Former Monero Developer’s Viral XRP Post Ignites Crypto Culture War

A former Monero lead developer sparked controversy after revealing that a close friend—previously skeptical of crypto—wanted to buy XRP, believing banks would be obsolete within two years.

Igniting the XRP Debate: A Skeptic’s Inquiry

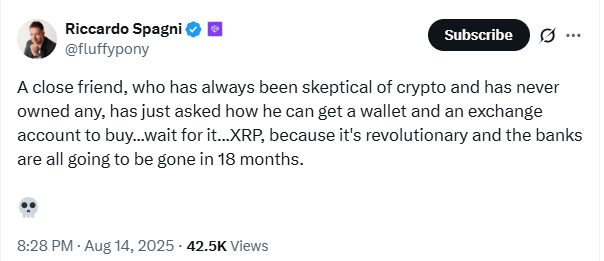

The claim by Riccardo Spagni, former lead developer for Monero, that a close friend and longtime crypto skeptic had expressed interest in buying XRP ignited debate between the digital asset’s fervent supporters and its persistent critics. The conversation was further fueled by the unnamed friend’s striking belief that traditional banks would be obsolete in less than two years, a sentiment that has brought renewed scrutiny to the marketing strategies of the XRP team.

After years of legal entanglements that jeopardized issuer Ripple’s vision of establishing XRP as a key bridging currency, the company has seen a more favorable environment emerge under the Trump administration. For instance, the U.S. Securities and Exchange Commission (SEC) has since agreed to cease its legal action against Ripple, and President Donald Trump took the notable step of naming XRP as a potential candidate for the nation’s digital asset stockpile.

These events and many other positive developments for Ripple have raised XRP’s profile and attracted the interest of first-time cryptocurrency buyers. The increased interest has seen XRP jump from under $1 on Nov. 16, 2024, to more than $3.60 on July 22, 2025. Although the cryptocurrency subsequently reversed some of its gains, it is still one of the best-performing high-cap altcoins over a 12-month period.

Furthermore, some pro- XRP analysts on the social media platform X are still projecting it to end the year around $4 or more, prompting new users like Spagni’s friend to seek exposure to the cryptocurrency.

“A close friend, who has always been skeptical of crypto and has never owned any, has just asked how he can get a wallet and an exchange account to buy…wait for it… XRP, because it’s revolutionary and the banks are all going to be gone in 18 months,” Spagni stated.

Critics and Accusations

Reacting to Spagni’s post, some X users seemed taken aback by the fact that the developer was being asked about buying XRP and not Monero’s privacy coin XMR. Still, many of those reacting to the post appeared to be resigned to the fact that “normies” seem intent on buying XRP regardless of what critics are saying about it.

Others, however, slammed the narrative that Ripple’s XRP, which is the number three digital asset by market capitalization, could replace banks, saying this shows proponents’ apparent lack of understanding of how the blockchain works.

“The idea of XRP and Ripple working out as banks has always boggled me so much. You have to have really iq below shoe level and 0 world understanding. What bank will want this, and why give power to a private company that outsources price to the open market. Then the entire risk and responsibility is in that one company. How? Doesn’t make sense in open permissionless blockchains to have a single point of failure like CEO and company structure. Brainrot,” one user wrote.

However, even the most vocal detractors seemed to agree that XRP’s promotional team knows how to make an impact. They point to the engagement levels of social media posts mentioning Ripple and XRP as well as number of new crypto enthusiasts inquiring about the digital asset. Still, not everyone is in admiration of the Ripple/ XRP marketing machine.

One user, Fish Catfish, suggested that the entirety of XRP’s market cap is based on misinformation about banks and the “false belief that being a ‘bridge currency’ makes a token valuable.” Catfish also seemed displeased by investigative journalists whom the user accused of failing to identify parties involved in what they called a misinformation campaign.

“It’s unbelievable that investigative journalists haven’t dug down the rabbit hole to figure out where all the funding of these misinformation campaigns is coming from and where the money trail leads,” Catfish stated.

You May Also Like

Over $9 billion flowed out of Bitcoin and Ethereum ETFs in four months

Will XRP Price Increase In September 2025?