Crypto Sentiment Plunges to Lowest Level Since 2022 as Bitcoin Crashes Below $60K

TLDR

- The Crypto Fear & Greed Index dropped to 9 out of 100 on Friday, marking the lowest sentiment reading since June 2022 during the Terra blockchain collapse

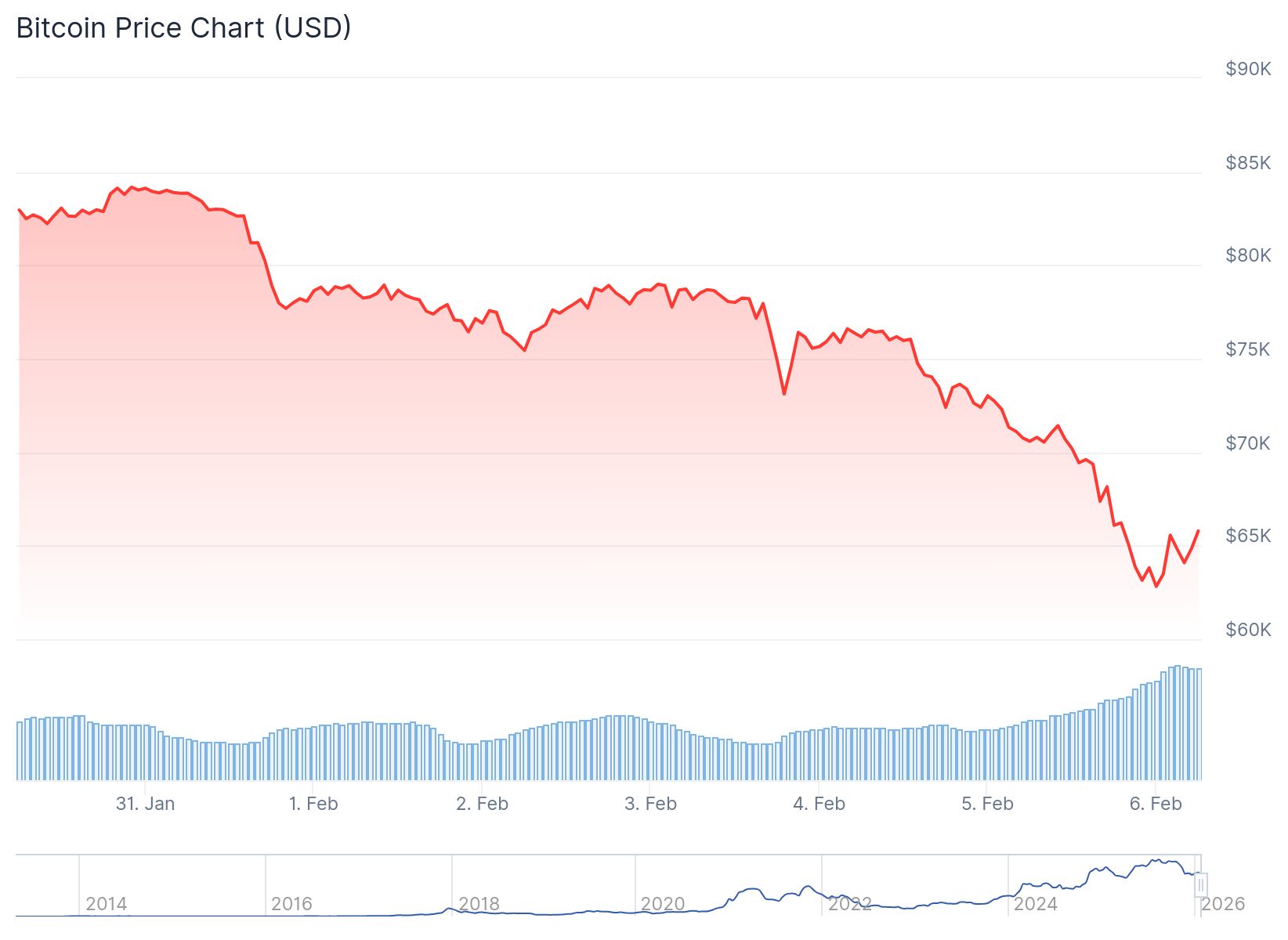

- Bitcoin fell to around $60,000 on Coinbase, losing 13% in 24 hours and wiping out 16 months of gains after dropping 38% from its 2026 high of $97,000

