Crypto market on edge as China asks banks to dump US Treasuries

The crypto market remained on edge on Monday, Feb. 9, as the recent recovery faltered, and after China continued to decouple from the U.S.

- The crypto market remained under pressure on Monday as US government bond yields rose.

- China asked banks and other financial services in the country to reduce their exposure to U.S. debt.

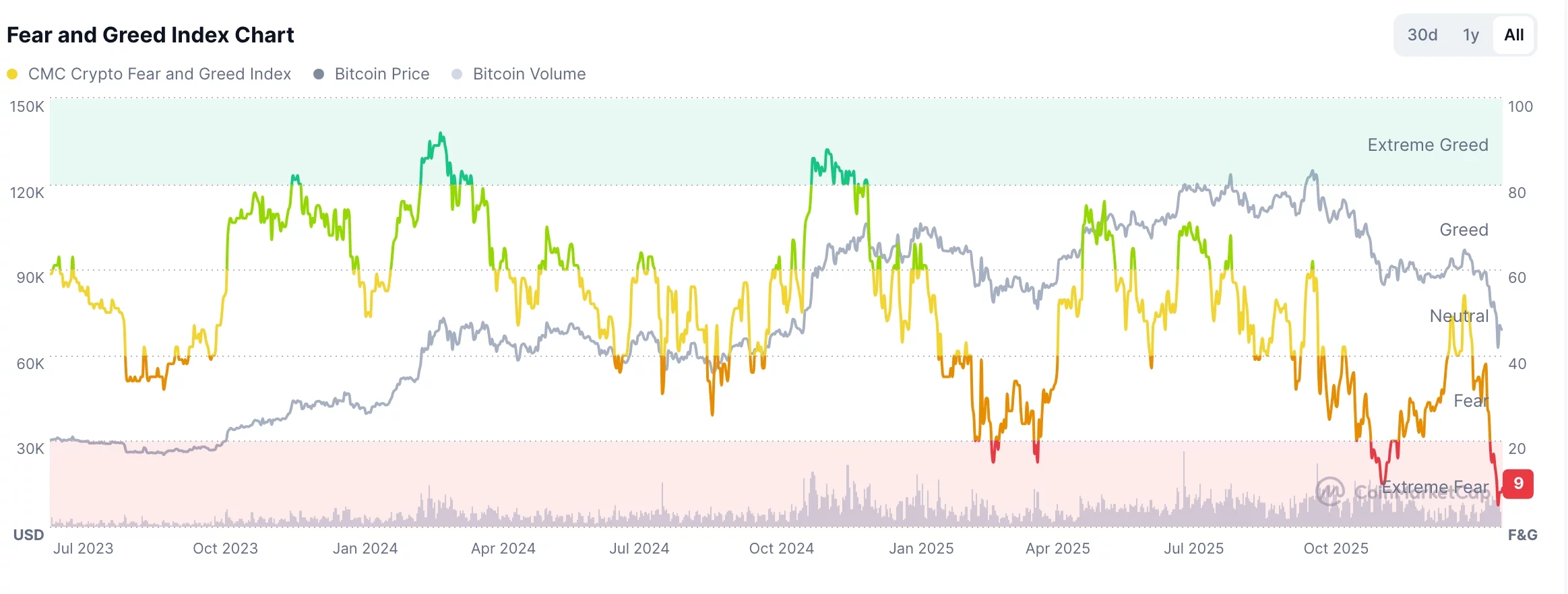

- The futures open interest in the crypto industry continued to fall, while the Fear and Greed Index retreated.

Bitcoin (BTC) retreated below the key support level at $70,000, while the market capitalization of all tokens fell by 2.75% in the last 24 hours. The Crypto Fear and Greed Index remained in the extreme fear zone, while positions worth over $356 million soared to $356 million.

China urges banks to reduce exposure to US Treasuries

Bitcoin and the broader crypto market retreated on Monday as other risky assets pulled back. Futures tied to the Dow Jones and the Nasdaq 100 Index also retreated, paring back some of the gains made on Friday.

This price action happened as Chinese regulators asked financial institutions, including banks, to reduce their exposure to U.S. Treasuries. It also urged those with a high exposure to these assets to reduce them.

According to Bloomberg, the new measures have been framed as a way to diversify their risks rather than the ongoing geopolitical tensions between the two economies. Officials are worried that higher holdings of US Treasuries may expose these companies to higher volatility in the future.

China’s government has also continued selling its own US government bonds in the past few years. It now holds $682 billion in US Treasuries, down from over $1 trillion a few years ago.

Worse, some European governments also considered using their large holdings of U.S. Treasury securities as leverage during the recent Greenland crisis. Many European countries, such as the United Kingdom, Belgium, and Luxembourg, hold trillions of U.S. dollars in bonds.

Continued selling of U.S. Treasuries as the government debt has jumped, is one reason why long-term bond yields and gold prices have soared in the past few years. The 30-year rose to 4.90%, while the gold price jumped to above $5,000 as the rally continued.

Crypto Fear and Greed Index remains in the fear zone

Crypto market traders are still fearful that the recent plunge will resume. For one, the Crypto Fear Index has dropped to the extreme fear zone of 9.

The volume in the crypto industry has also dropped sharply in the past few days. According to CoinMarketCap, trading volume dropped 12% over the last 24 hours to $100 billion.

Most importantly, futures open interest has retreated to $96 billion, down from last year’s high of over $255 billion. Falling futures open interest is a sign that investors are continuing their deleveraging, which often leads to lower crypto prices.

You May Also Like

Bitcoin Whales Sell 147,000 BTC Since August, Fastest Selloff Of Cycle

Travelzoo Q4 2025 Earnings Conference Call on February 19 at 11:00 AM ET