Ether (ETH) Price: Institutional Money Exits as Network Activity Drops 47%

TLDR

- Ether dropped 28% in a week to $2,110 as investors cut risk exposure and moved to safer assets like cash and government bonds.

- ETH funding rates turned negative for the first time in a while, meaning short sellers are paying fees to hold positions against bullish traders.

- Spot ETH ETF outflows hit $447 million over five days as institutional demand cooled across the market.

- Ethereum network activity fell 47% with DEX volumes dropping from $98.9 billion in October to $52.8 billion in January.

- Vitalik Buterin outlined a new vision for layer-2 networks, saying Ethereum’s base layer is scaling faster than expected and L2s should be more independent.

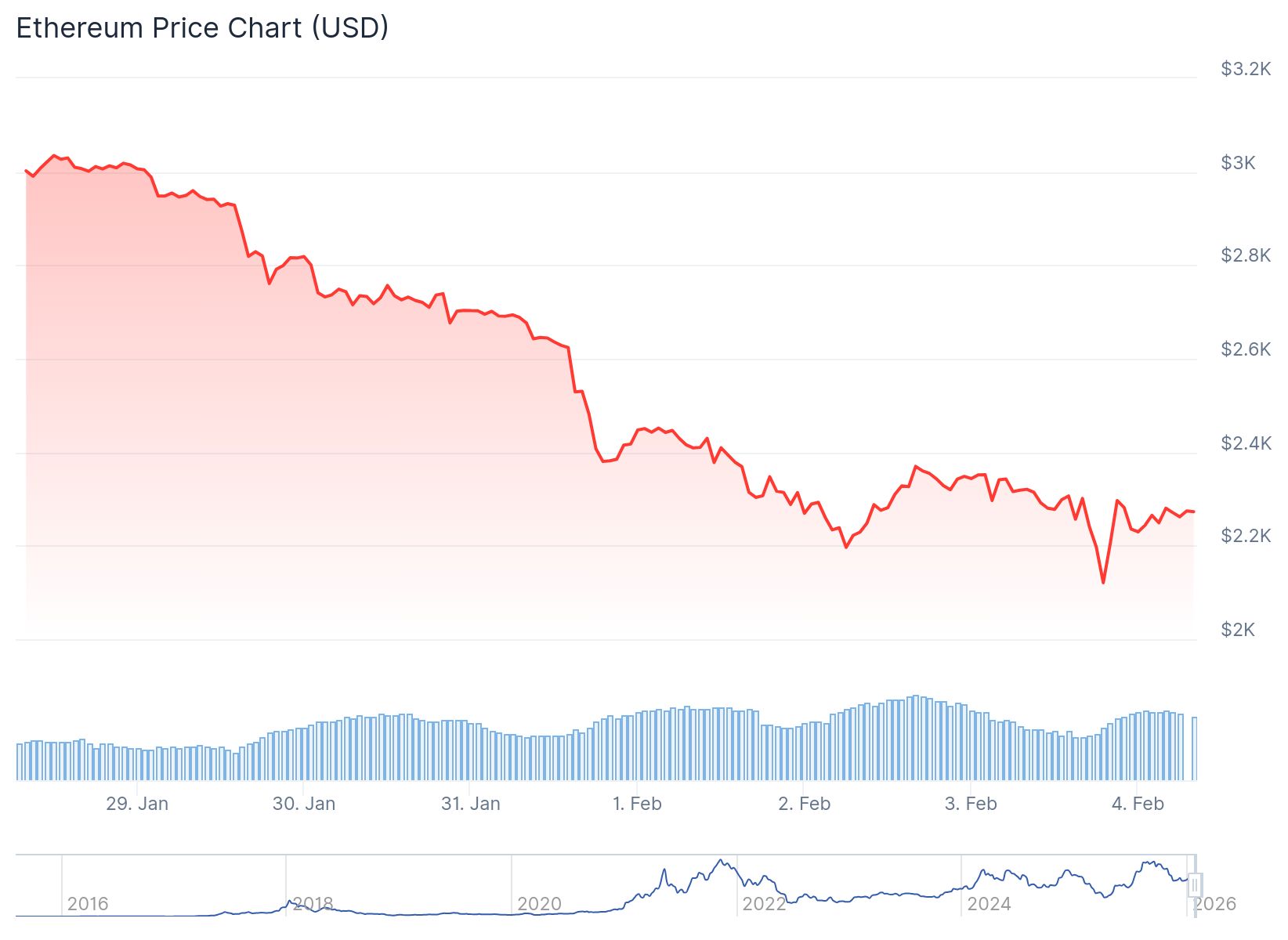

Ether fell to $2,110 on Tuesday after a 28% price drop over seven days. The decline came as investors moved money into cash and short-term government bonds.

Ethereum (ETH) Price

Ethereum (ETH) Price

The tech-heavy Nasdaq also fell 1.4% during the same period. Traders grew concerned about high valuations in technology stocks, particularly in the artificial intelligence sector.

Market sentiment weakened after Nvidia CEO Jensen Huang denied reports about a planned $100 billion investment in OpenAI. PayPal also reported disappointing quarterly earnings, adding to investor concerns.

Gold prices rose 6% and silver gained 9% as investors sought safer assets. The moves suggest traders doubt the Federal Reserve’s ability to prevent a recession.

The ETH perpetual futures annualized funding rate turned negative on Tuesday. This means short sellers are now paying fees to maintain their positions.

Negative funding rates typically indicate bearish sentiment. Long position holders are unwilling to pay the usual premium to keep bullish bets open.

Ether has underperformed the broader crypto market by 10% over the last 30 days. Bitcoin dropped 17% in the same timeframe, while BNB fell 14% and Tron declined just 4%.

ETF Outflows Signal Cooling Demand

US-listed Ethereum spot ETFs saw $447 million in net outflows over five days. The outflows show institutional demand has cooled despite continued buying from some smaller companies.

Bitmine Immersion, Sharplink and The Ether Machine have continued accumulating ETH. However, traders remain cautious about potential selling pressure from the $14.4 billion held in Ethereum ETFs overall.

The price drop forced liquidations of over $2 billion in leveraged bullish ETH futures. The mass liquidations have fueled concerns about more downside as bearish sentiment spreads.

Trading volumes on Ethereum decentralized exchanges reached $52.8 billion in January. This represents a sharp drop from $98.9 billion in October 2024, a 47% decline in activity.

Lower network activity reduces the burn mechanism that typically shrinks ETH supply. High demand for blockchain processing usually triggers this deflationary feature.

Buterin Outlines New L2 Vision

Ethereum co-founder Vitalik Buterin addressed linked to his wallet sold about $2.3 million in ETH. He previously earmarked $45 million for donations toward privacy technologies, open hardware and secure software.

Buterin said 16,384 ETH from his personal holdings will be gradually deployed over the coming years. The sales are part of his planned charitable giving strategy.

In a separate post, Buterin said Ethereum no longer needs to rely heavily on layer-2 networks for scaling. He explained that Ethereum’s base layer is now scaling faster than expected.

Progress by L2 networks toward full decentralization has been slower than anticipated. Many L2 developers have said they may never achieve complete decentralization due to technical or regulatory constraints.

Buterin said L2s should now be viewed as a spectrum ranging from deeply secured chains to more independent systems. He urged L2 projects to focus on specialized features like privacy tools or ultra-fast processing instead of just scaling.

He expressed support for a “native rollup precompile” that would let Ethereum verify cryptographic proofs used by L2s. This would reduce reliance on external security committees and improve trustless interoperability between networks.

The post Ether (ETH) Price: Institutional Money Exits as Network Activity Drops 47% appeared first on CoinCentral.

You May Also Like

Paxos launches new startup to help institutions offer DeFi products

Over 60% of crypto press releases linked to high-risk or scam projects: Report