Daily Market Update: Stock Futures Near Highs as Bitcoin Rally Loses Momentum

TLDR

- Stock futures traded flat Tuesday after the Dow Jones set a fresh record above 50,000, while the S&P 500 approaches its own all-time high

- Bitcoin’s recovery stalled at $70,000 after last week’s drop to the low-$60,000s, with analysts calling it a bear-market relief rally

- Crypto trading volumes fell 30% since late 2025, dropping from $1 trillion monthly to $700 billion as retail investors exit the market

- The Crypto Fear and Greed Index plunged to 6 over the weekend, matching 2022 FTX crash levels, before rebounding to 14

- Key economic data arrives this week including retail sales Tuesday, jobs report Wednesday, and inflation numbers Friday

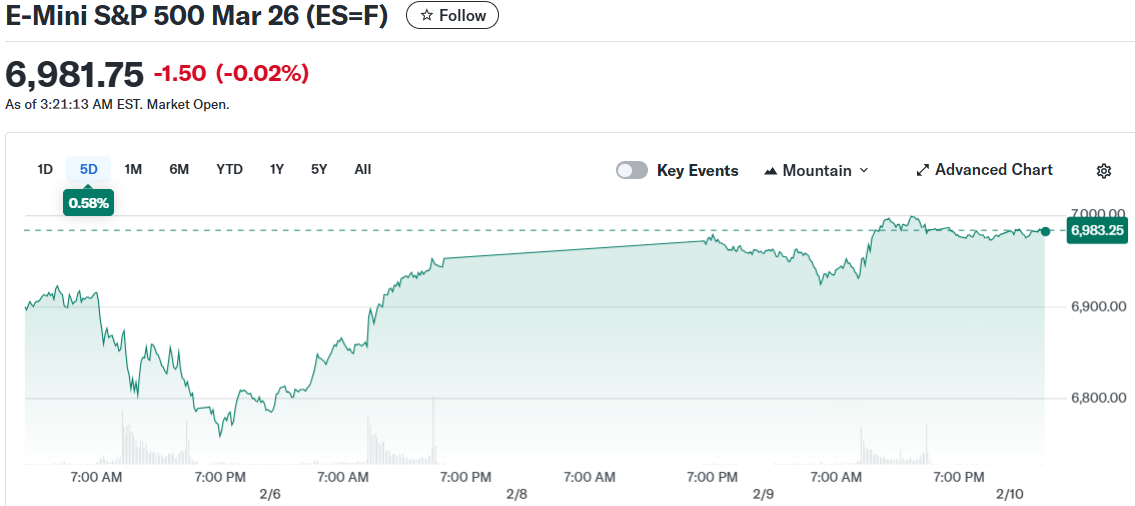

Stock futures remained near unchanged Tuesday morning following the Dow Jones Industrial Average’s latest record close above 50,000. Contracts on the Dow, S&P 500, and Nasdaq 100 hovered around breakeven as investors paused after Monday’s gains.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

The S&P 500 rose approximately 0.5% Monday and sits close to its own record high. The Nasdaq Composite jumped 0.9% as technology stocks led the advance after last week’s selloff.

Monday’s rally extended the rebound in tech shares. Investors regained confidence following recent concerns about software companies and megacap technology stocks.

Bitcoin struggled to maintain its bounce near $70,000 after plunging into the low-$60,000s last week. The cryptocurrency recovered over the weekend but has failed to push higher as sellers emerged at better price levels.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Traders now classify the move as a typical bear-market relief rally. These patterns often attract buyers on dips before meeting heavy resistance from investors seeking exits.

Crypto Sentiment Crashes to 2022 Levels

Market sentiment in the crypto space has deteriorated sharply. The Crypto Fear and Greed Index fell to 6 over the weekend, matching levels seen during the 2022 FTX collapse.

The index recovered slightly to 14 by Monday evening. FxPro chief market analyst Alex Kuptsikevich said these readings remain too low for confident buying activity.

Source: Kaiko

Source: Kaiko

Trading data shows a steep decline in market participation. Major centralized exchanges have seen aggregate volumes drop roughly 30% since October and November, according to Kaiko analytics.

Monthly spot trading volumes decreased from approximately $1 trillion to around $700 billion. Retail investors have gradually exited rather than being forced out through liquidations.

Lower liquidity creates conditions where small amounts of selling pressure trigger large price swings. This dynamic sets off stop-losses and additional liquidations in a self-reinforcing cycle.

Bitcoin Tests Key Support Levels

Bitcoin peaked near $126,000 in late 2025 and early 2026 before entering the current correction. The pullback to the $60,000-$70,000 range represents roughly a 50% decline from those highs.

Kaiko noted this pattern fits the historical four-year halving cycle. Previous bottoms in this cycle have taken months to form and featured multiple failed recovery attempts.

Support at $60,000 remains critical for market direction. If buyers defend this level, Bitcoin may enter a choppy sideways trading range.

A break below could trigger the same thin-liquidity selling that caused last week’s sharp decline. This risk grows if broader financial markets remain in risk-off mode.

Earnings reports continue Tuesday with Coca-Cola before the opening bell and Ford after the close. Economic data takes center stage with retail sales numbers due Tuesday morning.

The January jobs report arrives Wednesday and faces high scrutiny after recent data showed labor market weakness. Friday brings the Consumer Price Index reading for the latest inflation update.

Gold and Bitcoin both attempt to stabilize after last week’s volatility. One analyst described the cryptocurrency’s recent swings as a “crisis of confidence” for the digital asset market.

The post Daily Market Update: Stock Futures Near Highs as Bitcoin Rally Loses Momentum appeared first on Blockonomi.

You May Also Like

Shifting Tides in Bitcoin: New Challenges Emerge

We see a very good partnership with Venezuela