Fidelity Launches FIDD Stablecoin on Ethereum, Joining Race Under US Stablecoin Law

Fidelity Investments announced on Jan. 28 the launch of its first stablecoin, the Fidelity Digital Dollar (FIDD). The move positions the asset management giant as one of the first major traditional financial institutions to issue a dollar-backed token under the GENIUS Act, the federal stablecoin law signed in July 2025.

FIDD will be issued by Fidelity Digital Assets, National Association, a federally chartered national trust bank, and will operate on the Ethereum ETH $3 004 24h volatility: 0.5% Market cap: $362.56 B Vol. 24h: $26.96 B blockchain with each token redeemable for one US dollar, according to the company’s announcement. Reserves will consist of cash, cash equivalents, and short-term US Treasuries managed by Fidelity Management & Research Company LLC.

The Office of the Comptroller of the Currency (OCC), the federal banking regulator, granted conditional approval to Fidelity Digital Assets on Dec. 12, 2025. The approval requires Fidelity to obtain additional regulatory clearance before launching the token. Circulating supply and reserve net asset value will be disclosed daily on fidelity.com.

Stablecoin Market Competition

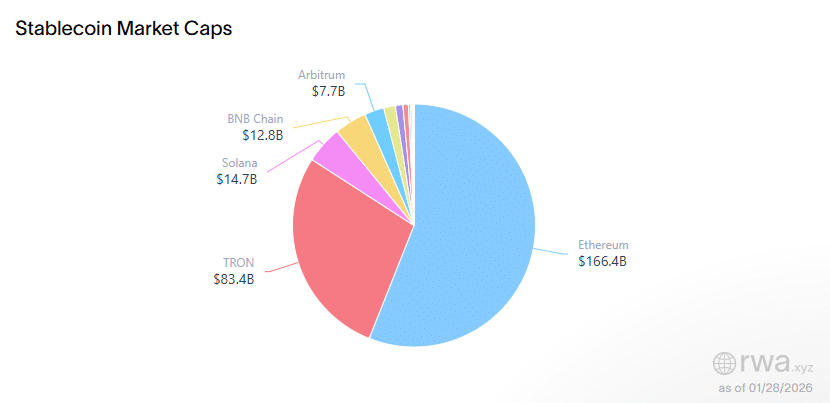

Fidelity enters a stablecoin market that processed $33 trillion in transactions in 2025, with a total market value of $296.95 billion as of Jan. 28, 2026. Ethereum dominates the sector with $166.4 billion in stablecoin market cap, followed by TRON at $83.4 billion. Stablecoin volume saw $9.67 trillion in monthly transfer volume, up 52.91% from the previous month.

Ethereum holds $166.4 billion in stablecoin market cap as of Jan. 28, 2026 | Source: RWA.xyz

Tether’s USDT holds approximately 60% market share with a $177 billion market cap, while Circle’s USDC faces competitive pressure at roughly $70 billion. PayPal and Ripple have each captured less than 10% of Circle’s market value despite launching stablecoins in 2023 and 2024, respectively.

The timing of Fidelity’s announcement follows Tether’s US-regulated USAT stablecoin launch on Jan. 27. Both launches come six months after the GENIUS Act was signed into law on July 18, 2025.

Fidelity’s Digital Asset Strategy

Fidelity has pursued digital asset initiatives since 2014, with Fidelity’s stablecoin development plans first reported in March 2025.

Mike O’Reilly, President of Fidelity Digital Assets, described the GENIUS Act as providing clear regulatory guardrails for payment stablecoins in the announcement. He said the timing was appropriate for meeting client demand.

FIDD will be available for purchase on Fidelity Digital Assets, Fidelity Crypto, and Fidelity Crypto for Wealth Managers platforms in the coming weeks. The token can also be transferred to any Ethereum wallet once available.

nextThe post Fidelity Launches FIDD Stablecoin on Ethereum, Joining Race Under US Stablecoin Law appeared first on Coinspeaker.

You May Also Like

The Future of Metalworking: Advancements and Innovations

Crypto whale loses $6M to sneaky phishing scheme targeting staked Ethereum