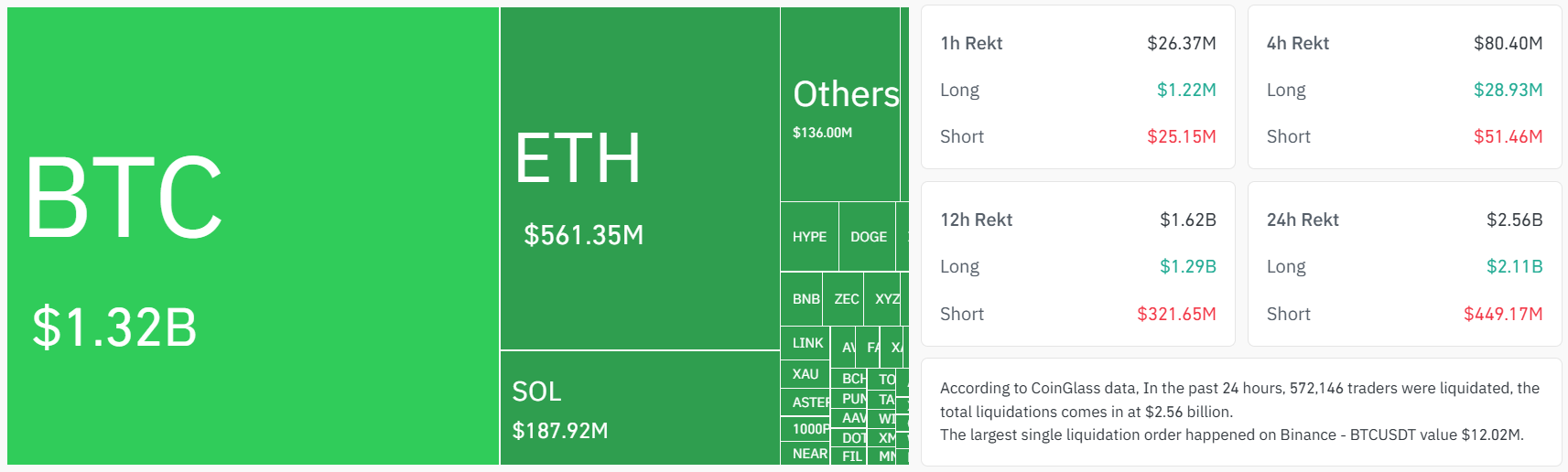

- Over 588,000 traders were liquidated for $2.7 billion in the past 24 hours, with 85% being leveraged long positions

- Bitcoin dropped below the 200-week exponential moving average, a level only reached during previous bear markets, and is now 50% down from its all-time high of $126,000

- Analysts cite US tech stock selloffs, concerns about an AI bubble, softer job market data, and rising unemployment claims as key factors driving the crash

Bitcoin experienced one of its steepest declines in years this week. The cryptocurrency fell to approximately $60,000 on Coinbase during early Friday trading. This marks its lowest level since October 2024.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The broader crypto market followed Bitcoin’s downturn. Market sentiment reached levels not seen since the FTX collapse in late 2022. The Crypto Fear & Greed Index, which measures investor emotion, plummeted to 9 out of 100.

This reading indicates “extreme fear” among market participants. The index hasn’t been this low since June 2022. That period followed the collapse of the Terra blockchain ecosystem in May 2022.

The speed of the sentiment shift caught many traders off guard. Just last month, the index stood at 42. A week before Friday’s reading, it was at 9.

Source: Alternative.me

Source: Alternative.me

Bitcoin lost over $10,000 in a single 24-hour period. The 13% daily drop represents its largest single-day loss since mid-2022. The cryptocurrency has now fallen 38% from its 2026 high of $97,000, reached just three weeks ago.

Market Liquidations Hit Multi-Year Highs

The rapid price decline triggered massive liquidations across crypto exchanges. More than 588,000 traders saw their positions liquidated in 24 hours. The total value of these liquidations reached $2.7 billion.

Source: Coinglass

Source: Coinglass

Leveraged long positions accounted for 85% of these liquidations. Most losses centered on Bitcoin trades. The liquidation cascade added downward pressure on prices.

Bitcoin now trades around $64,000 after a brief recovery from the $60,000 lows. The cryptocurrency is down 50% from its all-time high of $126,000 set in early October. This decline has erased gains accumulated over the past 16 months.

Technical Indicators Flash Bear Market Signals

Bitcoin broke below a key technical level this week. The 200-week exponential moving average, a long-term trend indicator, was breached. This metric has only broken during previous bear markets.

The breach suggests the current downturn may be more than a temporary correction. Technical analysts view this moving average as a critical support level. Its failure indicates weakening long-term momentum.

Traditional Markets Add Pressure

Jeff Ko, chief analyst at CoinEx Research, pointed to weakness in US tech stocks as a contributing factor. Concerns about stretched valuations and an AI-driven bubble have weighed on equities. Amazon stock fell by double digits following its earnings release.

Ko noted that Bitcoin has failed to act as a safe haven during this period. Gold has outperformed cryptocurrencies in recent weeks. This challenges the narrative of Bitcoin as “digital gold.”

Nick Ruck, director at LVRG Research, highlighted macroeconomic concerns. Softer US job market data has increased risk aversion among investors. Rising unemployment claims raise questions about economic strength.

These labor market signals also affect Federal Reserve policy expectations. Traders now doubt the Fed will pursue aggressive interest rate cuts. Higher rates typically pressure risk assets like cryptocurrencies.

The Fear & Greed Index combines multiple data points to measure sentiment. It tracks volatility, market momentum, trading volume, social media engagement, Bitcoin dominance, and Google search trends. A sharp rise in volatility and fear-driven searches pushed the index to its current low.

While extreme fear readings have historically coincided with local price bottoms, they don’t guarantee immediate recovery. The index measures current stress levels rather than predicting future price movements. Bitcoin briefly rebounded toward $65,000 after touching $60,000, showing some buyers are stepping in at lower levels.

The post Crypto Sentiment Plunges to Lowest Level Since 2022 as Bitcoin Crashes Below $60K appeared first on CoinCentral.

You May Also Like

Strategy Defines Its Bitcoin Stress Point After Q4 Volatility

Bubblemaps: The top five traders in STBL token trading volume are interconnected and have made profits exceeding $10 million