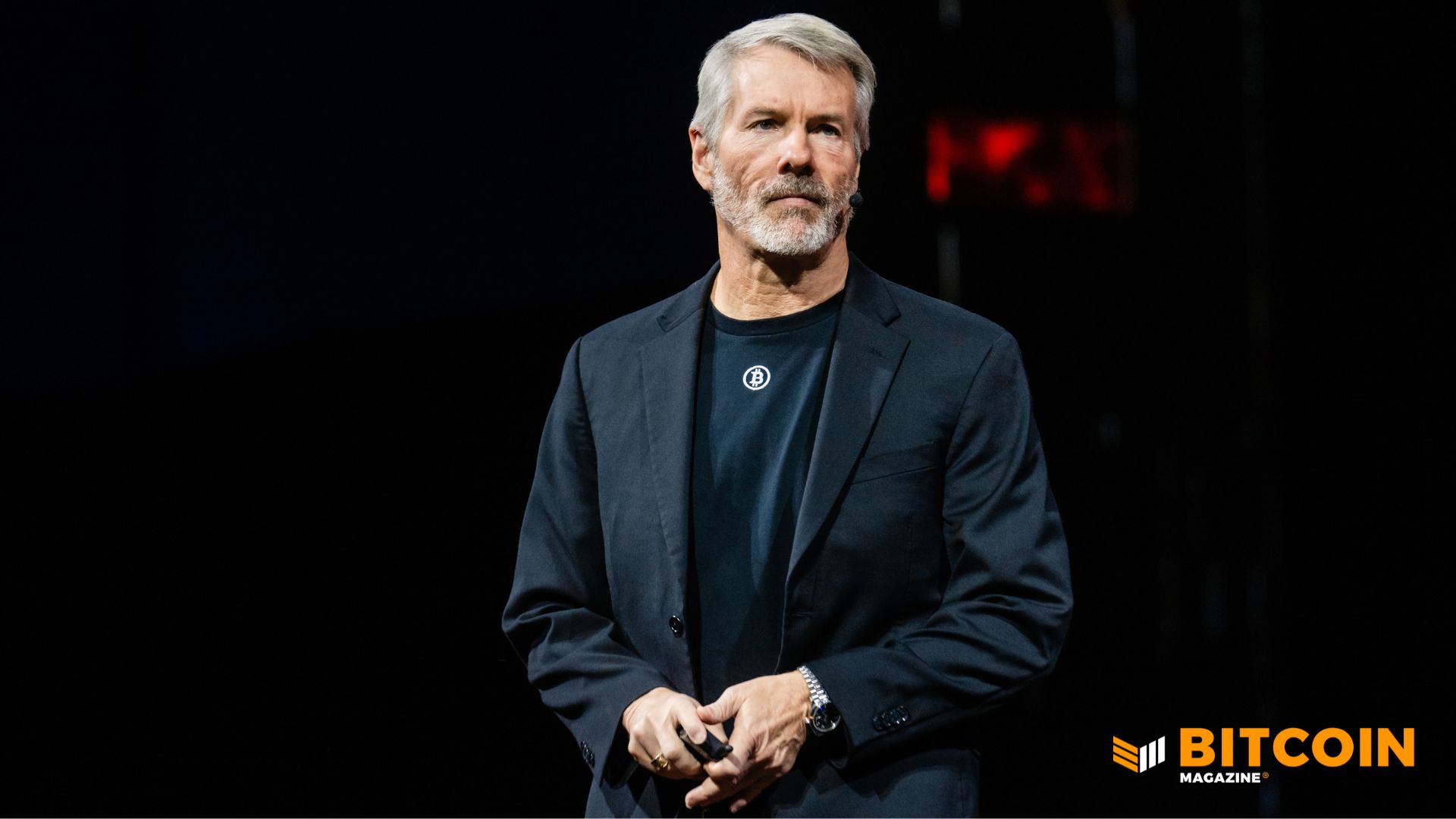

Strategy ($MSTR) Sells $257 Million in Stock to Buy 2,932 Bitcoin

Bitcoin Magazine

Strategy ($MSTR) Sells $257 Million in Stock to Buy 2,932 Bitcoin

Bitcoin proxy Strategy announced Monday that it acquired an additional 2,932 bitcoin for approximately $264 million between Jan. 20 and Jan. 25, according to a filing with the U.S. Securities and Exchange Commission.

The purchases were executed at an average price of $90,061 per coin, lifting the company’s total bitcoin holdings to 712,647 BTC.

At current market prices, Strategy’s bitcoin treasury is valued at roughly $62.5 billion, reinforcing its position as the world’s largest publicly traded corporate holder of the asset.

The company’s aggregate purchase price for its holdings stands at approximately $54.2 billion, including fees and expenses, translating to an average acquisition price of $76,037 per bitcoin.

The latest purchases were funded through proceeds generated under Strategy’s at-the-market (ATM) offering program. According to the filing, the firm sold 1,569,770 shares of its Class A common stock, MSTR, for approximately $257 million in net proceeds during the five-day period.

It also sold 70,201 shares of its perpetual preferred stock, STRC, raising an additional $7 million, bringing total ATM proceeds to roughly $264 million.

As of Jan. 25, Strategy said it still has substantial capacity remaining across its ATM programs, including approximately $8.17 billion available for future issuance under its common stock offering. The company also maintains multiple preferred stock programs, including STRK, STRF, STRC and STRD, which collectively represent tens of billions of dollars in potential future capital raises.

With more than 712,000 BTC now on its balance sheet, Strategy controls roughly 3.4% of bitcoin’s fixed 21 million supply.

At current prices, the company is sitting on an estimated $8.3 billion in unrealized gains.

Strategy’s MSCI inclusion

Earlier this month, Strategy was relieved of some selling pressure when MSCI concluded its review of digital asset treasury companies and decided not to exclude them from its major global equity indexes.

The index provider said bitcoin-heavy firms will remain eligible under existing rules while it conducts further research on how to distinguish operating companies from investment-like entities.

The decision eased months of market anxiety after MSCI had proposed reclassifying companies with more than 50% of assets in digital assets as fund-like and therefore ineligible for inclusion.

Companies like Strategy, along with industry groups, pushed back strongly, warning that exclusions could trigger billions of dollars in forced passive selling.

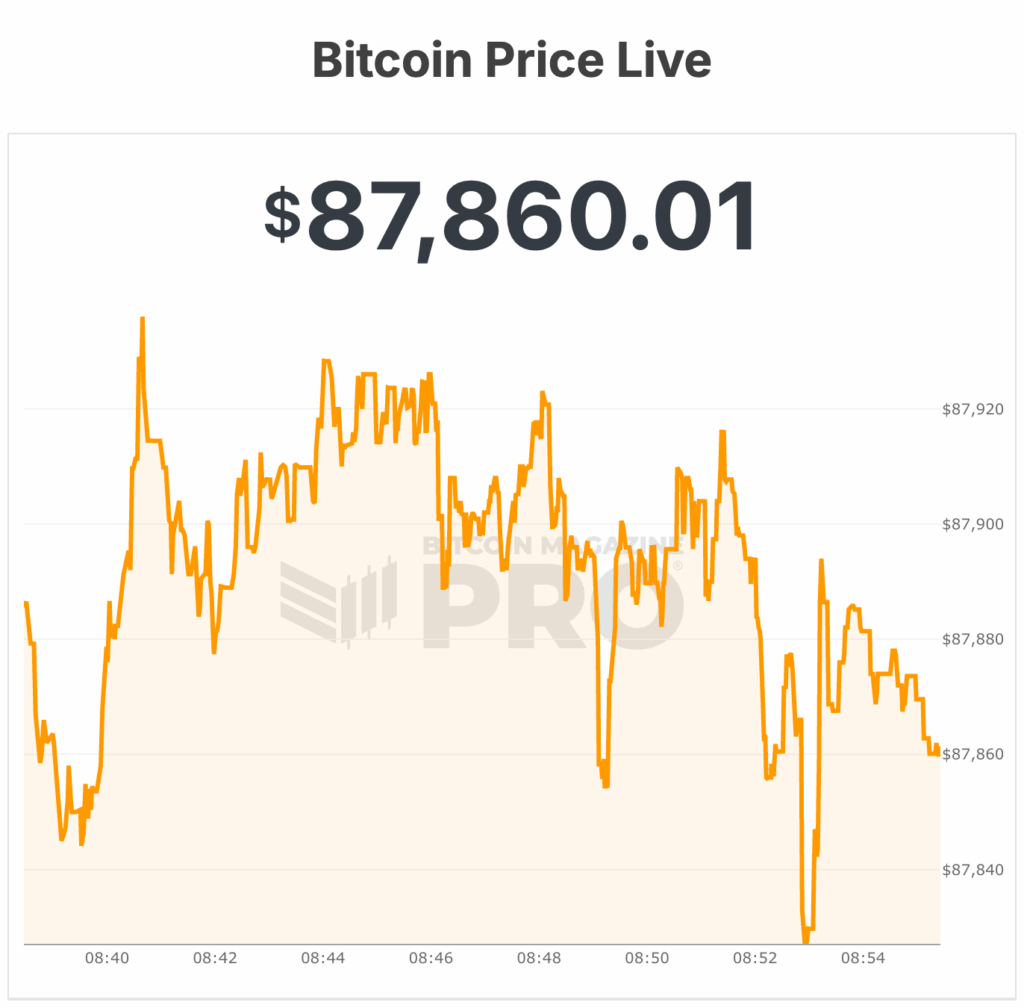

At the time of writing, Bitcoin is trading near $89,000.

This post Strategy ($MSTR) Sells $257 Million in Stock to Buy 2,932 Bitcoin first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC

Bitcoin Cash’s rally faces KEY test – Can BCH hold above $500?