Bitcoin Flashes Luna-Level Capitulation Signal at $67K, Not $19K

Bitcoin is printing on-chain loss-taking on a scale last seen during the Luna/UST meltdown, but at a radically different price point, a distinction that changes what the signal likely means for this drawdown.

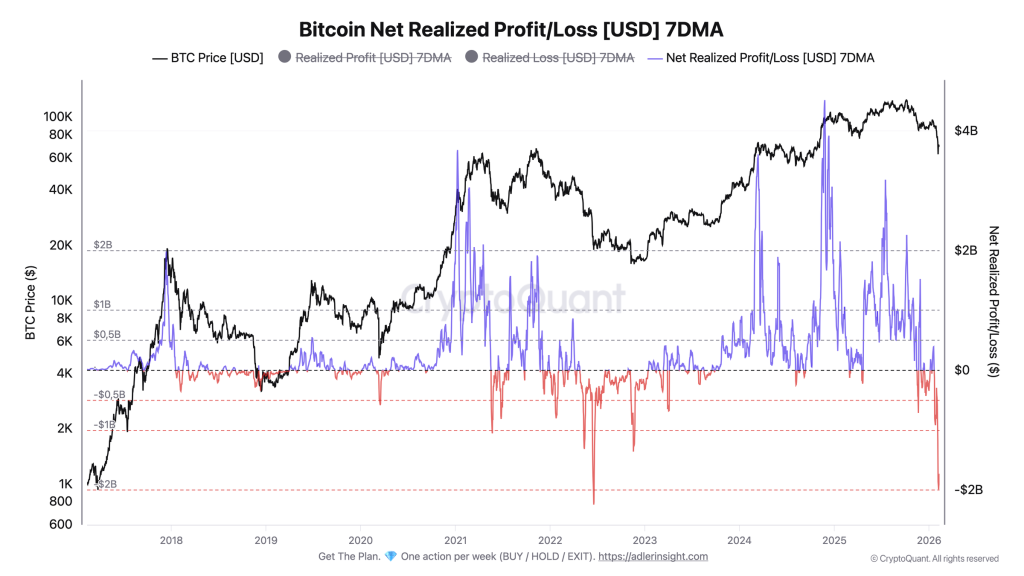

Axel Adler Jr. said Bitcoin’s Net Realized Profit/Loss has sunk deep into negative territory, with the 7-day moving average falling to -$1.99 billion on Feb. 7 before improving slightly to -$1.73 billion by Feb. 10. That places the current regime among the most severe loss-dominant stretches on record. Adler described it as “the second deepest negative reading in the entire history of observations,” exceeded only by June 18, 2022, when the metric hit -$2.24 billion amid the Luna/UST crash and cascading liquidations.

The key detail, Adler argues, is persistence. Net Realized Profit/Loss has stayed below roughly -$1.7 billion for five consecutive days, forming what he framed as a sustained cluster of seller pressure, the kind of multi-day compression that typically marks capitulation behavior rather than a single shock print.

In Adler’s framing, the mechanic is straightforward: realized losses are dominating realized profits on moved coins, and the market is working through the supply owned by participants forced or willing to sell below their cost basis.

“The depth and duration of the current negative regime point to massive capitulation of participants who bought coins at higher levels,” he wrote. “The key reversal trigger is the return of Net Realized Profit/Loss above zero, which would signal the market’s transition from loss dominance to profit dominance. As long as the metric remains in deeply negative territory, seller pressure persists.”

Bitcoin Losses Match Luna Crash Scale

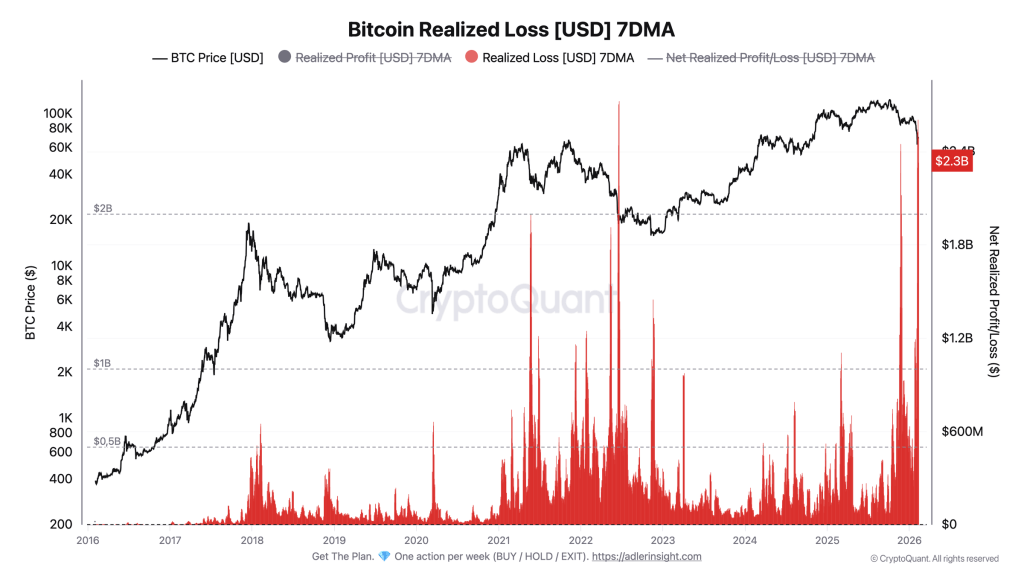

The companion chart, Bitcoin Realized Loss (7DMA), shows realized losses rising to about $2.3 billion on Feb. 7 and holding near that level through Feb. 10, another rarity in historical context. Adler called it “one of the highest smoothed levels in the entire history of observations,” explicitly comparing it to June 2022.

He also emphasized that the 7-day smoothing understates peak stress in real time. At the height of the 2022 episode, Adler noted, single-day losses were roughly three times higher than the weekly-smoothed figure. In the current window, he pointed to a single-day realized loss of $6.05 billion on Feb. 5, the second-largest one-day loss in Bitcoin’s history, according to his note.

The headline comparison, however, is not just magnitude but setting. In 2022, a similar realized-loss regime occurred with bitcoin trading around $19,000. This time, Adler says, the losses are being crystallized around $67,000 after a pullback from $125,000, a context he frames as a correction that is flushing out late entries rather than an ecosystem-wide failure cascade.

“Back then, Realized Loss at $2.7B was occurring at a price of $19K,” Adler wrote. “Now, comparable loss volumes are being locked in at a price of $67K, which suggests not a systemic crash but rather a flushing out of late bull-cycle entries. This is capitulation of local top buyers, not a fundamental loss of network value.”

Adler’s playbook puts two markers front and center. The first is a sustained move of Net Realized Profit/Loss (7DMA) back above zero for multiple weeks, which he frames as the transition from loss dominance to profit dominance. The second is a decline of Realized Loss (7DMA) below $1 billion, which would indicate that the wave of forced or pain-driven selling is fading.

The risk, in his view, is that the market’s “cleansing stress” shifts into something more final if price weakness compounds. Adler flagged the sub-$60,000 area as a line where continued growth in realized losses alongside further price decline could turn a correction into “full-blown capitulation”, not because the current prints are small, but because the regime could extend and deepen.

For now, Adler’s core claim is that Bitcoin is producing Luna-sized loss signals without Luna-like structural damage. Same order of magnitude on-chain, different story in the tape.

At press time, BTC traded at $67,924.

You May Also Like

Ultimea Unveils Skywave X100 Dual: 9.2.6 Wireless Home Theater Launching March 2026

XRPL Validator Reveals Why He Just Vetoed New Amendment