Own the Rail, Not the Ride: Why $EDM is the Crypto Building the Future of Energy.

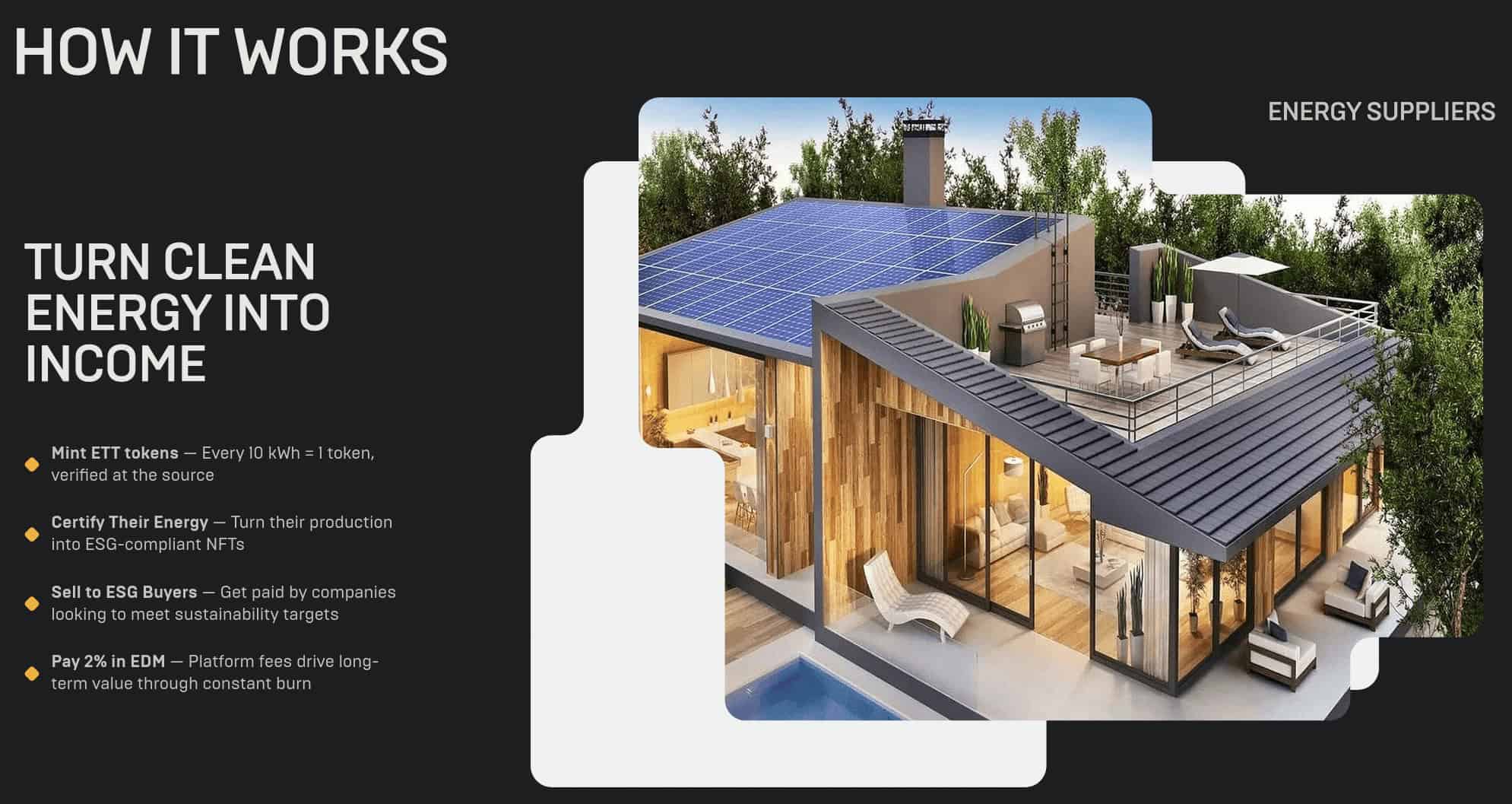

A meter tips past 10 kWh. Somewhere a family eats dinner; somewhere a dashboard lights up with verified supply. The two never meet. The market does. That’s EDMA’s promise in one breath: turn sunlight into a receipt you can trust, then make it liquid.

The platform play (a.k.a. uberization)

Uber didn’t win by buying taxis—it coordinated idle capacity and let demand settle instantly. EDMA does the same for clean energy. Instead of chasing one giant plant, it orchestrates the long tail so a million small parks can earn like one big one.

- Mint: When a connected meter crosses a threshold (e.g., 10 kWh), EDMA mints an ETT (Energy Tracking Token)—a public, auditable receipt of who/when/how much.

- Market: Inside EDMA, ETTs become value buyers already understand—renewable certificates (where rules allow), verified clean-energy purchases for ESG, or utility for participants.

- Settle: No $EDM, no conversion. $EDM is the settlement token that turns proof into profit. More rooftops → more ETT → more demand for $EDM.

(Utility perks live on CLE, a separate lane—proof and benefits never mix.)

Why this matters now

- 30M+ homes already run rooftop solar.

- Under EDMA’s model, that unlocks ~$45B/year across clean-energy tokens, RECs, and carbon markets.

- The voluntary carbon market is tracking toward $50B by 2030,while demand for verified renewable supply exceeds available supply by more than 30%. That shortage forces corporations to pay premiums to meet ESG compliance — and EDMA is positioned to deliver the missing, verifiable supply.

