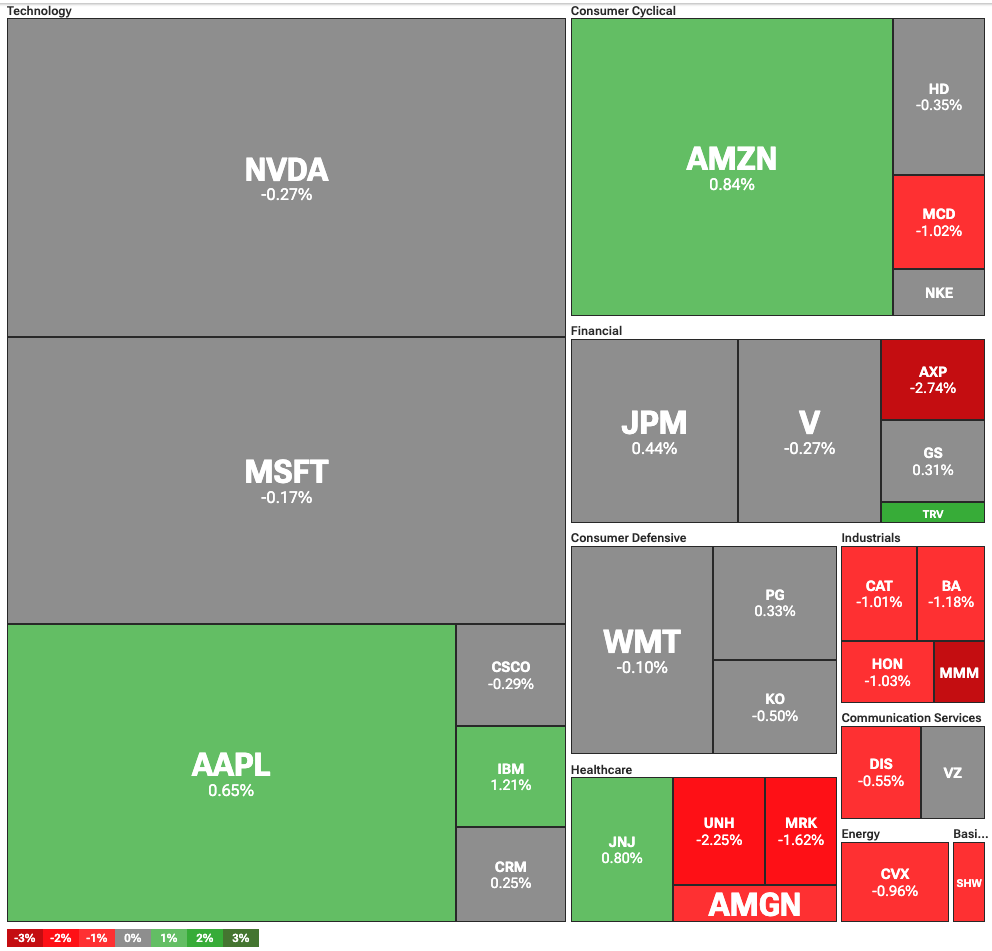

U.S. stocks hovered near record levels amid ongoing uncertainty over the Fed and tariffs. On Friday, Dow Jones fell 238 points or 0.54%, and the S&P 500 fell 0.14%. At the same time, the tech-focused Nasdaq Composite fell 0.09%.

The much-anticipated Netflix earnings did not deliver the news that traders were hoping for. The stock fell 5% despite beating earnings forecasts, as the company issued a lower-than-expected guidance. At the same time, shares of American Express were also down 2.5% despite strong earnings.

Traders were focused on the latest tariffs against the EU and the ongoing feud between the Fed Chair Jerome Powell and President Donald Trump. For one, Trump escalated his demands against the EU, pushing the 15% minimum tariff on imports to 20%.

This escalation came after weeks of negotiations that seemed to establish a 10% baseline tariff on most goods. What is more, Trump rebuked the EU’s offer to reduce its tariffs on U.S. automobiles, and suggested that the rate could stay at 25%.

Trump continues attacks against the Fed Chair

Trump has also continued his attacks against the Fed Chair Jerome Powell, calling him a “numbskull” for not lowering interest rates. The President stated that higher interest rates are making it more difficult for young people to buy houses.

Trump also said that Powell was “truly one of my worst appointments,” before placing a part of the blame on Joe Biden, who reappointed him. The attacks come after ongoing criticism over the $2.5 billion renovation of several Fed buildings.

Several Trump appointees criticized the Chair over the renovation, setting the stage for a potential coup. However, recent reports suggest that Trump appointees pushed for the use of expensive marble in the buildings, which added to the costs.

You May Also Like

GD Culture to Acquire Pallas Capital Assets, Adding 7,500 Bitcoin to Treasury

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation