Crypto Market Crash: BTC, ETH, XRP, DOGE Drop 6% in $850M Liquidations

Key Insights:

- In less than a month, the crypto market crash has led to investors losing nearly $900 billion.

- Analyst noted that a Bitcoin price drop under $70,000 would trigger potential downside targets in the $55.7K–$58.2K range.

- Ethereum is down about 40% over the month, with a similar correction in other top altcoins like XRP, BNB, etc.

The crypto market crash has intensified further with BTC, ETH, XRP, and other assets crashing over 7% each. As a result, the 24-hour liquidations have soared to $833 million during this bloodbath. Bitcoin price is now testing the $70,000 support in what seems to be a make-or-break situation.

Crypto Market Crash Triggers Nearly $900 Billion Loss

After a good start to 2026, the cryptocurrency market lost momentum so after. In the last 24 hours, the broader market has lost over $170 billion of investors wealth. Over the past 22 trading days, the crypto market crash has eroded nearly $900 billion from its market cap.

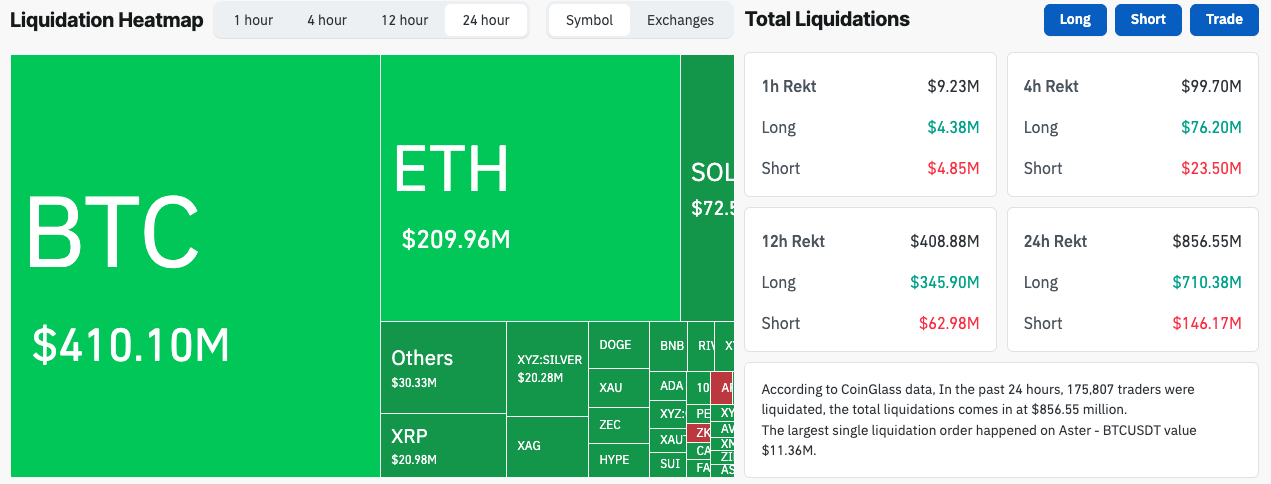

The daily crypto market liquidations have also soared to $856 million, of which $710 million is in long liquidations. Additionally, the Coinglass data indicates that more than 175,000 traders were liquidated in a single day.

Bitcoin is leading this market crash with a 7% drop today. Top altcoins like Ethereum (ETH), XRP, and Solana (SOL) are also bleeding. ETH dropped 7% in the latest trading. BNB and XRP led the decline with losses of 10% each. The sharp fall highlights the ongoing crypto market crash.

Crypto Market Liquidations | Source: Coinglass

Crypto Market Liquidations | Source: Coinglass

Overall, the market sentiment has turned absolutely bearish amid macro uncertainty and precious metals rally. So far, Bitcoin and crypto haven’t found their space as a hedge asset, and have behaved typically like risk-ON assets.

Is Bitcoin Leading the Crypto Market Crash?

Today’s Bitcoin price crash to $71,000 marks its lowest level since November 2024. This means that BTC has erased all of its gains since the post-US Elections 2024. Although BTC surged to make its all-time high at $126,000 in September, it has lost major ground since then.

After more than a 45% drop from the top, investors are asking where the next Bitcoin bottom is. On-chain analysis shows that the Bitcoin price has been falling under every crucial support.

Crypto analyst Nic Crypto said Bitcoin’s momentum has remained firmly bearish since breaking below its 50-week moving average (WMA) in November.

In a recent analysis, Nic Crypto noted that Bitcoin also fell through the 100-week moving average two weeks ago. A breakdown below both the ETF cost basis and the true market mean followed this.

Nic Crypto noted that if BTC price drops under its previous all-time highs of $69,000, it could lead to deeper corrections. The next downside target stands between $55,700 and $58,200. It’s an area that aligns with the average realized price and the 200-week moving average.

Bitcoin price crash to 200 WMA | Source: TradingView

Bitcoin price crash to 200 WMA | Source: TradingView

Crypto analyst Benjamin Cowen said the current market structure resembles conditions seen during the 2019 cycle. This is particularly true on the BTC dominance behaviour.

Cowen observed Bitcoin dominance declined in 2019. He explained that altcoins were not outperforming. He said Bitcoin simply fell faster than altcoins.

He said a similar dynamic appears to be unfolding now. Cowen stated that Bitcoin’s downside move is dragging the market. He noted the fall is pulling altcoins lower. He warned that the broader crypto market crash is intensifying.

Another market experts share similar outlook. Mike Investing noted that BTC price could see a further drop to $60,000. He wrote:

Altcoins Have No Room To Breathe

Amid the crypto market crash, altcoins have no room to breathe. Ethereum (ETH) price is down 6%, hitting fresh monthly lows at $2,133. Over the past month, ETH has lost over $150 billion market cap, or 40% of its value.

This ETH price crash has also spilt over to other altcoins as well. Ripple’s XRP has also corrected by 40% over the past month, falling below the April 2025 lows of $1.60. At the same time, other altcoins like Solana (SOL), BNB, and Dogecoin (DOGE) are down 15-25% over the past week.

The post Crypto Market Crash: BTC, ETH, XRP, DOGE Drop 6% in $850M Liquidations appeared first on The Market Periodical.

You May Also Like

Vitalik Buterin Reveals Ethereum’s (ETH) Future Plans – Here’s What’s Planned

SON DAKİKA: Kara Gecede Sürpriz Altcoin İçin Spot ETF Başvurusu Geldi!