Ethereum Price Prediction: ETH Defends Macro Support Levels

TLDR

- ETH holds key $2,000 demand amid daily downtrend.

- Descending trendline keeps short-term bias cautious.

- Range between $1,980–$2,120 traps momentum.

- Weekly macro trendline supports broader uptrend.

Ethereum(ETH) is trading near a critical technical zone as multiple timeframes converge around long-term support. Analysts point to the $2,000 zone as a decisive level, with downside risk toward $1,500 if it fails. At the same time, a higher-timeframe structure suggests consolidation rather than structural collapse.

Ethereum Price Faces Daily Pressure Below Key Resistance

According to analyst CryptoWZRD, Ethereum price remains locked in a corrective structure on the daily timeframe. A clearly defined descending trendline continues to cap upside attempts, reinforcing a pattern of lower highs and lower lows. This dynamic resistance confirms that sellers still control broader price direction.

From a horizontal standpoint, Ethereum has lost several major support zones. The $3,700 and $2,800 levels have flipped into resistance, weakening bullish positioning. The recent sell-off drove price into the $2,100–$2,000 demand zone, which has historically attracted buyers.

Long lower wicks indicate reactive buying interest at this level. However, conviction remains limited without a trendline break. Holding above $2,000 could allow a relief bounce toward $2,400–$2,600. A failure would expose downside toward the $1,500 level.

Range-Bound Trading Dominates Short-Term ETH Conditions

Meanwhile, analyst Jip Molenaar highlighted a compressed range on the intraday chart. Ethereum price is oscillating around the $2,050 level, which acts as a short-term equilibrium level. Price behavior reflects rotation between liquidity zones rather than directional momentum.

The analysis points to potential liquidity sweeps on both sides of the range. Upside moves toward $2,120 may target stops before reversing. Similarly, downside probes toward $1,980–$2,000 could serve as liquidity grabs below equal lows.

Until ETH price moves outside this range, conditions remain reactive. False breakouts are likely without volume expansion. A sustained move above $2,120 would shift short-term bias toward $2,200. Acceptance below $1,980 would reopen continuation toward higher-timeframe demand.

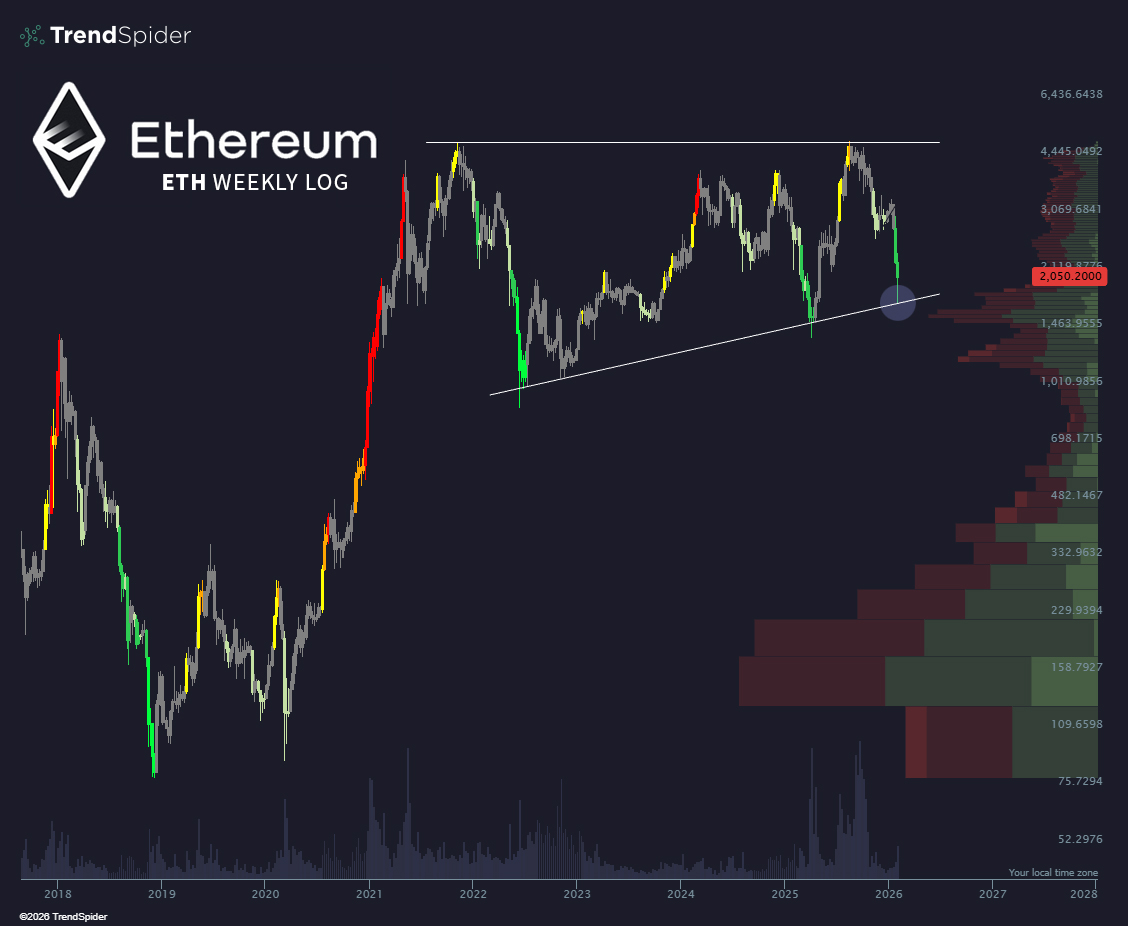

Weekly Chart Shows Ethereum Price Holding Macro Trend

Additionally, analyst TrendSpider’s weekly logarithmic chart presents a broader structural view. Ethereum price continues to respect a rising macro trendline that has guided price since the 2022 cycle low. Recent reactions from this support suggest long-term buyers remain active.

More so, the structure resembles a large consolidation within an established macro uptrend. Price continues to oscillate between ascending support and resistance near the $4,400–$4,500 zone. Volume profile data shows strong acceptance between $2,000 and $2,200, defining a high-value zone.

As long as the rising trendline holds on a weekly closing basis, the broader structure remains intact. A breakdown would significantly weaken the bullish framework and expose deeper retracement risk. For now, the chart supports consolidation rather than trend failure.

The post Ethereum Price Prediction: ETH Defends Macro Support Levels appeared first on CoinCentral.

You May Also Like

Lyn Alden: The Fed is Printing Money, What Will Happen to BTC?

Goldman Sachs Warns $80 Billion in Forced Selling Could Still Hit U.S. Stocks

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more