The ‘Ugly’ ETH Scenario: What Happens If Ethereum Loses $2,620

Ethereum is entering February 2026 on unstable ground. After slipping below key levels, the asset is hovering near zones that traders have been watching. Pressure is building, and market attention is now on whether ETH can hold its ground or if further losses are ahead.

Key Levels in Focus

The $2,710 level has been an important support since December. Ethereum recently dipped below it, raising concerns that a deeper move may follow. Crypto analyst Ardi described this zone as “very critical” and said if ETH fails to hold here, “the $2,620 swing low is the next hunt.”

If $2,620 fails, attention will likely shift to the $2,450 level, which acted as a strong base in mid-2025. According to Ardi, this area should serve as “the main line of defence” on a larger move down. “Below that gets extremely ugly,” they said, referring to the lack of nearby support beneath this zone.

Meanwhile, Ethereum is trading at around $2,730 with a 24-hour volume of $45.3 billion. The price is down 7% in the last 24 hours and almost 7% over the past week (per CoinGecko’s data). For the month of January, ETH lost nearly 7%, currently trading well below the levels seen at the start of the year.

Over the past day, the price has ranged between $2,700 and $2,940. Ethereum is now 45% below its all-time high of $4,950 reached in August 2025.

Outflows from ETFs Add Pressure

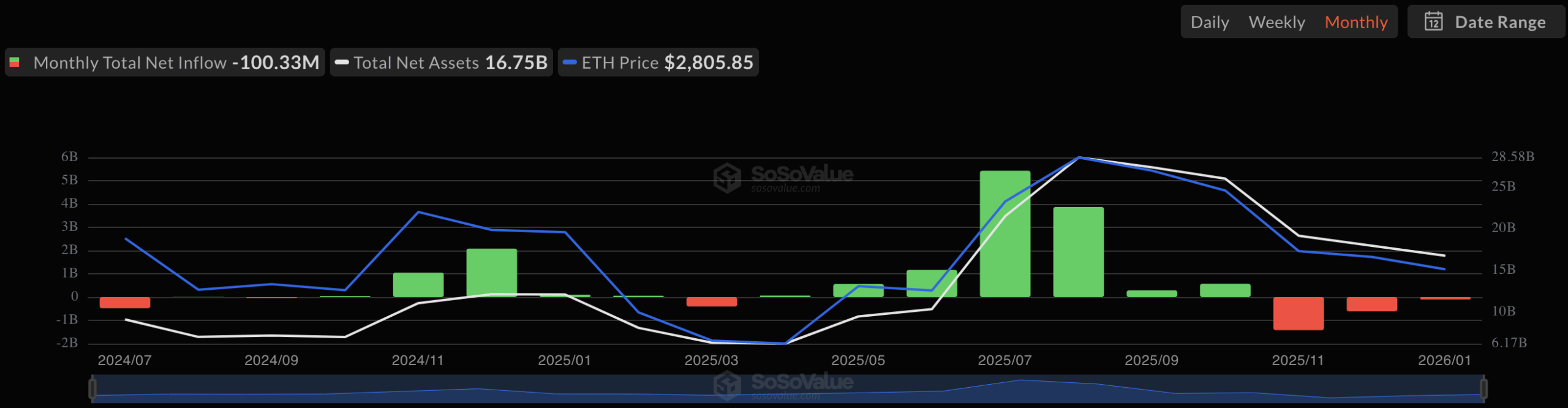

Investor flows into Ethereum ETFs continue to show weakness. January saw a net outflow of more than $100 million. This followed heavier outflows of $617 million in December and nearly $1.5 billion in November. The consistent exit over three months suggests reduced institutional interest.

Ethereum Spot ETF Net Inflow 1.30. Source: SoSoValue

Ethereum Spot ETF Net Inflow 1.30. Source: SoSoValue

Another analyst, Ted, commented that ETH has lost the $2,800 zone, pointing to the $2,500–$2,600 range as the next likely support. “This is most likely to hold in the short term for any bounce,” he said. Still, the pattern of mixed ETF flows has kept some traders cautious.

While the trend has weakened, some analysts believe conditions are forming for a reversal. Bryant noted ETH is showing a “triple bullish divergence,” where price forms lower lows and RSI forms higher lows.

Others are watching long-term trendlines. Kamran Asghar pointed out that ETH is testing a support that has held since 2022, asking if this could be a “buy-the-dip” area. Meanwhile, Sykodelic projected a longer-term target of $10,000, calling it a “reasonable minimum” if a full recovery builds.

The post The ‘Ugly’ ETH Scenario: What Happens If Ethereum Loses $2,620 appeared first on CryptoPotato.

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip