Gold vs Bitcoin price prediction: Why gold is outperforming BTC right now?

In early 2026, gold and Bitcoin are moving in opposite directions. Bitcoin is struggling to bounce back from its January $98,000 peak, while gold climbs past $5,000, led by tokenized markets.

Table of Contents

- Tokenized gold breaks out above $5,000

- Gold price prediction: Why the rally looks durable

- Why Bitcoin is going down

- Bitcoin price prediction: Key downside levels

- BTC-to-Gold ratio signals defensive capital shift

- Final outlook

The takeaway: investors are playing it safe rather than chasing risky gains.

- Gold is climbing while Bitcoin faces downside pressure, with potential drops to $74,000, $68,000, or even $53,000 in extreme scenarios.

- The BTC-to-Gold ratio near 17.3 signals a defensive capital shift, favoring gold over Bitcoin until market risk appetite improves.

- Tokenized gold, like Pax Gold and Tether Gold, trades 24/7, accelerating price discovery and reflecting real-time macro demand.

Tokenized gold breaks out above $5,000

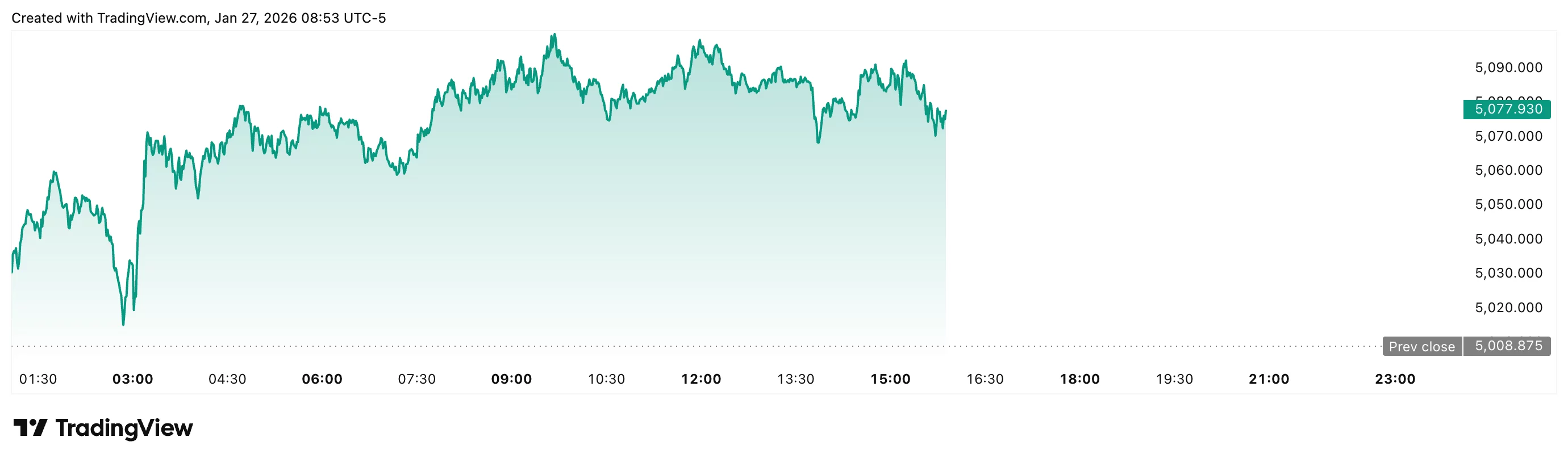

Pax Gold and Tether Gold broke above $5,000 this week, rising from the mid-$4,600s and holding support near $4,900 as gold rallied.

Because tokenized gold trades 24/7, macro demand showed up instantly, accelerating price discovery and highlighting tokenization’s edge over traditional markets.

Gold price prediction: Why the rally looks durable

This gold rally isn’t driven by speculation — it’s fundamentals at work. Central banks are buying more gold than they have in decades, and worries about geopolitics, debt, and currencies keep demand strong.

With gold near $5,080, banks are raising long-term forecasts, and tokenized gold reflects these expectations in real time, giving a sneak peek at how markets could trade 24/7.

Why Bitcoin is going down

Bitcoin (BTC) has come under pressure as investors shift toward safer assets.

Weakening global risk sentiment, U.S. policy uncertainty, and fears of a yen carry-trade unwind are weighing on prices.

Trading around $87,967, Bitcoin has fallen more than 10% from its January peak.

Bitcoin price prediction: Key downside levels

On the technical side, Bitcoin looks at risk of testing the $82,000–$85,000 support area.

If macro conditions continue to deteriorate and the Fed stays hawkish, the next downside levels sit around $74,000 and $68,000.

In a more extreme sell-off, Fibonacci extensions point to a possible move toward $53,000 — near the psychologically important $50,000 mark.

It’s not the main scenario, but it’s a risk if markets stay in risk-off mode.

BTC-to-Gold ratio signals defensive capital shift

The BTC-to-Gold ratio is around 17.3, close to the lower end of its usual range.

It shows how much gold one Bitcoin can buy and gives a sense of whether investors are taking risks or playing it safe.

In past Bitcoin bull runs, this ratio often went above 30–35. Right now, tight liquidity and muted speculation leave gold as the clear winner.

Final outlook

Gold’s outlook remains positive thanks to strong institutional buying, while Bitcoin forecasts point to continued volatility and potential downside. Gold is likely to keep its edge over Bitcoin until investors grow more confident.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Egrag Crypto: XRP Could be Around $6 or $7 by Mid-November Based on this Analysis