EDMA bridges that gap with time-stamped, meter-based supply—and gives it a frictionless settlement rail.

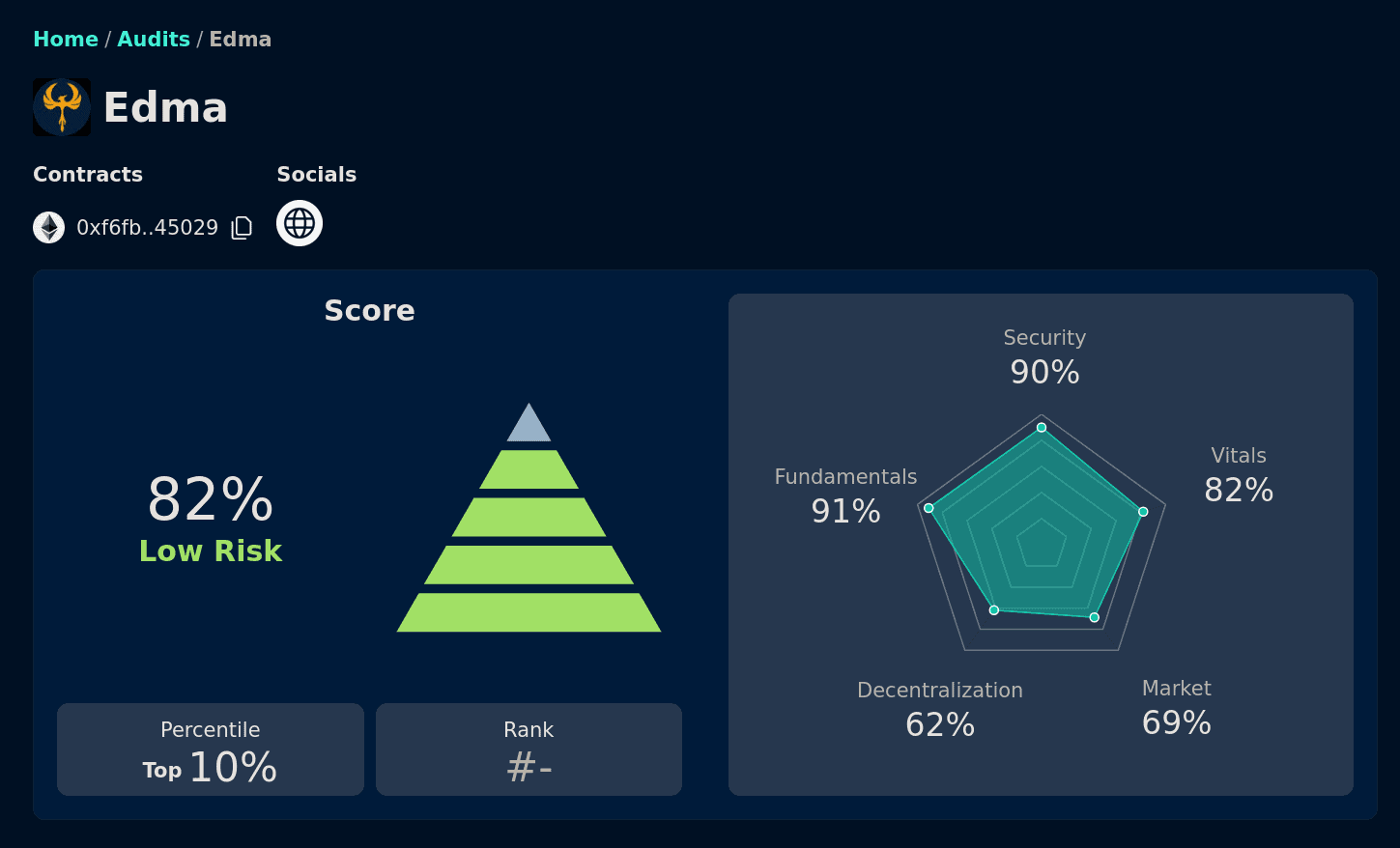

Built to be trusted

EDMA is developed by PrimeHire—500 engineers in the global top 1%—so the plumbing is industrial-grade: security, throughput, auditability, uptime. The complete smart-contract suite — token, vesting, and marketplace modules — has been independently audited by Cyberscope and Coinsult, with zero critical vulnerabilities.

Full reports are available at edma.app. If you want corporates and regulators on the same page, the chain has to read like a ledger, not a blog.

The holder’s angle

You don’t need panels to participate. Holding $EDM means owning the rail: every ETT conversion, every verified clean-energy purchase settles on your lane. It’s a simple flywheel: more rooftops mint → more ETT → more $EDM needed.

Supply is capped at 500,000,000 $EDM, with a target supply of 100,000,000 $EDM. Each ETT trade burns 1% of the $EDM used and pays 1% to stakers. As supply decreases and the household community connects, demand concentrates.

30,000,000 wallets competing for 100 million tokens.

Utility drives usage; usage drives scarcity.

What the market is already saying

With $0 in ads, EDMA’s presale counts 14,000 holders and $1,730,000 committed. People don’t need a 40-page explainer. They need one sentence: the sun hits a roof, the meter proves it, the marketplace pays for it.

Presale terms

- Now: $EDM = $0.1

- Next stage: $0.18

- Target listing: $0.50

- No VC allocations—the upside is designed for the network that makes this real.

You can spend the next quarter guessing the next ride—or own the rail it runs on.

Presale is live at edma.app. Sunlight becomes income.

You May Also Like

The Channel Factories We’ve Been Waiting For

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.