Amboss Unveils RailsX: Lightning DEX Connects Bitcoin to $9.5 Trillion FX Market

Amboss Technologies launched RailsX, a Lightning-native, peer-to-peer (P2P) decentralized exchange, at the PlanB Forum in El Salvador on Jan. 30, 2026.

Unlike other exchanges that build separate protocol layers, RailsX executes trades entirely via the Lightning Network. Transactions work as circular self-payments: funds route through existing Lightning channels, exchange assets atomically, then loop back to the sender. This eliminates custodial intermediaries and cross-chain bridge risks while maintaining Bitcoin’s security model.

The platform builds on five years of development, integrating Amboss’s Magma liquidity marketplace with its Rails automated liquidity service.

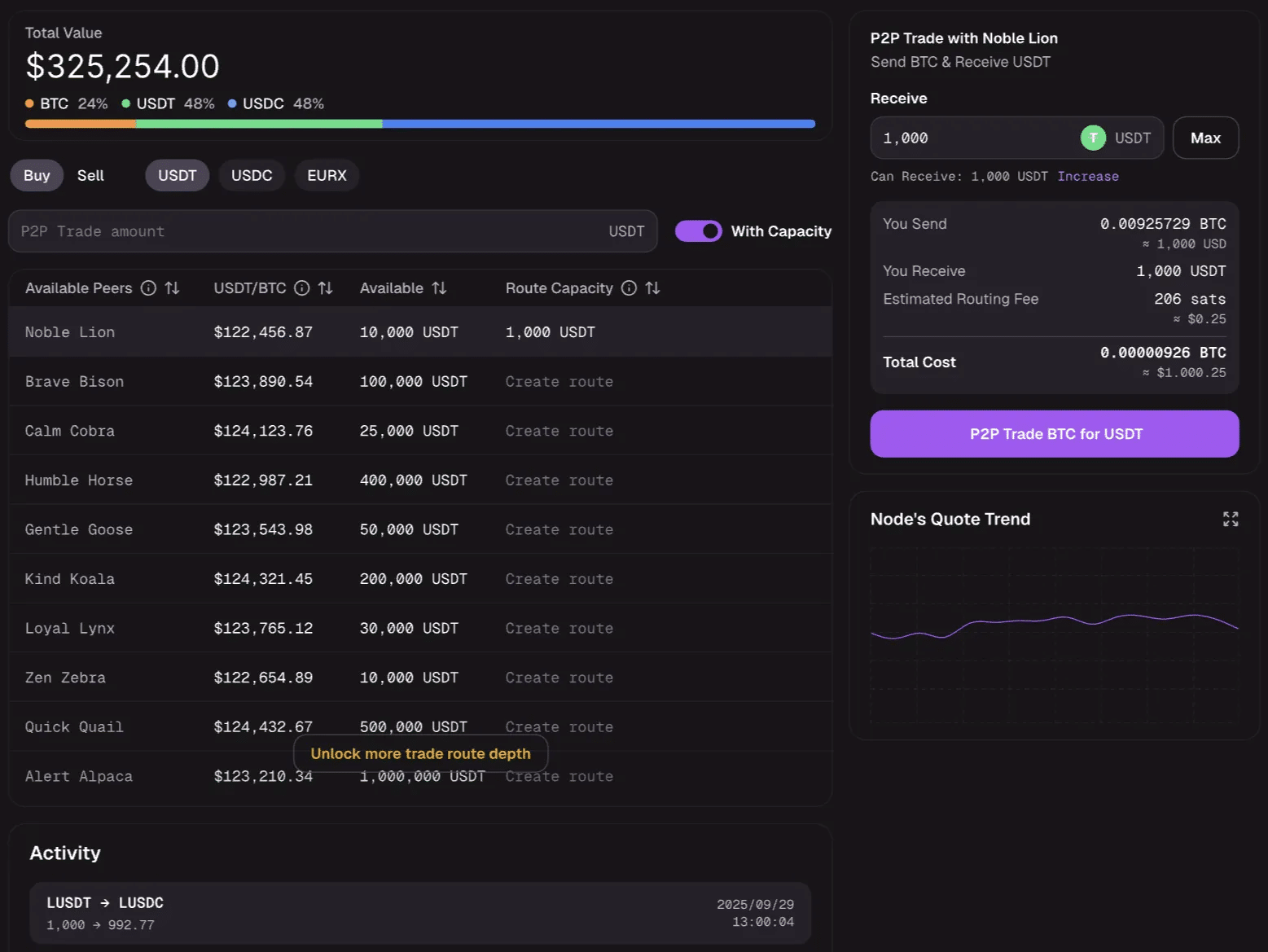

A first peak of the user interface for RailsX | Source: Amboss blog

Bitcoin DeFi Just Had its Breakout in Recent Years

RailsX launches into a growing Bitcoin ecosystem. Bitcoin BTC $84 182 24h volatility: 0.4% Market cap: $1.68 T Vol. 24h: $79.16 B DeFi total value locked surged 2000% in 2024, jumping from $307 million in January to $6.5 billion by year’s end. Babylon, a staking protocol, drove most of that growth, accounting for over 80% of the sector’s TVL. Despite the current bearish market, the Bitcoin DeFi ecosystem had close to $6.11 billion in total value locked on Jan. 30, according to DefiLlama.

In June 2025, Lightning Labs released Taproot Assets v0.6, enabling multi-asset support on Lightning for the first time. Suddenly, stablecoins could move through Lightning channels at a fraction of the cost of traditional transfers.

Tether saw the opportunity. The company committed to issuing USDT as a Taproot Asset and pumped $8 million into Speed1 to scale Lightning stablecoin payments. Speed already handled $1.5 billion in annual volume for 1.2 million users with instant settlement.

Bitcoin DeFi still trails Ethereum $66 billion TVL, but the gap is closing. RailsX connects Bitcoin-stablecoin pairs to the $9.5 trillion daily forex market, according to the company. Processing costs hit 0.29% in optimized configurations, though real-world fees depend on channel liquidity.

Success hinges on whether Lightning can handle actual trading volume—something DEXs have promised for years but rarely delivered at scale.

nextThe post Amboss Unveils RailsX: Lightning DEX Connects Bitcoin to $9.5 Trillion FX Market appeared first on Coinspeaker.

You May Also Like

YZi Labs Binance Deposit: A $6.63M Signal That Could Shake the ID Token Market

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more